There are many reasons to doubt a national economic strategy premised centrally on digging out non-renewable resources, and selling them off to foreigners as quickly as possible. But one of the most irrational aspects of the recent energy boom has been its perverse impact on export revenues. In essence, the faster we extract bitumen and export it, the cheaper it gets. Our regulatory system gives each individual company free reign to export as much as possible, as fast as possible. But the resulting export surge drives down the overall price. That perversely undermines each producer’s revenue, and squanders the public interest in maximizing the value of non-renewable resources.

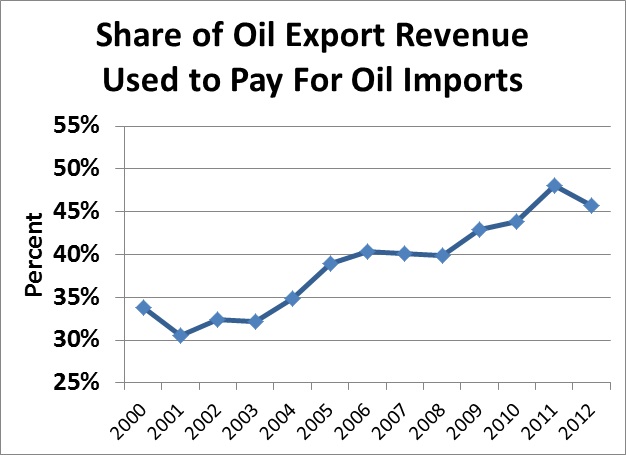

Canada both exports oil (from the west), and imports it (to the east). However, because of the depressing effect of unrestrained exports on prices, an incredible gap has emerged between what we pay for imports, and what we fetch for our exports. Last December, that so-called “Canadian discount” surged to over $60 per barrel: in essence, we had to export two barrels from the west, to pay for each barrel imported in the east. The gap has narrowed somewhat since then, but still costs Canadians billions of dollars per year (hurting not just oil companies in the west, but also consumers in the east). Almost half of Canada’s petroleum export revenue now goes to pay for petroleum imports (see chart).

The Canadian discount is commonly attributed to clogged southbound pipelines, but this is false. Export pipelines still have capacity, and will continue to for a while (depending on how fast bitumen production grows). The problem is that the regional market those pipelines serve (in the U.S. southwest) is saturated. Other oil has flooded that market (including new shale oil), refineries are full-up, and U.S. demand is sluggish (partly due to energy conservation).

There is a basic principle in economics that if demand for a product is inelastic (that is, not very responsive to price changes), then increasing the supply of a product is likely to drive down not only its unit price, but even the total amount of revenue collected (since the resulting boost to demand is proportionately smaller). That would clearly seem to be the case for Canadian oil selling in the U.S. market.

A rational monopolist or cartel would therefore restrict the supply in order to maximize revenue — all the more so being that it is a non-renewable resource, so you only get to sell it once. But our energy industry is directed by the atomistic self-interest of private companies, each of whom thinks it’s in their interest to pump and sell the stuff as quickly as possible (regardless of the irrational consequences for the industry as a whole). Citizens of Alberta are badly short-changed by this arrangement, since their (one-time-only) royalties on the product, already low (given Alberta’s business-friendly royalty regime), are suppressed further by the fire-sale of their family jewels by private corporations.

Politicians at all levels now routinely invoke the Canadian discount as a scapegoat for all their fiscal ailments. Alberta Finance Minister Doug Horner singled out the price differential when he revealed a surprise $3 billion provincial deficit. Federal Finance Minister Jim Flaherty did the same, referencing the issue in explaining why his government is $5 billion behind its budget target. This is unconvincing, especially at the federal level: since Ottawa collects no oil royalties, any fiscal benefit from oil exports is indirect and modest (captured largely through corporate taxes from oil companies — taxes which Ottawa cut in half since 2001). Indeed, Ottawa typically collects less than two cents from each dollar in upstream oil revenue. The real cause of Canada’s deficits is the failure to stimulate employment and income growth across the economy. We can hardly single out one industry (petroleum extraction) that produces just three per cent of real GDP.

However, these politicians have another motive for blaming deficits on oil price differentials. They support new export pipelines, and hope their fiscal arguments might make those pipelines more palatable to a skeptical public.

But if the problem exists because we’re pumping out raw bitumen faster than markets can absorb it, will it really help to pump it out even faster? Few analysts believe the Keystone pipeline to the U.S. (even if it’s built) would solve the problem: at best it would displace downward price pressure from Oklahoma southward to Louisiana. Pipelines through B.C. are unlikely to be built, for environmental reasons. And even if Canadian oil could reach Asia, don’t forget there are similar price risks there, too — including alternative supplies, conservation, and environmental constraints. In sum, the inherent limitations of an economic strategy rooted in the extraction and export of raw resources cannot be overcome by simply finding another foreigner to sell to.

The sheer waste and irrationality of the Canadian discount should be addressed with alternative measures. Instead of extracting and exporting raw commodities, we should strive to add more value to our resources — right here in Canada. Upstream, we could use far more Canadian-made equipment in resource projects. Downstream, we could upgrade and refine the resource, instead of saturating export markets with raw output. Even better would be to use Canadian petroleum (refined here at home) to displace the uber-expensive crude now tankered in from Britain and Algeria.

Yes, this would mean slowing down the pace of bitumen expansion (since there’s not enough demand in Canada, even including the east, to absorb all the new bitumen the industry wants to pump). But we’d extract much more value from each barrel. And we’d stop cheapening the value of our own non-renewable resources with a mad rush to export.

Jim Stanford is an economist with the Canadian Auto Workers union. A version of this commentary was originally published in the Globe and Mail.