According to [url=http://www.telegraph.co.uk/finance/financetopics/financialcrisis/7252288... report[/u][/color][/url]:

"The council of EU finance ministers said Athens must comply with austerity demands by March 16 or lose control over its own tax and spend policies altogether. It if fails to do so, the EU will itself impose cuts under the draconian Article 126.9 of the Lisbon Treaty in what would amount to economic suzerainty.

While the symbolic move to suspend Greece of its voting rights at one meeting makes no practical difference, it marks a constitutional watershed and represents a crushing loss of sovereignty.

[snip]

Greece must reduce its deficit from 12.7pc of GDP to 3pc in three years."

The "draconian" cuts in government spending will likely remain in place for years.

Next up?

Probably Spain.

aren't they happy they held the Olympics and took their own bath for corporations too?

Perhaps its time to consider increasing rent on the US Military bases and NSA outposts.

na, I think it is time people indicated just who the corporations were/are that soak tax payers and who owns the main bulk of corporations that suck tax payers dollars in financing their corporate extravanganza....that leaves nations broke.

Perhaps its time to consider increasing rent on the US Military bases and NSA outposts.

The Yanks prolly suckered them into a 99 year lease at rock-bottom rates, like they've wangled out of our stooges for massive supplies of oil and gas, hydroelectric power, timber and mineral rights in various parts of Bananada over the years.

I've always been somewhat pro-EU because it seemed like an interesting experiment. In some ways it's superior to NAFTA, which isn't very accountable. The EU's Parliament, Council of Ministers and President are at least somewhat accountable to the people - hence making it more likely to respond to public pressure, which could in theory make it more respectful of sovereignty. Considering the far more streamlined border controls and the lower levels of red tape when it comes to labour mobility it's a better internal market than NAFTA as well.

But this crisis is probably a really good example of why countries shouldn't enter into monetary unions, at least not if they're on unequal economic playing fields. I suppose there's always a risk, even without provisions like this that the larger countries in a monetary union will be able to take advantage of the smaller ones. Should this article 126.9 be implemented, it will validate every Euroskeptic's criticism of the EU's threat to national sovereignty and it will probably set back the cause of the UK and other hold outs from joining the Eurozone for decades. The EU would be well advised not to impose anything on the Greeks the Greeks aren't willing to do themselves.

pffft...the Olympic committee and corporations, and athletes who won medals, should be paying them profit royalities for the tax payer funded extravanganza and monetary windfall they got, which has put Greece and its people, into this situation.

Greece has a huge problem with tax evasion and part of their solution is to crack doen on it. Many BBC articles Ive read recently show and quote greeks as talking about their 'duty' to avoid taxes

Could Olympics Undo the Global Economy?

http://thetyee.ca/Opinion/2010/02/17/OlympicEconomy/

"Greece's crushing debt problems can be traced back to the 2004 games, which cost the smallest nation to ever host the Olympics a whopping $15 Billion--double what was originally predicted.."

Oooh, Greek Finance Minister - not a job I'd want to have!

Hundreds of thousands of Greeks are on strike to protest at the imposition of austerity measures to save the economy.

Greece's airspace will be closed to all flights, trains and ferries will stand idle, and archaeological sites shut.

quote:

"Papaconstantinou is looking for clearer EU support to help escape a vicious circle of rising borrowing costs, harsher austerity measures, prolonged recession and diminished revenue.

Having owned up to a massive under reporting of its deficit and promised swift corrective action, Greece's negotiating leverage with its EU partners is mostly negative.

It can dramatize the risks for the entire euro zone if its debt woes get worse, it can point to the danger of social unrest if the EU forces too harsh austerity on Greeks, and it can threaten to go to the International Monetary Fund."

Demand is going to drive up the price of Hemlock, for sure. Just hope we hear more about the role of U.S. banks in this.

quote:

"Papaconstantinou is looking for clearer EU support to help escape a vicious circle of rising borrowing costs, harsher austerity measures, prolonged recession and diminished revenue."

Greece cannot "escape" from a choice between suffering high borrowing costs and implementing austerity measures.

If Greece chooses to not implement draconian austerity measures, then Greece will only be able to borrow the money needed to run the government at stratospheric interest rates. Greece can only avoid such interest rates if it implements draconian austerity measures.

