People who bot stock to hold for the long term must be doing very well.

https://ca.finance.yahoo.com/echarts?s=%5EGSPC#symbol=%5EGSPC;range=my

People who bot stock to hold for the long term must be doing very well.

https://ca.finance.yahoo.com/echarts?s=%5EGSPC#symbol=%5EGSPC;range=my

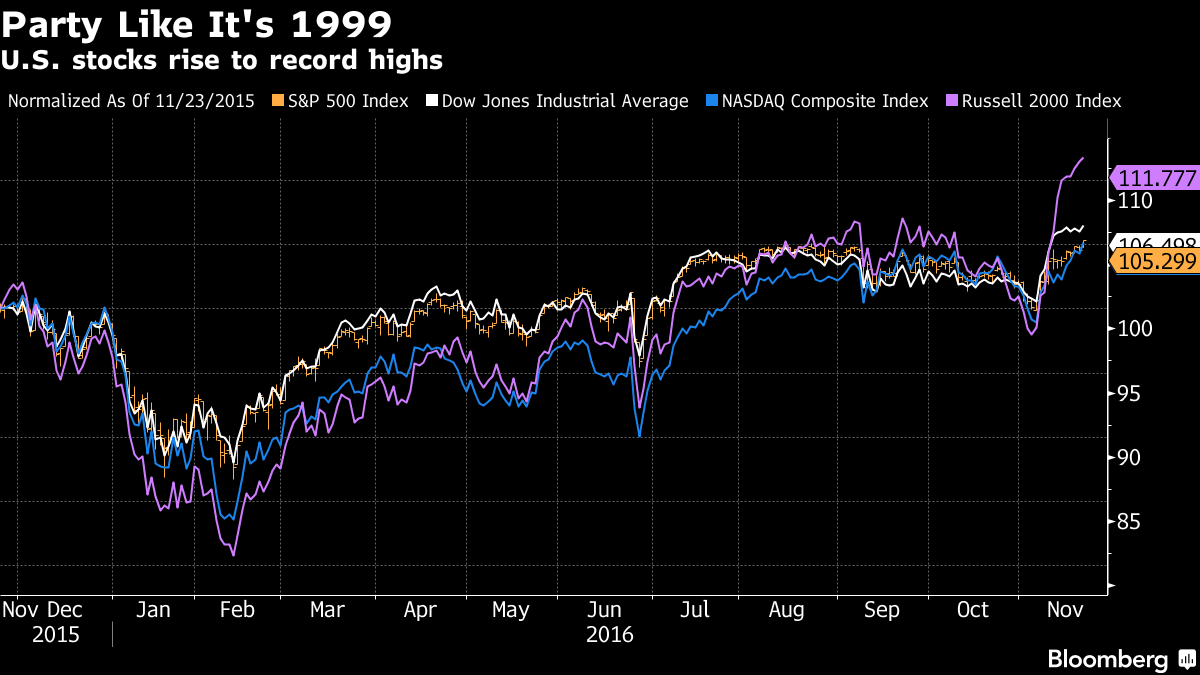

U.S. Stocks Hit Highs as Oil Jumps;

https://www.bloomberg.com/news/articles/2016-11-20/dollar-is-king-as-fed...

All four major U.S. equity benchmarks climbed to record highs as oil jumped on optimism OPEC will agree to cut output. The yen rose as markets digested reports of a tsunami warning in the Fukushima region.

The S&P 500 Index, the Dow Jones Industrial Average, the Nasdaq Composite Index and the Russell 2000 Index rallied together to their all-time peaks for the first time since 1999. Oil surged as Iran signaled optimism that OPEC will agree to a supply-cut deal and Iraq said it will offer new proposals to help bolster unity before next week’s meeting in Vienna. The dollar halted its longest advance ever against the euro. The yen climbed after a magnitude 7.3 earthquake struck Japan off the coast of Fukushima, home to the nuclear power plant badly damaged in a March 2011 quake, triggering a tsunami alert.

American stocks achieved the new milestone as companies ended a five-quarter profit slump and Donald Trump’s election fueled optimism that his plans to cut taxes and boost fiscal spending will benefit industries more geared toward economic growth. Acknowledging the strength in the economy, Federal Reserve Chair Janet Yellen said Thursday that the central bank is close to lifting interest rates.

