[url=http://www.guardian.co.uk/business/2009/mar/07/government-takes-over-llo... UK bank bailout[/u][/color][/url]

World Financial Crisis Redux

In one of the bleakest assessments yet, economists at the World Bank predicted on Sunday that the global economy and the volume of global trade would both shrink this year for the first time since World War II.

The World Bank said in a new report that the crisis that began with junk mortgages in the United States was causing havoc for poorer countries that had nothing to do with the original problem.

As a result, it said, nations in Latin America, Africa and East Asia have had not only their growth stifled but their access to credit as well.

http://www.nytimes.com/2009/03/09/business/09bank.html?_r=1

Financial crisis hits Irish teachers, nurses

[url=http://www.google.com/hostednews/ap/article/ALeqM5ghj7xpYYH1xKMaDrZDHy8o...

DUBLIN (AP) — As a veteran nurse, Margaret Horan is used to feeling overworked and underpaid. A steady flow of coughing, moaning and bleeding Dubliners must wait hours to be seen because of staff shortages at her hospital in the working-class heart of the capital.As if that wasn't enough, Horan now can scarcely believe that the government plans to cut her pay by 10 percent or more — a sacrifice to be shared by hundreds of thousands of middle-class families across Ireland's unraveling economy.

A government that long profited from a property boom is now raising income taxes and pension charges to combat a sudden, gaping hole in the public finances that means borrowing one euro for every three spent. Its emergency approach is fueling rebellion throughout the bedrock of Irish society — teachers, bus drivers, police officers and nurses — who feel they are being asked to surrender too much in defense of a wealthy, discredited elite.

"Our genius government blew the boom. On their friends in the banks, on property madmen who made the whole country insane with greed. We had a once-in-a-lifetime chance to pull this country out of the muck. All that money wasted," rued Horan, dragging deeply from a cigarette outside her crowded emergency room on an icy March night.

"They can find billions for the banks, and we're getting our salaries and budgets slashed. It's a sick, sick joke

A fine agenda for re-regulating finance - probably nobody important will listen:

Financial innovation in products and institutions is potentially beneficial and potentially harmful. There is a need to regulate financial innovation. I propose the model used in the US by the Food and Drug Administration for pharmaceutical and medical products.

- First, there is a positive list of financial instruments and institutions. Anything that is not explicitly allowed is forbidden.

- To get a new instrument or new institution approved, there will have to be testing, scrutiny by regulators, supervisors, academic specialists and other interested parties, and pilot projects. It is possible that, once a new instrument or institution has been approved, it is only available ‘with a prescription'. For instance, only professional counterparties rather than the general public could be permitted.

- Clearly, this approach to financial innovation would slow down financial innovation. [b]It may even kill off certain innovations that would have been socially useful. So be it. The dangers of unbridled financial innovation are too manifest.[/b]

I love this guy. The only thing he didn't explicitly promote, but which even Paul Krugman seems to be coming to accept as inevitable in his latest reprint of Depression Economics, is controls over capital flows.

I have this theory about finance. Finance is really about doing nothing. It's about daming the river of trade and hording essentials to gain power over the population.

Government spending on social welfare is full of problems but they can be measured and corrected by concrete results.

The cause of this crisis was and perhaps still is about giving too much to the finance sector, the monetary intelligentia.

Imagine a card game were everyone has to bring there own money except the financier. He brings a bond rating agent and no money. Evertime he wants to bet he asks the game for credit. The game asks the bond rater if Joe Finance is good for his marker. "yup", the agent says.

This card game is the stock market.It goes on for 24/7. Every time he loses he just asks for more credit. Probability dictates that with these unlimited resources he will win all the money at the table if people keep playing. The banks get up an leave with their cash. But the government says that they will give them more. It won't matter.The dynamics of unlimited credit will always result in the ul;timate triumph of Joe Finance and his unlimited markers.

Will "regulation" work? I don't think so. We need to radically downsize the finance sector not strengthen it. How can this be done while ensuring that things like pensions, healthcare, education, public transportation are preserved?

The answer is simple - socialism.

