Have things really changed all that much for Alberta since then-energy minister Ron Liepert predicted in early 2012 that the province was on the verge of a “Bitumen Gusher” of unprecedented magnitude?

One just hates to endorse the financial predictions of any Alberta Tory cabinet minister, but it is said here they likely haven’t.

If Mr. Liepert got it basically right in February 2012, understanding that fact helpfully illuminates the re-election strategy of Premier Alison Redford and her Progressive Conservative government for 2016.

At the very least, Mr. Liepert’s one-year-old forecast is extremely helpful in analyzing the real meaning of Ms. Redford’s “Bitumen Bubble” claims that are being used to justify a range of cutbacks in government services as befits her government’s true privatization agenda, which appears to differ only in insignificant detail from the Wildrose Party’s platform.

In a speech to the Calgary Chamber of Commerce the day after he released his spring 2012 budget, Mr. Liepert predicted bitumen royalties were about to soar and as a result Albertans could expect annual surpluses of $10 billion or more.

“I don’t think any of us realize what kind of – I’ll call it a gusher – is coming out of the oil sands,” Mr. Liepert said in his pre-retirement swan song to the Calgary Chamber.

The day before, Mr. Liepert boasted to the Edmonton Journal that one of the reasons for his optimism was that each year more oilsands projects were approaching “payout” – the point at which they have recovered their costs and are subject to a higher royalty rate.

“Nothing is factored into this plan that isn’t already producing or about to produce, because many of these have a 10-year lead time,” Mr. Liepert assured the Journal.

In the same story, a spokesperson for the Canadian Association of Petroleum Producers agreed with Mr. Liepert’s analysis, observing, “this seems pretty consistent with our own figures.”

Readers will note the Redford Government has been very quiet lately about when it expects projects now paying royalties based on gross revenues to achieve payout and switch to the more generous rate based on net revenues. But judging from Mr. Liepert’s prediction just a year ago, his government analysts were of the view that happy day is not far away.

For a government with a neoconservative agenda of cutbacks and privatization, or which simply has some competency issues regarding budgeting, the so-called “Bitumen Bubble” was conveniently timed. It provides justification for holding the line on the salaries of public employees. It also offers and excuse for privatizing more services that belong in the public sector and finding new ways to minimize the public reaction to cuts in essential and popular public services.

As the Alberta Union of Provincial Employees – which as the representative of direct government employees, many health care workers and other public-sector employees, obviously has a dog in this fight – noted in a paper released this morning, the differential in the price fetched by Western Canada Select and West Texas Intermediate, the so called Bitumen Bubble, is almost certainly a temporary phenomenon.

Leastways, it is if past behaviour is a good way to predict future behavior – as it generally has been throughout of human history.

Back in October 2007, for example, the difference was about $30 – not seen to be a particular cause for concern at the time. Through most of 2011 it shrank to about $17. By December 2012, it was back to $30. Now it’s a crisis.

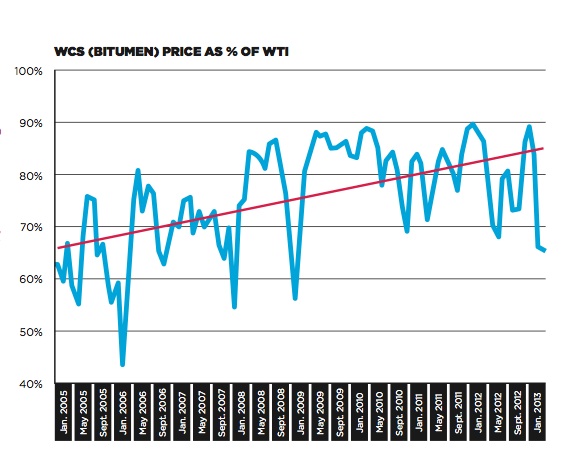

Look at the chart provided by AUPE: the price of bitumen as a percentage of WTI has been going up and down like an elevator in an office building since the start of 2005, but the trend has been steadily and happily upward.

Dubious estimates of the value of shale gas and horizontal drilling in Oklahoma have changed all that? Don’t you believe it!

In fact, energy analysts predict the price of the differential will tighten up again soon, just as it always has. Baytex Energy Corp.’s fourth quarter 2012 Heavy Oil Pricing Update and the PIRA Energy Group’s North American Midcontinent Oil Forecast, both in January 2013, for example, predicted the differential will tighten to about $22 by June and $13 by the end of the year.

A year ago this month, a report of the Canadian Energy Research Institute forecast “royalties collected from the oil sands industry are expected to exceed the $10 billion mark by 2016 and the $30 billion mark by 2024.”

In 2024, the number of projects in the post-payout phase, paying the higher rate, will exceed the number not yet paid out. And by 2040, CERI concluded, “oil sands royalties are estimated at around $52 billion. Between 2011 and 2045 a total of over $1.2 trillion are estimated to be collected by the Alberta Government from oil sands operators, a figure just below the equivalent of the current value of Canada’s economy or GDP.” (Emphasis added.)

Oh, and one more thing, with the government’s third-quarter fiscal update still predicting oil sands production 130,000 barrels a day higher than last year, the Bank of Canada is holding the line of interest rates – accounting for the recent decline in the value of the Loonie.

And remember, as the government pointed out in its 2012 budget, every one-cent decrease in the Loonie against the Greenback puts another $247 billion in Alberta’s back pocket – so if the dollar stays at about 95 cents, there’s another billion in the treasury!

This is a financial crisis?

Don’t expect to hear much about this just yet, however, because for ideological and policy reasons, the “Bitumen Bubble” narrative is equally convenient to the Redford Government, the Opposition Wildrose Party and the federal Conservative government of Prime Minister Stephen Harper – all of which advocate the same policies on pipelines, privatization and public-sector penury.

It is particularly helpful to the PCs, of course. For now, they can blame their current substantial deficits on unexpected factors outside their control – the Bitumen Bubble – never mind that it’s been understood and predicted for ages.

Going into the next election, they can claim it was good management and a tough line with public employees like teachers and government workers that are behind Alberta’s good fortune.

Corporate donors will be happy, the beneficiaries of continued rightward policies that feather their corporate nests. Suddenly the place will be awash in cash again, enough at least to lull the rest of us back to sleep.

Count on it that the government is confident it can again get progressive voters worried enough about the Wildrose agenda to once again abandon the Alberta NDP and Alberta Liberals and vote “strategically” for the government.

Obviously, Alberta shouldn’t be making long-term policy changes based on a ginned up panic over revenues that, as Ron Liepert rightly predicted, are only going to go up, way up!

But it sure sounds like that’s exactly what we’re doing.

This post also appears on David Climenhaga’s blog, Alberta Diary.