“There’s optimism that it’s more likely that Trump is going to put us on an economic fast track versus Clinton,” said Terry Morris, manager director of equities at BB&T Institutional Investment Advisors in Wyomissing, Pennsylvania. “The election had something to do with this, and I also think there’s some short covering going on. People that were hedging the election had to rush to cover after the news, and I think generally the perception is the economy is starting to pick up as the Fed is likely to raise rates in December.”

Traders are now pricing in a 100 percent chance of a move next month, compared with a 68 percent probability in the beginning of November. If the Fed doesn’t act as expected, it may bring on more market turmoil, says Seven Investment Management’s Ben Kumar.

A heavy dose of reality is what the naysayers around here need.

These Charts Show That Trump Is Bringing the 1990s Back to Markets

https://www.bloomberg.com/news/articles/2016-11-23/these-charts-show-tha...

The business community appears to be very happy with Trump at least so far, and as far as Canada is concerned it looks like Trudeau dodged a trade bullet

Investors' Economic Optimism Surges to Level Not Seen Since 2011

https://www.bloomberg.com/news/articles/2017-02-14/investors-economic-op...

Nonsense, buy Amazon. It would not surprise to see it hit $1,500 a share over the next year.

http://www.cnbc.com/2017/04/25/amazon-gets-downgraded-on-wall-street-for...

Amazon Prime Now Has 80 Million Members

http://www.marketwatch.com/story/central-bank-buying-still-only-flow-tha...

https://seekingalpha.com/article/4064824-central-banks-massive-incursion...

http://www.reuters.com/investigates/special-report/usa-buybacks-cannibal...

Why are stockmarkets going up? Unlike NR which seems to be booster for the stockmarket I will try to take more quantifiative approach.

In the first article we see a graph from 2006 to 2017 where the central banks have purchased around 11 trilion in variuos asset classes. This how stockmarkets are influenced by central bank buying. Even if the banks do not buy stock directly(Which they certainly do) for example buying mortages bonds. How does buying bonds affect stockmarket for example 500 billion a year in housing mortage bonds, when the central bank buys the 500 billion someone else does have ability to buy those assets. Other investors wanted to buy those bonds but now they are no longer available on the market. These investors have money sitting cash because they then buy the mortage bonds. Generally speaking cash wants to be invested in somesort asset class, these individuales have been taught the money not in the market is a wasted opportunity. The official term used "opportunity cost" you are getting zero in profit on that 500 billion, they will spend that money of other bonds, or most likely the stock market assets to earn a return. This how central bank purchase of 500 billion of bonds will indirectly bost the stockmarket. Its important that the major central banks can create cash/credit at will.

The second article talks about direct purchases of stock equity by the banks.

And the third is my favorite, the buy backs and divident rises. Buy backs are when company uses is retained profit or bank loans to purcahse its own stock. How do but backs raise the stockmarket? The mechanics are as such. Here is simple example company Babble has gone public. The company has issued 100 shares of certicate stock. Each share is valued at $20 so the value of the company is $2000 dollars. Its important to keep in mind the 100 shares are held by the public. Now the Babble issues a call that will buy back 20% of floating shares held by the public. This where finincial magic happens, to purchase the 20 shares of its own stock it has rise the pay higher price than when the stock was orginally sold. It sold 100 shares at $20 per share. Now it buy back 20 shares at $30, the new market value is $2400 of Babble. 80 shares are left in the float held by the public valued at $30 a piece. What are the implacations for the events for the general public. The stockmarket goes up by $400. The investors that sold their shares back to the company have been made a profit $10 per share sold because they purchased at 20 and sold at 30. What about public that holds the 80 shares, they now make paper profit 10 at per share which will be realized when they see their stock to other indivduals. What about the employess in the company, generally most companies pay the majority a wage while top management is payed with shares. From example some CEO's point out they have wage of 1 dollar for the year but what do generally say they are paid by new shares issued by the company. So it in the interest of top management to keep the value of their shares high and growing bacause that is generally where they make their money. What are the implactions of top management compensation being tied to value of the stock, easy they will ever thing in the power to raise the price of Babble stock. What are the implactions for companies, you have discuss where the money comes from to pruchase there own stock(buyback). Either the money comes from retained profit for basic operations of the company, or they can borrow from the bank or issue bonds--- basicly debt.

The other piece is dividens which is a distribution of profit the owners for the owners of the stock. Higher dividens means higher prices of stock and general raise of the stock market.

Here are couple quotes form the article 3 for more context.