Financialization, the change of the centre of gravity from production to finance in the capitalist economy, is an objective trend that's been going on for some decades. While it's certainly true that the cascading Financial Crisis which began in July 2007 with the collapse of two Bear Stearns Hedge Funds took place in this growing part of the economy, there are differing views on the benefits of downsizing this part of the economy. Short of socialism, Harry Magdoff and Paul Sweezy noted in 1985:

"Does the casino society in fact channel far too much talent and energy

into financial shell games. Yes, of course. No sensible person could

deny it. Does it do so at the expense of producing real goods and services?

Absolutely not. There is no reason whatever to assume that if you

could deflate the financial structure, the talent and energy now employed

there would move into productive pursuits. They would simply

become unemployed and add to the country’s already huge reservoir of

idle human and material resources. Is the casino society a significant

drag on economic growth? Again, absolutely not. What growth the

economy has experienced in recent years, apart from that attributable to

an unprecedented peacetime military build-up, has been almost entirely

due to the financial explosion."

Socialism, sure, as a permanent long, term remedy is the solution. In the meantime, measure should be taken to assist the most needy.

http://www.doctorhousingbubble.com/

We are now in a “bull” market everyone! A “leaked” Citigroup memo discusses a word that has been foreign in the banking sector for much of 2008. Profit. The market enjoyed that even though it is based on the same fantasy of those that believe in elves and other mythical creatures. At least we enjoyed the Lord of the Financial Rings on Tuesday and the market shot up like it was flying on the next NASA rocket. Next, we have Boom Boom Helicopter Bernanke talking tough about how to solve the market and how we can prevent this mess from ever happening again (as if we are in the clear now). So today’s rally was based more on technical resistance and mere exhaustion of the market being so incredibly down for 2009:

Canadian unemployment rate rises to 7.7%

http://www.cbc.ca/canada/story/2009/03/13/unemployment-february-998.html

The Chinese premier Wen Jiabao expressed concern on Friday about the safety of China's $1 trillion investment in American government debt, the world's largest such holding, and urged the Obama administration to provide assurances that its investment would keep its value in the face of a global financial crisis.

. . . .

China has the world's largest reserves of foreign exchange, estimated at $2 trillion, the product of years of double-digit growth.

Economists say half of that money has been invested in United States Treasury notes and other government-backed debt.

http://www.nytimes.com/2009/03/14/business/worldbusiness/14china.html?hp

It is the rot at the top that has brought us to the brink of another world depression, and until we have in place very strict reulations to police these Madoff-type creeps, as well as reversing all the tax concessions given to the rich, we will never sort out this financial mess.

Instead of that idiot CEO who was lamaenting the vilification of business corporations, perhaps these gready vultures from Wall Street or Bay Street, wherever, might trying emulating this:

Warren Buffett’s Berkshire Salary Remains $100,000

http://www.bloomberg.com/apps/news?pid=20601087&sid=aKSmwPf7CItc&refer=home

Warren Buffett, the world’s second- richest man, received a $100,000 salary for the 28th consecutive year in 2008 as Berkshire Hathaway Inc. posted the worst annual results of his tenure. He received no bonus.Berkshire this month said book value per share, a measure highlighted on the first page of the Omaha, Nebraska-based company’s annual report, fell for the second time since he wrested control of the company four decades ago. Buffett gets no stock options or grants for serving as chief executive officer and chairman, Berkshire said in a regulatory filing today.

Buffett, 78, built the once-failing textile manufacturer into a $130 billion investment and holding company with businesses from ice cream and candy stores to insurance and corporate jet leasing. He is Berkshire’s largest shareholder, and has pledged the bulk of his stake to the Bill & Melinda Gates Foundation and four family charities.

I added a comment above in response to the remarks of blackhand9. The remarks had to do with the long term trend of financialization in the economy. There's more ... I've found a very, very readable interview with the editor of Monthly Review and here are a few sections ...

J.B.Foster: I think it is true, as you say, that the American people have been misled by analyses of the crisis into focusing on mere symptoms, or on the straws that broke the camel's back, such as subprime loans. There is still a great deal of toxic financial waste out there in the financial superstructure of the economy, but the real problems go much deeper. One reason for this failure to account realistically for the crisis is that those at the top of the system have very little clue themselves, given the near bankruptcy of orthodox economics. A second reason is that the dominant ideology is designed to naturalize/externalize economic disaster, pretending it has nothing to do with the inner contradictions of the system but is simply the result of human psychology, mistakes of federal regulators, deregulation, corruption of a few individuals, etc. Under these circumstances, what you get from the elites and the media is mostly nonsense ....