American politicians would be well advised to look closely at what's happening in Greece.

ETA: Of course, Greece can "escape" to the extent that Germany, primarily, elects to help them with billions of euros. But, the German people (and rightly so) are not terribly keen on that plan.

It appears that the newly-elected PASOK government is the victim of horrific budget fraud by the right-wing government it just defeated.

Even worse, the austerity fetishists of the EU and the international financial system are using this fraud to essentially reverse the election results, because if the PASOK government implements the massive cuts, there will be nothing it can do at all that will make it distinguishable from the right-wing government other than when it is forced to govern to that government's RIGHT. It means PASOK can do nothing progressive in office at all. If PASOK is forced to implement this level of austerity, it will make all future elections anywhere essentially meaningless. If the policies always have to stay the same, it can't really matter who implements them, after all. Austerity is austerity is austerity, and is never to the good of the people.

And, ironically, if the people's revolt in Greece against the EU grows, the cost of violently suppressing it (and we can assume it will be violent suppression, given the history of the Greek police and military)will end up far exceeding the costs of not forcing austerity and the recession that will have to accompany it on the Greek people

What the EU is doing is a betrayal of democracy. It should not be possible for outside forces to deny the people of a particular country the government and the policies that they voted for.

What the EU is doing is a betrayal of democracy. It should not be possible for outside forces to deny the people of a particular country the government and the policies that they voted for.

Problem is that Greece has also tied itself to the EU (presumably with the consent of its people, who never opposed it over the past 20 years or so). In doing so it gave up some sovereignty over its financial policy.

Sure, what's happening now (in terms of the loss of sovereignty) goes far beyond what Greece may have originally signed up for, but it must have been aware that with a common currency and common market, it would never be permitted to just do whatever it wants (at least without first leaving the EU and the Euro zone).

It appears that the newly-elected PASOK government is the victim of horrific budget fraud by the right-wing government it just defeated.

Even worse, the austerity fetishists of the EU and the international financial system are using this fraud to essentially reverse the election results, because if the PASOK government implements the massive cuts, there will be nothing it can do at all that will make it distinguishable from the right-wing government other than when it is forced to govern to that government's RIGHT. It means PASOK can do nothing progressive in office at all. If PASOK is forced to implement this level of austerity, it will make all future elections anywhere essentially meaningless. If the policies always have to stay the same, it can't really matter who implements them, after all. Austerity is austerity is austerity, and is never to the good of the people.

I'm not so sure. There are progressive ways to deal with austerity too and one of those is really important to Greece right now. That's ending the culture of tax evasion. Making middle and upper class Greeks pay their taxes will probably be unpopular too, it's just as necessary as spending cuts. They can't spend more as promised, but they can spend better.

What the EU is doing is a betrayal of democracy. It should not be possible for outside forces to deny the people of a particular country the government and the policies that they voted for.

Greece did choose as a democracy to join the EU and adopt its rules. Greece would still be in trouble without the EU, however. A currency devaluation would soften the blow but that's about all and then it would be off to the tender mercies of the IMF.

I'd be all for cracking down on tax cheat. But that's not what's likely to happen here.

Is there any way the current Greek government could indict the ministers of the previous government for fraud, given that they deliberately hid the level of debt they had incurred? How about an audit discovering where the funds went? And assets recovery from any institutions that received funds they shouldn't have received(kickbacks, subsidies, hidden cost overruns on infrastructure)?

It would be great if those things were done, yet it seems likely that the Greek and international political elite will insist on making the poor and public workers "tighten their belts" first(even if the poor already have those belts cinched tightly around their vertebra).

Wall Street gets Greece coming and going!

Echoing the kind of trades that nearly toppled the American International Group, the increasingly popular insurance against the risk of a Greek default is making it harder for Athens to raise the money it needs to pay its bills, according to traders and money managers.

It's a lovely business that, where either way you win.

Michael Hudson recently said that Latvia is just as much the neoliberalized basket case that Greece is. So how could Latvia(and Greece, too, I would imagine) possibly deal with corrupt leadership dropping it down a debt hole and exposing the country to neoliberalized asset stripping and debt peonage? [url=http://www.creditwritedowns.com/2009/10/latvia-the-insanity-continues.ht... Auerback[/url] said that Latvia's problems could be solved over a weekend:

The sad part about this whole episode is that Latvia’s problems could be fixed over a weekend. Here’s what I would do:Drop the peg to the euro, which functionally acts like an gold standard external constraint.