Almost 60 percent of the 3,297 publicly traded non-financial U.S. companies Reuters examined have bought back their shares since 2010. In fiscal 2014, spending on buybacks and dividends surpassed the companies’ combined net income for the first time outside of a recessionary period, and continued to climb for the 613 companies that have already reported for fiscal 2015.

In the most recent reporting year, share purchases reached a record $520 billion. Throw in the most recent year’s $365 billion in dividends, and the total amount returned to shareholders reaches $885 billion, more than the companies’ combined net income of $847 billion.

So all profit is being returned to the owners of stock through buybacks and dividens, this naturally raises the stock market numbers. What the implacations of this stragety? Companies have borrow money in invest in training, increase production, deal with deprecation of equipment(wear and tear), and of cousre Reasearch and Development. If want to give employees a raise you to borrow as well. But this drives up the stock market so it must be good?

Buy COSTCO as well. Trading at $175 this morning.

https://ca.finance.yahoo.com/quote/COST?ltr=1

Here's why Costco may be the one company Amazon can't destroy

http://www.cnbc.com/2017/04/21/heres-why-costco-may-be-the-one-company-a...

Nasdaq composite hits fresh intraday record

Amazon trading at $945 this morning

Oh, my!

Amazon up again, and again, and again, trading at $953 US, up over $28 US on the NASDAQ today.

Amazon - First Trillion Dollar Company?

https://news.thestreet.com/independent/story/14109099/1/amazon-will-some...

Why Don't These Winning Stocks Pay Dividends?

Many big companies could easily pay dividends. Should they?

https://www.fool.com/investing/general/2015/03/01/why-dont-these-winning...

Alphabet Inc (Google)

https://www.google.ca/search?q=google+stock&oq=google+stock&aqs=chrome.....

Ha! Ha!

After latest threats, Chinese see Trump as a Marvel villain out to destroy them

This is probably the best possibly financial investment one can make

An excellent book ‘Take a random walk down Wall Street’ explains why

The Dow is presently off 529 points today - oh woe is me. Ha! Ha! Ha!

Amazing resilience of the stock market, meet Donald.

Buffett who went into a cash recently probably bot lots of stocks today and will soon be adding to his fortune. Too bad we don't have legitimate inheritance taxes, eh! No one should be inheriting that much.

Dow jumps 250 points, energy leads

How can this be!

U.S. stocks jump as trade war rhetoric cools on both sides

The bounce comes just days after back-to-back retaliatory tariffs brought the U.S.-China conflict to a boiling point.

Imagine the money one could make if they only knew what erratic move Trump was going to make next. If the POTUS belonged to a grifter family one would have to wonder about that but as it is he is just crazy, right?

The theme of this thread of course is a crock! While the US fed may manipulate the markets til it is no longer possible,,,the elephant in the room is the collapsing financial system of China, which of course the US Fed and President´s power has zero influence....

Today Looks Like Just Before 2000 Dotcom Crash - Charles Hugh Smith, April 24, 2019.

"You will get a slowdown, and that is a self-reinforcing feedback loop. Once people stop buying houses and once people stop buying cars . . . then you are going to get people being laid off, less people being able to afford to eat out, and then you get a self-reinforcing recession. It's not a crisis, but like an erosion because everybody is kind of tapped out."

"Recently, President Trump and his economic advisors have been talking up rate cuts and money printing to help the economy. Are they seeing a slowdown coming? Smith, who has written 12 financial oriented books, says, "I think they do, and I think that's the only reasonable explanation for why they are talking about rate cuts when the employment is strong and the economy is looking good by many factors. Why would they want cheaper money unless they see the slowdown in auto sales, and they see the slowdown in housing, and they see a slowdown with all the things where you have to borrow a lot of money to make it work." That was April. Was he wrong?

U.S. New-Home Sales Miss Estimates After Big Upward Revision, August 23, 2019

Nearly 25% of Americans are going into debt trying to pay for necessities like food, May 24, 2019

Most Americans Can't Afford to Pay Rent, Eat Food, Buy Stuff, or Get Sick (And It's Just Going to Get WORSE), July 5, 2019 - Accurate, not fake numbers tell the truth.

On The Edge Of Disaster: 59 Percent Of Americans Are Living Paycheck To Paycheck, May 16, 2019

Great Recession still hurting? 23% of Americans say their financial situation is 'worse' now, June 13, 2019

These 15 retailers have filed for bankruptcy or liquidation in 2019, August 12, 2019

The running list of 2019 bankruptcy victims, August 23, 2019

Here Are 15 Numbers That Show How The Global Economy Is Performing, And All Of Them Are Bad

An "Earnings Recession" Is Here - Big Companies All Over America Are Reporting Disastrous Financial Results, July 24, 2019

U.S. Consumer Debt Surpasses Financial Crisis Levels, June 24, 2019

You have been preaching this doom and gloom since before you were born. Even a stopped clock is right twice a day.