What's happening right now?

Rather we are experiencing one of the greatest robberies in history. I have written on the question of nationalization for the "Notes from the Editors" forthcoming in the March 2009 Monthly Review. All the attempts to rescue the financial system at this time go in the direction of nationalization. The federal government is providing more and more of the capital and assuming financial responsibility for the banks. However, they are doing everything they can to keep the banks in private hands, resulting in a kind of de facto nationalization with de jure private control. Whether the federal government is forced eventually toward full nationalization (that is, assuming direct control of the banks) is a big question. But even that is unlikely to change the nature of what is going on, which is a classic case of the socialization of losses of financial institutions while leaving untouched the massive gains still in the hands of those who most profited from the whole extreme period of financial speculation.... The fact that Geithner, Obama's pick for Treasury Secretary, is overseeing the enormous robbery taking place, probably exceeding any theft in history, with the ordinary taxpayers picking up the tab, should certainly cause one to ask questions about the "progressive" nature of the new administration.

And what's needed?

What is needed in the United States today, we argue in The Great Financial Crisis, is a renewal of the classic concept of political economy (with its class perspective), whereby it comes to be understood that the economy is subject to public control and should be wrested from the domination of the ruling class. The bailing out of the system right now is going on with taxpayer funds but without the say of the public. A revolt to gain popular control of the political economy is therefore necessary.

http://mrzine.monthlyreview.org/foster270209.html

Why do I get the impression that what the peasants were told by their leaders leadng up to the 1930s depression is the same thing our leaders are telling us now.

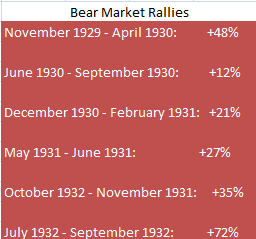

And finally, we will examine previous bear market rallies including those during the Great Depression. Keep in mind the market was rallying in the early 1930s as unemployment kept making its trek upward to 25 percent.

Bear Market Rallies

Some people think that stock market rallies only happen in full on bull markets. That is not the case. In fact, some of the fiercest short term jumps happen when the economy is in utter disarray. Let us take a look at the Great Depression for example:

From November of 1929 to September of 1932, the Dow saw 5 rallies over 20+%. One hit 72% and one hit 48%! In fact, the 72 percent rally happened right after the market hit the abyss. Yet as we all know, the Great Depression caused fundamental problems in the economy that lasted the entire 1930s. So only looking at the stock market as an indicator is problematic. And keep in mind the rally occurred right on the heels of thousands of bank failures in the 1930s and unemployment spiking to 25%.

We also have the problem of interpreting math results. For example, everyone was cheering the 40 percent rise of Citigroup this week but forgot to mention that this amounted to 40 cents. You gained 1 quarter, 1 dime, and 1 nickel for each share you owned. The rally we are currently seeing is strictly a technical rally. Don’t fool yourself into thinking otherwise. It is the same as the Great Depression bear market rallies. We will test lows again soon. Maybe once those stress tests are released or when the 1st quarter results are announced starting in April of 2009. For the mean time, enjoy the bear market rally.

What an idiot!

Who is he pimping for - Harper or the business community. Most probably both. Evertyone knows his economic forecasts aren't worth the paper they are written on.

Carney hedges economic rebound prediction

http://www.theglobeandmail.com/servlet/story/RTGAM.20090314.wg20wrestle0314/BNStory/Business

The Bank of Canada seems to have ditched its prediction for a made-in-Canada economic rebound next year.Speaking to reporters at the Group of 20 finance ministers meeting in Horsham, Bank of Canada Governor Mark Carney hinted strongly that his last forecast for 3.8 per cent growth in 2010 is no longer valid. “Clearly the risks are breaking to the downside,” he said, referring to the string of grim Canadian and international growth data in recent weeks.

Officially, the 3.8 per cent growth figure stands. The number is revised four times a year and the next revision comes in late April. Mr. Carney would give no clue what the new number might be but said the bank is “in broad agreement” with the International Monetary Funds' growing pessimism about the potential for recovery in 2010. “Many of the downside risks we identified in our last Monetary Policy Report Update are now materializing,” he said.