Don’t answer the phone when the foreign creditors call the government.

Have the banks declared insolvent, convert their external debt to equity, and then have them reopen that way on Monday with full deposit insurance guaranteed in the now free floating local currency.

Enact a 0% rate policy (use fiscal policy to regulate demand going forward).

Offer a local currency minimum wage job that includes healthcare to anyone willing and able to work as was done in Argentina after the Kirchner regime repudiated the IMF’s toxic package of debt repayment.Full employment and economic prosperity would come in no time at all.

A Turning Point in Europe

http://www.wsws.org/articles/2010/feb2010/pers-f26.shtml

"Wednesday's general strike in Greece involving 2 million workers in the public and private sectors, marks a turning point in the political situation throughout Europe.."

quote:

"Papaconstantinou is looking for clearer EU support to help escape a vicious circle of rising borrowing costs, harsher austerity measures, prolonged recession and diminished revenue.

Having owned up to a massive under reporting of its deficit and promised swift corrective action, Greece's negotiating leverage with its EU partners is mostly negative.

It can dramatize the risks for the entire euro zone if its debt woes get worse, it can point to the danger of social unrest if the EU forces too harsh austerity on Greeks, and it can threaten to go to the International Monetary Fund."

Demand is going to drive up the price of Hemlock, for sure. Just hope we hear more about the role of U.S. banks in this.

The Globe Report on Business lead on Feb.26: "Role of banks eyed in Greek debt crisis". "The vast and unruly credit-default-swap market is facing renewed scrutiny as U.S.authorities probe the role Golman Sachs and other Wall Street banks may be playing in pushing Greece toward financial collapse...U.S.Federal Reserve Board chairman Ben Bernanke expressed concern yesterday that U.S.banks and other investors may be compounding the debt pressures facing some European countries by using swaps to wager the countries will default on their debts."

And on page 8 of the business report ..."Heavy weight hedge funds are teaming up in big bets against the euro, in an effort to'break' the currency that some say resembles George Soros's move in 1992 to break the British pound." The page 8 head reads: Hedge funds bet against euro: Currency wagers signal that big financial players spot a rare opportunity to 'make a lot of money'."

A rare opportunity knocks. What were your bets for the Euro on opening this thread, Sven?

This looks like the solution? :-)

Ideas for Iceland facing similar IF predation, from Ms. Birgitta Jonsdottir,

"First, we should rid ourselves of the IMF presence in our country using all available means. The European Union has also been hostile to Iceland in the Icesave debate and hence it would be inadvisable to continue with our membership application at this time.

Secondly, we should initiate measures to control speculative trading, first by placing a 1% "Tobin-tax" on all financial transactions and profits, including derivatives, stocks, currency transactions and commodity speculation. Additionally we should halt the repossession of homes and businesses and update our regulatory framework for banks and financial markets."

Full article link:

http://www.truthjihad.com/birgitta.htm

Other thoughts... It's rather tempting to call Soros' bluff about gold being an ultimate bubble... I'de prefer for Iceland say, to 'pop' the 'money' bubble & bring down all the world's biggest financiers and all the banks!!! Gold will be left with 0 monetary value but will still be a hunk of useful metal! Financial industry "talent"~ Who needs it then?

Greece should sell islands to keep bankruptcy at bay, say German MPs

Greece must consider a fire sale of land, historic buildings and art works to cut its debts, two rightwing German politicians said today in a newspaper interview that is bound to exacerbate tensions between Athens and Berlin.Alongside austerity measures such as cuts to public sector pay and a freeze on state pensions, why not sell a few uninhabited islands or ancient artefacts, asked Josef Schlarmann, a senior member of Angela Merkel's Christian Democrats, and Frank Schaeffler, a finance policy expert in the Free Democrats.

The Acropolis and the Parthenon could also fall under the hammer, along with temptingly idyllic Aegean islands still under state ownership, in a rush to keep bankruptcy at bay.

"Those in insolvency have to sell everything they have to pay their creditors," Schlarmann told Bild newspaper. "Greece owns buildings, companies and uninhabited islands, which could all be used for debt redemption."