As this chart shows it's just terrible out there for stock market investors, isn't it.

Spare us the nonsense.

What we are witnessing with US stocks, (only) is buybacks....a reason to force down the US bond markets,,everyone is borrowing silly to buy back their own stock to keep up the price...but again...check out the Chinese stock markets....not under US Fed control of course...this is where the system will initiate the global collapse....the prolongation of the stock market surge in the US will only create a far worse disaster....

do not forget, my talk of gloom and doom was totally accurate with the crash of 2007/2008, only salvaged with a 23 trillion US dollar injection by the Fed...this time...23 trillion would do nothing! Where will the hundreds of trillions come from to buy out the 750 trillion derivative market...

what is happening is that the cash is being squeezed out of the economic system...ordinary citizens ever more in debt, to finance the debt of the government, the corporate sector....they will no longer sit back passively as the system tries to retrieve another few hundred trillion to keep the finances from total collapse...so please spare us this nonsense stuff...if you have any arguments to make to rebut what I say, say it!

Check out the latest stats on the Yuan...in free fall!

The corporates are fleeing China in preparation for its collapse!

You do realize that people's retirement through their pension plans are somewhat connected to the stock market of course.

You do realize that people's retirement through their pension plans are somewhat connected to the stock market of course.

So you are in agreement with that neo-con policy? A one time they were not tied to the stock market and they shouldn't be now.

Dow Jones up at one point today over 450 points but I know sharing that doesn’t pass the so-called left’s purity tests

You do realize that people's retirement through their pension plans are somewhat connected to the stock market of course.

So you are in agreement with that neo-con policy? A one time they were not tied to the stock market and they shouldn't be now.

[quote=NDPP]

I'll say! Especially given the precarious state of these instruments and the very real possibility they could go right down the crapper any time now...

Instability Affects Investments and Global Bond Breakdown (and vid)

https://www.rt.com/shows/boom-bust/468078-south-america-eu-markets/

"Today we look at global instability and how it's impacting both investors and consumers..."

Gold and Bitcoin to Replace Fiat Money as Consumers Lose Faith in 'Social Contract' (and vid)

"As the debt-based money system gradually collapses the idea of central banking and the social contract, an expert tells RT that other forms of money may take over the market soon..."

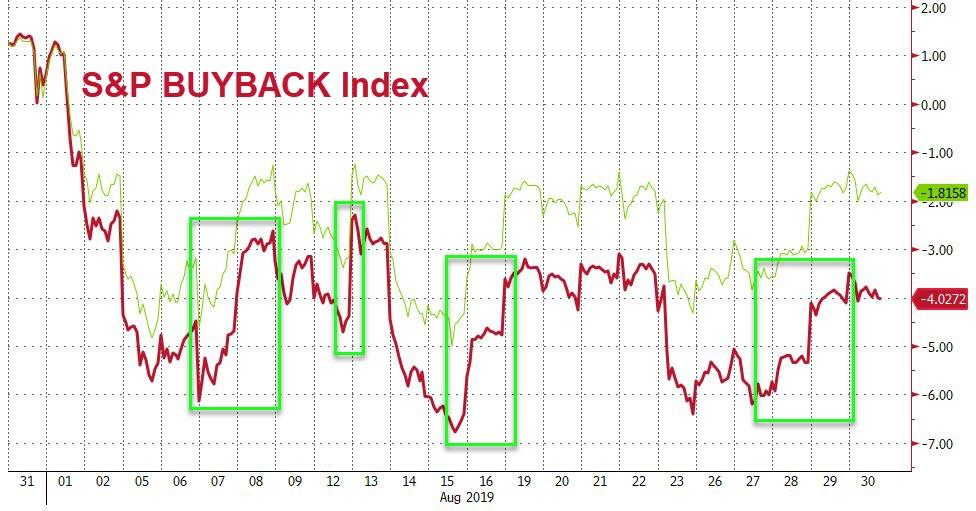

who is buying stocks here?

His answer: "the sole buyer of US stocks remain corporate buybacks, not institutions" as shown in the chart below.