Mr. Carney's comments came as the G20 meeting ended with broad pledges for a “sustained” effort to end the global recession, which is deepening by most indications, though the ministers stopped short of announcing specific new monetary and stimulus measures. “The situation remains critical and most forecasters, including the IMF, believe we have not hit bottom,” Jim Flaherty, Canada's finance minister, said at a press conference.

The BOC is hoping nobody will notice that they started printing money.

(Click "printing money")

This is incredibly sick.

What is the matter with government negotiators that they are allowing something like this to happen.

A.I.G. Planning $165 Million in Bonuses After Huge Bailout

http://www.nytimes.com/2009/03/15/business/15AIG.html?_r=1&hp

The American International Group, which has received more than $170 billion in taxpayer bailout money from the Treasury and Federal Reserve, plans to pay about $165 million in bonuses by Sunday to executives in the same business unit that brought the company to the brink of collapse last year¨

[url=http://www.thenation.com/doc/20090323/foster][color=mediumblue][u]John Bellamy Foster[/u][/color][/url]We are living in a new historical moment. Today's threefold crisis of capitalism--viewed in terms of economy, ecology and empire--is potentially the worst in history, not excluding the 1930s and '40s. The current economic downturn already compares in many ways with the Great Depression, and the bottom has not yet been reached. The ecological catastrophe is the most serious that humanity has experienced, threatening the mass extinction of species and human civilization. The struggle over empire, with US hegemony waning but far from gone at present, points to the danger of more frequent and larger wars. I have discussed the three aspects of this historical crisis in [i]The Great Financial Crisis[/i] (recently published with Fred Magdoff), [i]The Ecological Revolution[/i] (forthcoming in April) and [i]Naked Imperialism[/i] (2006). Any realistic treatment of the world situation, and the need for socialism, must attend to all three of these global contradictions emanating from capitalism.

Fortunately, global resistance to the system is also growing, in response to its economic, ecological and imperial contradictions. Today Venezuela, Bolivia and Ecuador, together with Cuba, are leading the way in promoting a "socialism for the twenty-first century." Much of the rest of Latin America is also in revolt against decades of neoliberalism. In Nepal a revolutionary struggle has overthrown the monarchy and is working at establishing more egalitarian and democratic conditions. A broad, popular movement against neoliberalism has emerged in South Africa. General strikes have broken out in Guadeloupe and Martinique (the French Antilles). Widespread revolts have arisen in Greece and throughout the European Union with millions in the streets. The governments of Iceland and Latvia have been toppled. A New Anti-Capitalist Party (NAP) has been established in France. China is experiencing labor unrest as a result of the crisis.

If there is one place in this world ferment where mass dissent seems noticeably absent at the moment, it is in the United States, the epicenter of the global crisis. In my view, this is likely temporary....

Here's some positive news for a change -

Gordon Brown last night hailed the beginning of the end for tax havens, as Switzerland opened up its legendary system of bank secrecy and agreed to hand over information on wealthy clients suspected of tax evasion.

The move, described as historic by anti-poverty campaigners, came as international pressure, including action from Brown and Barack Obama, forced the world's tax havens to hand over previously undisclosed data on account holders.

In a remarkable week, Europe's secrecy jurisdictions – Liechtenstein, Andorra, Austria, Luxembourg, Jersey and Switzerland – all entered into international information sharing agreements.

http://www.guardian.co.uk/business/2009/mar/13/switzerland-tax-evasion-f...

I smell exchange controls on the horizon. It's the next logical step as governments start cracking down on what rich people have been able to get away with doing.

Incidentally, if you want to get the right-wingers on board, tell the hoary old anti-Communists that the KGB was taking advantage of deregulation of financial markets in the 1970s to build up the USSR's hard currency reserve by gambling on the forex markets.

(It's actually true, by the way; KGB officers built up their own personal war chests as well as the KGB's war chest in a sort of judo use of the West's own penchant for thinking big business can do anything better than a government can)

Oh, that explains it. The police forces were too busy fighting the millions and billions of terrorists to go after the white-collar criminals. What a convenient diversion by Bush & Wall Street.

When will bad bankers go to jail?

Wall Street lies in tatters, but we're still waiting for the prosecutions that might reassure investors that the system works. One key issue: Were risk-taking bankers criminals? Or just dumb?

http://finance.sympatico.msn.ca/Investing/MichaelBrush/Article.aspx?cp-documentid=18547376

Rio Tinto Alcan is going to be rebuilding the aluminum smelter in Kitimat. It had a bit of a false start in 2008, so I wonder when this project will actually take off.

