You can change the conversation. Chip in to rabble’s donation drive today!

Nearly two years ago, I wrote a post about how the Canadian digital economy strategy seemed to be taking shape. The government had moved on several legislative issues including copyright and spam, it was bringing together federal and provincial ministers to discuss the issue, the open government initiative was on the way and telecom policy was beginning to emerge as a major concern. All that was missing was an announcement, identification of some targets and the signal that this was a priority. While I’m told that some in government also saw it this way, then-Industry Minister Christian Paradis let the moment slip away and the entire digital strategy become little more than a punchline.

Yesterday’s federal budget marks the revival of the Canadian digital strategy. The government will undoubtedly still point to past accomplishments (the budget references reforms that date back to the 2006, so digital economy activities from several years ago are surely fair game), but this budget provides many of the remaining ingredients for a digital strategy (Mark Goldberg offers a similar perspective). Once again, all that is left missing is the official announcement from Industry Minister James Moore. So what will the Canadian digital strategy contain? Based on this budget, it would seem to include:

1. Connectivity and Access: The government has set a target of “near-universal” access to broadband (which it is defining as 5 Mbps) within five years. That is consistent with the CRTC’s target from 2011, but at a far slower pace, since the Commission talked about universal access by the end of 2015, not 2019.

In addition to broadband access, the government is continuing support for computers in schools and embracing regulation of wireless services in an effort to address ongoing concerns (including those of the Competition Bureau) about the state of competition. This includes previously announced wholesale wireless roaming regulation, stronger enforcement powers, more spectrum auctions, tower sharing and foreign investment changes.

In sum, the good news is that there is finally a government target for universal broadband access, some money to finish the job and a commitment to address wireless competition concerns. The bad news is that a 5 Mbps goal by 2019 is too slow. By comparison, the Digital Agenda for Europe sets a target of 30 Mbps by 2020 and Australia has targeted 100 Mbps by 2016.

2. Intellectual Property: The government has already passed copyright reform and will soon also pass Bill C-8, the anti-counterfeiting bill that includes major reforms to Canadian trademark law. It recently tabled five intellectual property treaties that focus on the administration of intellectual property rights. The budget confirms the intent to pass the amendments needed to ratify or accede to those treaties. In addition, it will reform plant breeders rights, another form of IP. All of the latest IP reforms are being driven by trade agreements as these are required reforms for the Canada-European Union Trade Agreement.

3. Online Commerce: Electronic commerce issues often fall within provincial jurisdiction (for example, online contracting), but the government seems to have identified several areas where it can play a role. The anti-spam legislation that takes effect later this year is the most obvious policy intervention, but the budget contains two more. First, the government has launched a consultation (deadline in 120 days) on the collection of sales tax on e-commerce transactions. It asks:

the Government is inviting input from stakeholders on what actions the Government should take to ensure the effective collection of sales tax on e-commerce sales to residents of Canada by foreign-based vendors. For example, should the Government adopt the approach taken in some other countries (such as in South Africa and the European Union) and require foreign-based vendors to register with the Canada Revenue Agency and charge the Goods and Services Tax/Harmonized Sales Tax (GST/HST) if they make e-commerce sales to residents of Canada?

Second, the government says it plans to introduce anti-money laundering and anti-terrorist financing regulations for virtual currencies such as Bitcoin. The budget cites a 2013 Senate report for support for the move, though that report does not reference virtual currencies. There have been some efforts elsewhere to address money laundering concerns with online currencies, but some remain skeptical over whether the concern is warranted.

The government may have also encouraged the Competition Bureau to flex its muscles on online commerce issues, leading to the recent e-books settlement and the greater cooperation between the CRTC and the Bureau.

4. Content: The budget includes a couple of digital items involving online content with money allocated for the Virtual Museum of Canada and Online Works of Reference, which includes The Canadian Encyclopedia/Encyclopedia of Music in Canada and The Dictionary of Canadian Biography. Unfortunately, a serious commitment to digitization is still absent. I suspect that the government will point to many earlier initiatives — changes to the Canada Media Fund (including major funding several years ago) and the IP reforms — as evidence of its support for online content. The other important element of government policy is how Canadians access content, with the government’s commitment to a pick-and-pay model for television broadcasting and its likely opposition to regulation of Internet video providers focusing on the access side of the equation.

5. Skills Development: Every budget includes money for skills development and this one is no different. While there are no references to specific digital skills development, training programs, research funding and other support can be easily brought into the digital agenda umbrella.

6. Government as a Model User: Given the inaccessibility of the budget website yesterday, the government still has plenty of room to improve in holding itself out as a model user. Yet the budget also includes key elements here: funding for an Open Data Institute and emphasis of web-based services (particularly for veterans) provide examples that would fall within the digital strategy. Indeed, open data has made real progress in recent years with more data sets available and the creation of a non-commercial open licence for government works.

The actual Canadian digital strategy may not look identical to this — privacy and security did not fall within the budget but would presumably be part of a strategy — but there is enough in this budget to provide observers with a good guess about where things seem to be headed.

Michael Geist holds the Canada Research Chair in Internet and E-commerce Law at the University of Ottawa, Faculty of Law.

This post originally appeared on Michael Geist’s blog and is reprinted with permission.

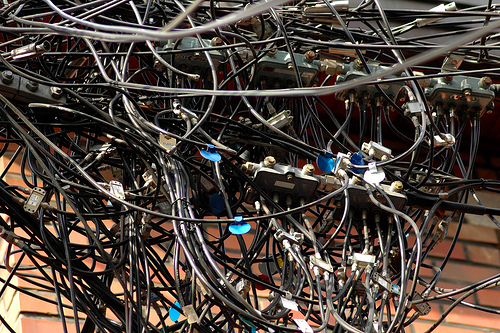

Photo: flickr/Abri_Beluga