So what happens when the same thing comes home to roast on our provincial government. We have P3 contracts for Olympic related building projects like the RAV Line. We are so tied to the puppet strings of the hedge funds through these deals. When the City of Vancouver had to take over the Olympic Village we got a glimpse of the kinds of deals that have been made in the last decade. When the RAV Line was being built even the counselors from the municipalities couldn't look at the contracts because that would have breached the proprietary rights of the corporations biding on them. Democracy is a great theory, anyone have any examples of a functioning one?

I think that part of Greece's problems are like BC's in that a large part of the expansion of direct costs came from shoveling money into the coffers of the imperial war and security regime. I am sure that like in BC part of the money owed is for the training that was provided to security personal for the Olympics. Isn't it nice when a government training program can see its usefulness so quickly.

If Gordon Brown wanted to help, he could put the Elgin Marbles up for sale on ebay and send Athens the proceeds.

Gordon Brown supports a Tobin tax. Apparently our stooges in Ottawa and their bosses in the imperial-master nation have nixed the deal recently.

Britain auctioning the sculptural elements from the Partnenon frieze? That might encourage a display of Greek nationalism, such as from the likes of that character in Las Vegas? But no, Lord Elgin was wrong to remove the marbles in the way he did and they are to be returned to Greece and England specifically should pay damages for the theft of culture. Since they are indeed priceless, England agreeing to erase Greece's current debt load on that basis could work out amicably.

the 'Tobin' tax is interesting isn't it! Actually brought a Canadian politician's surname to mind when I first read it!

I wasn't actually seriously suggesting the idea.

Just thought I'd put it out there as a satire of "free market" approaches to solving the ".problem".

Besides, who could afford the shipping and handling costs?

If Greeks paid taxes rather than bribes, there might be less of a problem.

There is an interesting interview with Petros Markaris in [url=http://www.spiegel.de/international/europe/0,1518,681705,00.html][color=... Spiegel[/u][/color][/url].

"Things aren't just going bad for the Greeks. They have been shaken to the core and terrified, and they don't know how to go forward from here. The government also deserves some of the blame for this because, for six months, it only discussed the issues and has only now announced its reform measures. This lack of action has had negative effects on the population and also kept the Greeks in the dark about just how bad things really were in the country. Another result is that there is now only a single way out of the crisis: If the country is going to be reformed, the Greeks must suffer.

[snip]

This isn't the first horrible crisis that Greece has gone through. But it is the most hopeless and, in any case, it marks the first time that the population, the media and politicians have spoken openly about the issues. [u]There are no more illusions[/u]."

We'll see over the coming months if there are, indeed, "no more illusions" in Greece.

bailout unpopular in Germany: click on the cover image (statue) :

http://www.focus.de/magazin/archiv/jahrgang_2010/ausgabe_8

the verb umbringen means to "kill", so I understand they feel Greece is killing the euro, with Portugal, Spain et cie to follow;

I can imagine all the German barroom/beer hall discussion about the incompetent southern Europeans they have to bail out of their own messes ...

I can imagine all the German barroom/beer hall discussion about the incompetent southern Europeans they have to bail out of their own messes ...

As I understand it, Germany had to impose a little austerity itself, to right its own economy, so it's not so surprising if they'd be a bit resentful of having to bail out a country that doesn't want to do the same.

Back onto the cultural side of it, just musing, I can well imagine 'austerity' being a cultural predilection quite germane to German society, but whereas with Greeks something more like dyonisian comes to mind? Wondering if Greeks might be better served 'heading backward' so to speak, in instituting applying certain cultural terms that make better sense to them, rather than forward and further into such alienly tentacled ways of financial culture?... Maybe they are quite happy with achieving their ends by what others may term 'bribing' (I know that in Japan this is referred to as showing one's appreciation, and on a socieatl level is absolutely expected as the social norm where warranted)? For all I know that might actually be their way? If they are able to communicate openly about a figure of Euros 1,355 per capita annually, I already find that to be a whole bunch more transparent than how the international banking cartels conduct their business!

Yup it is all the fault of the Greek people. No blame to be attached to the sharks from the American hedge funds that suckered them into deals that were bound to bankrupt them. Go after the hedge funds for the money I'm sure the principals in the Excited States have received enough public bailout money to cover it.