Chinalco scrutiny increased

http://business.theage.com.au/business/chinalco-scrutiny-increased-20090315-8yzo.html

Paul Kalfadellis, a Monash University lecturer who has researched foreign investment in Australia, said the Chinalco application may draw the most scrutiny. "In this case I think there is a general reticence for a BHP or Rio Tinto to be taken over by a Chinese firm," he said.

Rio has said it will wait for FIRB to rule on the investment agreement before it puts the matter to a shareholder vote. Rio chief executive Tom Albanese has also indicated the terms of the $US7.2 billion of convertible bonds and $US12.3 billion of asset sales are unlikely to be altered before a ruling from FIRB.

The deal needs the approval of 50 per cent of Rio's shareholders, and Chinalco has agreed to refrain from voting its existing 9 per cent stake in the company.

It seems that the big winners are those that strongly went against the pervailing wisdom in the financial community:

What Economic Crisis?

http://www.motherjones.com/politics/2009/03/10-people-who-are-profiting-...

-------------------------------------------------

God bless America!

October 17, 2008

http://www.portfolio.com/html/assets/AndrewLahdeFarewell.pdf

On the issue of the U.S. Government, I would like to make a modest proposal. First, I point out the

obvious flaws, whereby legislation was repeatedly brought forth to Congress over the past eight

years, which would have reigned in the predatory lending practices of now mostly defunct

institutions. These institutions regularly filled the coffers of both parties in return for voting down all

of this legislation designed to protect the common citizen. This is an outrage, yet no one seems to

know or care about it. Since Thomas Jefferson and Adam Smith passed, I would argue that there

has been a dearth of worthy philosophers in this country, at least ones focused on improving

government. Capitalism worked for two hundred years, but times change, and systems become

corrupt. George Soros, a man of staggering wealth, has stated that he would like to be

remembered as a philosopher. My suggestion is that this great man start and sponsor a forum for

great minds to come together to create a new system of government that truly represents the

common man’s interest, while at the same time creating rewards great enough to attract the best

and brightest minds to serve in government roles without having to rely on corruption to further their

interests or lifestyles. This forum could be similar to the one used to create the operating system,

Linux, which competes with Microsoft’s near monopoly. I believe there is an answer, but for now

the system is clearly broken.

A Continent Adrift

http://www.nytimes.com/2009/03/16/opinion/16krugman.html?em

Why is Europe falling short? Poor leadership is part of the story. European banking officials, who completely missed the depth of the crisis, still seem weirdly complacent. And to hear anything in America comparable to the know-nothing diatribes of Germany’s finance minister you have to listen to, well, Republicans.

But there’s a deeper problem: Europe’s economic and monetary integration has run too far ahead of its political institutions. The economies of Europe’s many nations are almost as tightly linked as the economies of America’s many states — and most of Europe shares a common currency. But unlike America, Europe doesn’t have the kind of continentwide institutions needed to deal with a continentwide crisis.

This is a major reason for the lack of fiscal action: there’s no government in a position to take responsibility for the European economy as a whole. What Europe has, instead, are national governments, each of which is reluctant to run up large debts to finance a stimulus that will convey many if not most of its benefits to voters in other countries.

"Capitalism is the extraordinary belief that the nastiest of men for the nastiest of motives will somehow work for the benefit of all."John Maynard Keynes

Destabilizing the EU Banking System

"......the LEAP/E2020 team (which warned about housing risks in Central and eastern Europe as early as December 2007 in GEAB N°20 decided to study carefully in the present public announcement the reality of this so-called “Eastern European banking bomb” which has invaded the media in the last month...........it represents in our opinion a deliberate attempt on the part of Wall Street to make the world believe in some rupture within the EU and to instil the idea that some deadly risk is weighing on the Eurozone, by endlessly conveying phony news on a banking risk coming from Eastern Europe......One aim is also to divert the attention from the increasing financial problems encountered in New York and London, and to weaken the Europe position on the eve of the G20 summit........The idea is brilliant: pick up a current and “in the news” theme to ensure interest, add one or two striking analogies to guarantee that the media and internet are eager to circulate the information; then call on a few devoted men and organisations, always available to tell one more lie.......Then, to make the idea more credible, you select some virulently anti-Euro media such as the UK’s Telegraph, for instance...."