So corporate bonds must continue to flourish...so interest rates must stay near zero...so the US dollar must continue to deteriorate...it`s all a very scary checkmate situation...when the corporates stop buybacks of their own stocks....it`s collapse time!

Up, up she goes. where it stops nobody knows, eh!

https://ca.finance.yahoo.com/news/stock-market-news-live-updates-february-12-2020-124508085.html

Up, up she goes. where it stops nobody knows, eh!

https://ca.finance.yahoo.com/news/stock-market-news-live-updates-february-12-2020-124508085.html

Today's news not as good as yesterday in terms of infections. So what will the stocks due tomorrow if they were pumped up on false hope today?

In a low-volume market dominated by trading programs/bots, the exit is very, very narrow. When the stampede tumbles off the cliff, buyers vanish and markets go bidless: every writhing, screaming victim wants to sell everything and save themselves, but there are no buyers at any price.......

Charles Hugh Smith

In a low-volume market dominated by trading programs/bots, the exit is very, very narrow. When the stampede tumbles off the cliff, buyers vanish and markets go bidless: every writhing, screaming victim wants to sell everything and save themselves, but there are no buyers at any price.......

Charles Hugh Smith

Yes-- this is very true. The concentration of capital that has created massive inequality has also made the markets more dependent on smaller number of bigger capitalists and therefore more fragile. Good point here.

ETA I can put it this way: when you have many decision makers and one gets worried, you can get a market correction. When you have a handful of big players you can only get a crash because any move by a decision-maker is going to be catastrophic due to their size. Thus, a more fragile market. I had not thought of this connection between inequality and the market before. Thanks for posting that as it led to an important realization for me about why the markets are more fragile in a way I had not thought of.

Canadians invest huge amount of money in foreign stocks in December as Wall Street outpaces Bay Street

Warren Buffett Torches Corporate America, Spells Doom for Stock Market

Warren Buffett's 2019 letter to Berkshire Hathaway shareholders blows the whistle on corporate corruption and spells stock market doom.

https://www.ccn.com/warren-buffett-torches-corporate-america-spells-doom-for-stock-market/

DJIA down 850 points this morning

The bears are having a good day as the stock market is continuing to drop now down over 1,000 pts on the DJIA

DJIA down another 900 points today.

The stock market appears to be bouncing back and has already cut almost half of yesteday's drop.

The stock market appears to be bouncing back and has already cut almost half of yesteday's drop.

This is not meaningful -- the stock market is influenced by real events and trnds. Many people buy after a sharp drop to get bargains. What happens in the following weeks defines if this was a good idea.

Consider the supply chain issues, the fact that companies are looking at raising prices or reducing advertising due to reduced supply and you have a different picture.

The overall health of the stock market related to covid-19 depends on one thing: whether the disease will react to warmer temperatures and the spread will slo or if it will continue. Government means of stopping transmission have failed so that appears off the table -- but they could ahve delayed it enough that warmer temperatures moderate it.

That said the long term effects are unknown. Greater transmission will probably cause more economic shocks but these could abate if the severity of the infections are found to be low.

Question is -- are you feeling lucky? This could become a long term economic drag or a short term blip. Other issue is that if the market is already fragile due to underlying issues a blip can expose and create a longer term problem.

The economy is sound and the stock market reflects it.

Sometimes people panic and oversell like they have done the last couple of days, but it is rebounding as expected.

The economy is sound and the stock market reflects it.

Sometimes people panic and oversell like they have done the last couple of days, but it is rebounding as expected.

This is an opinion. Not everyone shares it.

I think that the economy is fragile and that shocks like this can risk longer term problems. Debt is too high, the bull market has gone too long, real estate is too high, too many people are struggling with basic needs, the supply chains have been rocked by trade wars, confidence has been shaken by actions of government (for example the US decison to provide tax relief without any way of showing how they will pay for it, and now this....

The markets are based on psychology as much as anything else. I think there is a mixed opinion about the market and the market will follow that opinion. "Right" when it comes to stocks, is often a public opnion survey. So even if you are comfortable with the way things are, that does not make it safe unless many other people -- who have money -- agree with you.

Now as far as this Corona situation -- it really depends on whether this takes hold in North America. Right now it is easily manageable but if the outbreak spreads, as public authorities warn it could, then we will have issues with employment and money and supply and a lot of public worry. I cannot imagine the markets liking any of that especially after this long good run they have had. Far too many people in Canad and the US are living close to the edge and have no margin.

I see no reason to say the economy is sound enough for none of this to be a problem.