Global scams perpetrated by Wall Street.

Do the Wall Street Shuffle. See your money hustled.

No blame to be attached to the sharks from the American hedge funds that suckered them into deals that were bound to bankrupt them.

"Suckered" them?

Greeks are intelligent enough to avoid being "suckered"... aren't they? Or what are you saying? Are they gullible or something?

Why is it you defend the cheats? I can hardly wait for your view that the seniors in Victoria who got suckered in a ponzi scheme were gullible and not intelligent enough.

Why even have those kinds of fraud laws. Caveat emptor that great free market principal should cover it without having to resort to trying to punish someone for their actions since it would be implying the people suckered were gullible. So buyer beware is all we need.

And now they're "cheats", too!

Greece is a sovereign nation who were providing banking services thousands of years before there was a United States. You make it sound like the nation of Greece is some semi-literate farmboy who got tricked by the fast-talking stranger in the shiny suit.

I somehow doubt the Greeks feel that their situation is a result of someone more clever than them "tricking" them.

Up to 7,000 demonstrators gathered outside as lawmakers debated the austerity package, which aims to save the equivalent of $6.7 billion Cdn with measures including higher consumer taxes and cuts to public-sector workers' pay of up to eight per cent.

Demonstrators attacked the two military guards and their escorting officers, smashing windows and kicking the guard posts. Earlier, the head of Greece's largest trade union, Yiannis Panagopoulos, traded blows with left-wing protesters who attacked him while he was addressing the crowd. He was then whisked away, bloodied and with torn clothes.

Read more: http://www.cbc.ca/world/story/2010/03/05/greece-austerity-debt-crisis-protests.html#ixzz0hKPUUjNX

Learn to read and stop making up what people actually post you are being disingenuous and pedantic. I said something about Wall street everything about Greece are your slanderous words not mine.And now they're "cheats", too!

Greece is a sovereign nation who were providing banking services thousands of years before there was a United States. You make it sound like the nation of Greece is some semi-literate farmboy who got tricked by the fast-talking stranger in the shiny suit.

I somehow doubt the Greeks feel that their situation is a result of someone more clever than them "tricking" them.

You make it sound like the nation of Greece is some semi-literate farmboy who got tricked by the fast-talking stranger in the shiny suit. I somehow doubt the Greeks feel that their situation is a result of someone more clever than them "tricking" them.

In that case, a hypothetical war crimes tribunal of the future would be within its rights to indict the entire USian population, at least those who side with the warmongering demagogue or rethuglican regimes at election time, since they are clever enough to know whether or not the information being provided to them is the truth, and therefore their decisions at the ballot box are made in the clear light of day. They knowingly facilitate genocide against other peoples, but call it something else to cover their tracks.

Honestly Snert, do you actually believe the citizens of Greece, victims themselves of the same crooked lies and swindle as the ever increasing numbers of homeless in America, are ultimately responsible for what is happening to them?

[url=http://www.spiegel.de/international/europe/0,1518,druck-676634,00.html]How Goldman Sachs Helped Greece to Mask its True Debt[/url]

Same old story. Conservatives get in and charge up national debt big time with nothing to show for it. Then stick socialists with the mess to deal with.

You make it sound like the nation of Greece is some semi-literate farmboy who got tricked by the fast-talking stranger in the shiny suit. I somehow doubt the Greeks feel that their situation is a result of someone more clever than them "tricking" them.In that case, a hypothetical war crimes tribunal of the future would be within its rights to indict the entire USian population, at least those who side with the warmongering demagogue or rethuglican regimes at election time, since they are clever enough to know whether or not the information being provided to them is the truth, and therefore their decisions at the ballot box are made in the clear light of day. They knowingly facilitate genocide against other peoples, but call it something else to cover their tracks.

Honestly Snert, do you actually believe the citizens of Greece, victims themselves of the same crooked lies and swindle as the ever increasing numbers of homeless in America, are ultimately responsible for what is happening to them?

Snert may be young, and believes that credit was always this "easy" to obtain, that "bait and switch" was always a legal route to transactions in the finance industry, that taxes can be avoided/lowered forever, and that only governments proposing spending but not taxing are on the side of the people, and should be voted for. I thought that Papandreous was above that, but then the MSM tells us little of Europe, except in moments like this.