Everyone hates CEOs - amusing

Also some fairly big news out of the US - the Federal Reserve is going to start buying treasury bills - $300 billion worth this year. This essentially amounts to the US government printing that amount of money to spend rather than borrowing it. It speaks to the concern that must exist about deflation and might also be intended to further devalue the dollar now there's no way to reduce interest rates to accomplish that.

http://money.cnn.com/2009/03/18/news/economy/fed_decision/index.htm

Baby Boomers ‘Under Water’ (clickable link)

Oh, poor them! They got the subsidized educations and the good jobs in the 1950s and 1960s and now, after they voted to take the punch bowl away from their children over the last 20 years by falling for Reagan's, Mulroney's, Thatcher's crap about government being the problem, they'll have their goddamn hands out saying they decided government was good for something, after all.

from Doc's link:

Another factor that has led to a decline in personal wealth is what the report calls “the near zero level of savings nationally” from 2004 to 2009.

“As a result of the bubble-inflated values of their homes, tens of millions of families opted not to save during what would typically be their peak saving years,” the report said.

Savings shmavings, what do they need money for anyway? In perestroika years Russia, economic shock therapists considered Russians' life savings as pesky overhang and needed to be wiped out in order that market forces could work the magic.

It must be that US boomers, like those lazy Russians of post-Soviet rule, all need straightening out and noses put to grindstones while Wall St. fat-cats lap up what's left of the cream. It must be a shocking experience

[url=http://www.globalresearch.ca/index.php?context=va&aid=12794][color=red][... Real AIG Scandal. It's not the bonuses. It's that AIG's counterparties are getting paid back in full[/b][/color][/url]

Everybody is rushing to condemn AIG's bonuses, but this simple scandal is obscuring the real disgrace at the insurance giant: Why are AIG's counterparties getting paid back in full, to the tune of tens of billions of taxpayer dollars?

For the answer to this question, we need to go back to the very first decision to bail out AIG, made, we are told, by then-Treasury Secretary Henry Paulson, then-New York Fed official Timothy Geithner, Goldman Sachs CEO Lloyd Blankfein, and Fed Chairman Ben Bernanke last fall. Post-Lehman's collapse, they feared a systemic failure could be triggered by AIG's inability to pay the counterparties to all the sophisticated instruments AIG had sold. And who were AIG's trading partners? No shock here: Goldman, Bank of America, Merrill Lynch, UBS, JPMorgan Chase, Morgan Stanley, Deutsche Bank, Barclays, and on it goes. So now we know for sure what we already surmised: The AIG bailout has been a way to hide an enormous second round of cash to the same group that had received TARP money already.

It all appears, once again, to be the same insiders protecting themselves against sharing the pain and risk of their own bad adventure. The payments to AIG's counterparties are justified with an appeal to the sanctity of contract. If AIG's contracts turned out to be shaky, the theory goes, then the whole edifice of the financial system would collapse.

The bottom line is that the American public is being fed a carefully crafted mythology (no doubt “market tested” on “response groups” to see which images fly best) to mislead the American public into misunderstanding the nature of today’s financial problem – to mislead it in such a way that today’s policies will make sense and gain voter support.

But this mythology is based on false analogies, not economic reality. It is designed to make Wall Street appear as a savior, not an arsonist – and to depict the Fed and Treasury as protecting the welfare of American citizens by shoveling billions of dollars at the banks whose gambles have caused the crisis.

[url=http://www.counterpunch.org/hudson03172009.html][color=mediumblue][u]Sou...

AIG employees have been told not to wear AIG clothing or other items with the company logo in public for their personal safety.

http://latimesblogs.latimes.com/money_co/2009/03/aig-security-am.html

Ouch. You think people are angry?

ha! Guy on the news says AIG stands for arrogance, incompetence, and greed

"...distracting attention from the real causes."

It appears that Europe wants structural changes and America wants to re-inflate the present system.

