Chip in to keep stories like these coming.

It is tempting to look past the details and welcome the Ontario government’s announcement of the details of the proposed Ontario Retirement Pension Plan (ORPP) as an important milestone on the way to a better retirement income system in Canada. And it is a milestone.

Its importance has, ironically, been underlined by the bizarre decision of the federal government in the last days before Prime Minister Harper dropped the election writ to go from simple opposition to the expansion of the Canada Pension Plan to full-on no-holds-barred obstructionism.

Equally ironically, the belated entry into the pension debate by Canada’s most reliable advocate of all things right-wing, the Fraser Institute has merely served to underline the overwhelming superiority of the universal defined benefit model over all of the alternatives.

The details, however, keep getting in the way.

At the broad political level, by choosing not to mirror the structure and coverage of the CPP, Premier Wynne has missed a golden opportunity to solidify the ORPP’s positioning as both the second-best alternative to expanding the CPP and a potential future stepping-stone to CPP expansion.

Some of the differences between what the government has announced and the structure of the CPP are directly attributable to the federal government’s refusal to accommodate the ORPP.

That refusal has forced Ontario to structure the ORPP as a registered pension plan, rather than as a companion to the CPP that, in turn, complicates coverage for self-employed individuals, for example.

But the major departures from the structure of the CPP are self-inflicted. The most important of such departures concern coverage and portability, two of the key issues that gave impetus to the case for the ORPP in the first place. Rather than follow the CPP model and make ORPP participation mandatory, and leave it to the sponsors of current private pension plans to choose to amend or not to amend their plans in response, Ontario has mandated employer exemptions based on a complicated process for whether or not a current pension plan is “equivalent” to the ORPP.

In addition to the obvious administrative complexity introduced by requiring that plan sponsors demonstrate equivalency on an ongoing basis, the route taken for exemptions flies in the face of the basic principles that Ontario articulated for the ORPP in the first place.

Very few of the “equivalent” plans will actually deliver the secure, guaranteed inflation-protected retirement income implied by those principles.

More important, exemptions for employees covered by some current pension plans are inconsistent with a labour market reality in which both employees and employers turn over regularly and in which it is increasingly rare for an employee to work for the same employer and belong to the same pension plan for an entire working lifetime.

In the real world of the labour market, a significant proportion of the membership of exempt pension plans will never receive the equivalent-to-ORPP benefit for their service.

That problem could have been solved, in part, through mandatory portability of private pension benefits into the ORPP. The government has apparently chosen not to do that, opting instead for a yet-to-be-specified system of voluntary buy-backs into the ORPP for past service stranded in exempt pension plans.

The government’s commitment to exemptions for “equivalent” plans undermines the fundamental rationale for the ORPP in the first place.

Even more troubling is its decision to include defined contribution pension plans among the plans eligible for an exemption.

This decision is hard to explain on two grounds:

First, none of the potential arguments about the complexity of accommodating an existing pension arrangement to the ORPP apply to defined contribution plans. Since defined contribution plans do not offer defined retirement benefits, the only accommodation required is on the contributions side. All defined contribution plan sponsors would have to do in response to the ORPP is to decide whether or not they want to keep their total contribution the same or increase it.

Second, the equivalency formula for defined contribution plans proposed by the government actually underlines why defined contribution plans don’t make sense as retirement income vehicles. Under the announced system, a defined contribution plan would have to provide for contributions of eight per cent, with a minimum employer contribution of four per cent, in order to qualify for an exemption. That’s 2.1 times the total contribution required for the ORPP.

Why would the government support through an ORPP exemption registered defined contribution pension plans, which based on its own figures in effect waste more than half the money put into them? The government hasn’t answered that question.

The delay in implementation is also a concern. First announced in 2014, the ORPP will not be fully phased in until 2021 and won’t begin paying benefits until 2022. Eight years from announcement to full implementation of a program designed to meet a pressing public policy need is simply too long.

Mirroring the structure and coverage of the CPP would have accomplished two key objectives:

- It would have underlined the political role of the ORPP as a precursor to expansion of the Canada Pension Plan.

- And it would have produced an ORPP that was fully consistent with the principles that supposedly motivated its creation: a universal, portable indexed defined benefit pension plan.

So for the Ontario government’s announcement of the next stage in the development of the ORPP, two cheers.

One for keeping the pressure on real national retirement income reform.

And another for resisting demands that would broaden exemptions to the point of gutting the ORPP before it even got started.

But when it comes to delivering fully on the potential value of an ORPP, and truly heightening the political pressure for a true CPP expansion, a big, heartfelt raspberry.

Hugh Mackenzie is a CCPA research associate. Follow him on Twitter @mackhugh.

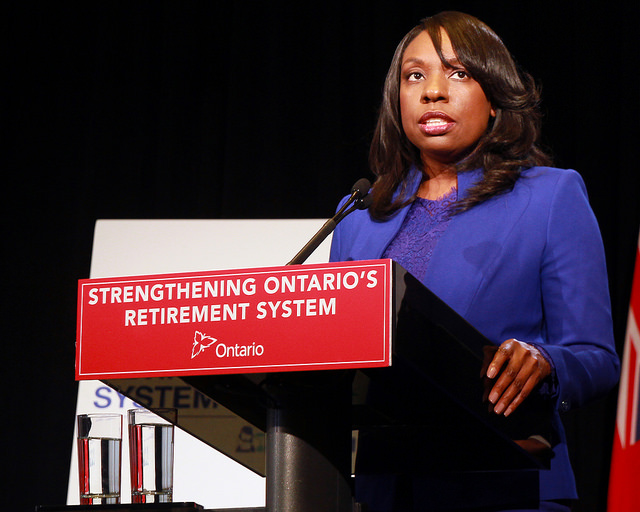

Photo: Ontario’s Associate Minister of Finance, Mitzie Hunter, gives details about legislation for the Ontario Retirement Pension Plan. Credit: Alex Guibord/flickr

Chip in to keep stories like these coming.