Although the spotlight has temporarily rested on AIG (Jack in Lord Of The Flies?), perhaps a bit of this is going on:

The scapegoat was a goat that was driven off into the wilderness as part of the ceremonies of Yom Kippur, the Day of Atonement....Since this goat, carrying the sins of the people placed on it, is sent away to perish, the word "scapegoat" has come to mean a person, often innocent, who is blamed and punished for the sins, crimes, or sufferings of others, generally as a way of distracting attention from the real causes. Wiki

I believe it has links to human sacrifice. Catharsis is not just drama, it's also a primitive medicine.

Let the fun of this Spring of Our Discontent begin!

Office workers face chaos next week with swaths of London in security lockdown for the G20 summit and warnings that bankers will be targeted in a series of protests aimed at causing maximum disruption.

Staff in the City are being advised to dress down and postpone non-essential meetings amid fears that they will be forced to run the gauntlet of protesters. Thousands of G20 Meltdown campaign posters show a mannequin wearing a suit being hanged, while an anarchist website has the slogan: "Burn a banker!"

Details of direct action, gleaned from chatter on anarchist websites and meetings attended by the Observer, include a rumoured plan to block the Blackwall Tunnel and cause a security scare on the London Underground by leaving bags unattended on trains. There is also speculation that protesters will drive a tank to the ExCeL conference centre in London's Docklands, where the G20 are meeting, and attempt to harass politicians with wake-up calls to their hotels in the middle of the night. None of the organisers of the peaceful demonstrations say they are aware of any such tactics.

http://www.guardian.co.uk/business/2009/mar/22/g20-anti-globalisation-protests

Which is too bad, because they sound good.

thanks for that link, Doug! the 'four horsemen of the apocalypse' ...[chuckle] what a lot of creativity - hope it goes well for everyone,

Will the rewards of failure never cease? Apparently not yet.

Remember the rating agencies? S&P? Moody's? The folks who rated all that subprime paper Triple-A?

Well, the Fed's baillout program is going to be issuing a lot of new asset-backed securities, which means the rating agencies are about to be busy again. In fact, the Wall Street Journal estimates that they'll make $1 billion of fees rating the paper produced in the latest bailout programs.

Call the Waaaaambulance!

After 12 months of hard work dismantling the company — during which A.I.G. reassured us many times we would be rewarded in March 2009 — we in the financial products unit have been betrayed by A.I.G. and are being unfairly persecuted by elected officials. In response to this, I will now leave the company and donate my entire post-tax retention payment to those suffering from the global economic downturn. My intent is to keep none of the money myself.

http://www.nytimes.com/2009/03/25/opinion/25desantis.html?_r=2&pagewanted=1

I have to wonder if he's falling on his sword or trying to win the world's smallest violin contest. They gave this guy $740 THOUSAND and he's bitching and whining? No wonder people are so hacked off at AIG. This isn't giving a deserved year-end bonus to workers struggling in today's economy; this is just grabbing taxpayer money and throwing it at the already wealthy, just like the Busheviks did with their tax cuts.

Disappearing jobs overrunning stimulus: official

OTTAWA — Canada's economy has deteriorated so badly since the federal government introduced its budget that more jobs have already vanished than the $40-billion stimulus was intended to create, the parliamentary budget officer says. . .[Parliamentary Budget officer]Page noted that Flaherty had estimated the stimulus would save or create 190,000 jobs over two years, but that Canada has already lost 212,000 in the first two months of the year before a dime of the stimulus is spent.

As many as 385,000 jobs will vanish in the first half of this year, he said.

[url=http://wsws.org/articles/2009/mar2009/pers-m25.shtml][color=red][b]IMF director warns of war[/b][/color][/url] WSWS

Dominique Strauss-Kahn, managing director of the International Monetary Fund, warned on Monday that the global economic situation is "dire" and could lead to social upheaval and war. The statement is the latest in a series of worried pronouncements from leading international figures in the financial and political establishment.

The IMF is projecting a 1 percent decline in the global economy this year, which Strauss-Kahn noted would be "the first setback of the world economy in over 50 years." The IMF chief was speaking before a meeting of the International Labour Organization (ILO) in Geneva, Switzerland. . .

The implications of the economic collapse for working people internationally are still in their initial stages. The ILO predicted in January that up to 50 million jobs would be eliminated throughout the world in 2009. This is likely an underestimation, as the economic crisis has sharply accelerated over the past several months.

Nevermind the fact that unemployment does nothing to represent true levels of employement. It is much worse than the past. The CBC had donna dasco on saying she doesn't understand why people are so down on the economy when unemplyment is only 7.8% unlike when we had 11 percent back in the 90's. Well dumb rich person, unlike the people you hang out with who see the stocks going back up as what means a good economy or not, we have to look at being under-employed.

If I go from a 20 something(you know the gardeners money) an hour job to a 10 dollar job, I am employed all right, but my standard of living will have been more than cut in half. But yes you are right I am employed. Or maybe I happen to be on workshare waiting for the other shoe to drop. Yep I'm employed but working 20 hours a week and struggling to make the bills. But hey the emploment numbers aren't that bad. Nevermind the fact that 60% can't qualify a ton of people have fallen off the EI ranks, homeless, moved etc.

I know I keep harping on this, but an economist said in november that employers that were not doing poorly were using the downturn to do layoffs they had on the books because they now had a good excuse to do so, even if they didn't NEED to.

Again the selfish ME ONLY group relies on other companies(see government) to do the heavy lifting of sustaining an economy as long as they continue to rake in the profits without helping out themselves. If I can reduce my workforce but people buy my service/product for the same price(or more, remember what the market will bare) that is all that matters. Well the tipping point is about to be reached were people can't afford it. This is why Henry Ford decided he needed people he employed to be able to afford the products they made, unlike today where it's a race to the bottom.

Belinda S talked about baking a bigger economic pie so we can all keep our share of the pie(meaning they won't give up the gluttonous portion they have). Well procuctivity and overall growing of the economy has happened. But here are the resault.

The original 10 kilo pie that had the 5% of people eating 5 Kg of the pie and the other 95% of us also having 5 kg of pie has expanded a lot say to a 20 kg pie, but 95% of us still have to eat from that same 5 kilos while the rich eat from their original 5 kg plus the additional 10 kilograms of the new bigger pie. So no matter how big the pie gets we still only get that 5 kg slice while they have the 45 kg of a 50kg pie. And their supporters will say that we should be grateful we get such a heavy slice to start with.

Cities Deal With a Surge in Shantytowns

"Hoovervilles" sprouting across America

China would like to reform the IMF:

http://news.bbc.co.uk/2/hi/business/7967706.stm

Eat THAT, USA :P

[url=http://www.socialistvoice.ca/?p=377][color=mediumblue][u]Federal Government in Denial as Economic Crisis Slams Canada[/u][/color][/url]

As the grim news of growing job losses mounts in Canada, the federal Conservative government is continuing the politics of denial that marked last autumn’s election campaign. Especially troubling for the working class is that opposition political parties, including the trade union-based New Democratic Party, are offering no substantial alternative.

This is a really excellent article in some ways

In its depth and suddenness, the U.S. economic and financial crisis is shockingly reminiscent of moments we have recently seen in emerging markets (and only in emerging markets): South Korea (1997), Malaysia (1998), Russia and Argentina (time and again). In each of those cases, global investors, afraid that the country or its financial sector wouldn’t be able to pay off mountainous debt, suddenly stopped lending. And in each case, that fear became self-fulfilling, as banks that couldn’t roll over their debt did, in fact, become unable to pay. This is precisely what drove Lehman Brothers into bankruptcy on September 15, causing all sources of funding to the U.S. financial sector to dry up overnight. Just as in emerging-market crises, the weakness in the banking system has quickly rippled out into the rest of the economy, causing a severe economic contraction and hardship for millions of people.

But there’s a deeper and more disturbing similarity: elite business interests—financiers, in the case of the U.S.—played a central role in creating the crisis, making ever-larger gambles, with the implicit backing of the government, until the inevitable collapse. More alarming, they are now using their influence to prevent precisely the sorts of reforms that are needed, and fast, to pull the economy out of its nosedive. The government seems helpless, or unwilling, to act against them.

The American economy shed another 663,000 jobs in March, the government reported Friday, bringing the toll of job losses during the recession to 5.1 million.

The Bureau of Labor Statistics reported that the national unemployment rate climbed to 8.5 percent from 8.1 percent in February, its highest levels in a quarter-century, as employers raced to cut their payroll costs. It was the 15th consecutive month of job losses.

. . . .

The agency also drastically revised the job losses in January to 741,000 from the earlier report of 655,000, but left February's job loss estimate of 651,000 unchanged.

http://www.nytimes.com/2009/04/04/business/economy/04jobs.html?hp