[url=http://www.slate.com/id/2247257/][color=blue][u]The Germans are getting tired of Greek whining[/u][/color][/url]:

Frankfurter Allgemeine Zeitung, Germany's deeply serious paper of record, has pointed out that while the Greeks are out protesting the raising of the pension age from 61 to 63, Germany recently raised its pension age from 65 to 67: "Does that mean that the Germans should in future extend the working age from 67 to 69, so that Greeks can enjoy their retirement?'

Honestly Snert, do you actually believe the citizens of Greece, victims themselves of the same crooked lies and swindle as the ever increasing numbers of homeless in America, are ultimately responsible for what is happening to them?

Do I blame each and every one of them, personally? No. But ultimately, they got the government they voted for.

So did we, for that matter. I don't love much of what our current government does, but whatever they do or don't do, they do with our mandate. If Stephen Harper makes a (further) right mess of things, whether or not I or you or your neighbour wanted him to, or knew he would, it's our mess. It's not somebody else's mess just because we're not engaged enough in our own governance to have prevented it. If Stephen Harper blows all the public money on magic beans then Canadians will be tightening our belts, paying some more taxes, and hopefully taking our complaints to the polls the first chance we get. Please tell me that in such a scenario you wouldn't be whining that it's everyone else's fault except Canada.

Markaris: Corruption permeates all of Greek society. If the only way to get swift treatment in a Greek hospital is to bribe someone, it is really a problem of the state. Even the respectable citizen has given up hope and believes that evading taxes is justifiable. As he sees it, that is the only way to get his money back. From this arises a society in which everyone shares in the guilt.

Wow. Sounds like those citizens did everything they possibly could to prevent this. Well, except paying taxes. But what possible difference could that have made?

From a distance it does look like Greeks were just so stupid, but it isn't quite so. The corruption and tax evasion do have a history. Greece has been pretty short on legitimate and stable governments.

They're the cradle of democracy. They shouldn't need anyone's help forming a legitimate government.

That's what I find funny about all of this. They're not a so-called "developing country", they're not ruled by a dictator, they're not a former colony, they're not war-ravaged and they haven't suffered any recent catastrophic hurricanes or earthquakes or levee breaches that I'm aware of.

They're the cradle of democracy. They shouldn't need anyone's help forming a legitimate government.

That's what I find funny about all of this. They're not a so-called "developing country", they're not ruled by a dictator, they're not a former colony, they're not war-ravaged and they haven't suffered any recent catastrophic hurricanes or earthquakes or levee breaches that I'm aware of.

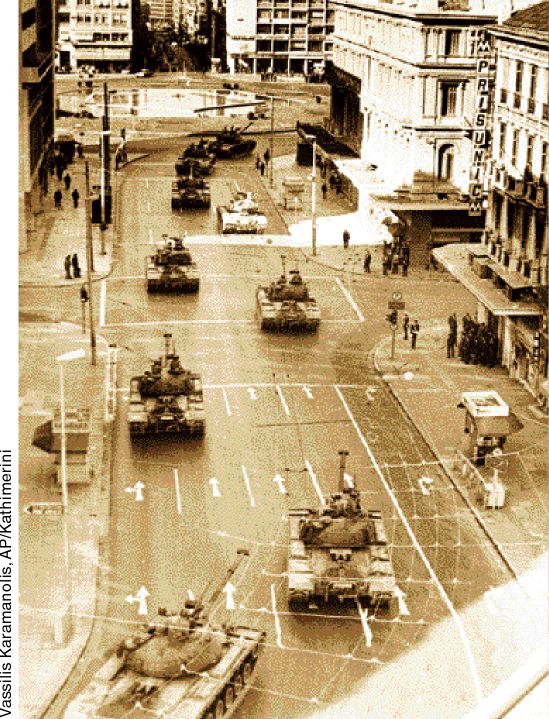

Actually, they had capitalist American "help" in ceasing to be a democracy in the late 1960's,

and are thus a "new democracy" in the sesnse that they're still recovering from the consequences of "anticommunist" fascism". It's likely that the tax evasion among the wealthy became much worse because the military junta didn't care if the rich paid(or was bribed NOT to care).

Snert, I'd strongly recommend you watch the movie "Z" on whatever formate you can get it in.

I agree they likely do not need anyone's help either forming or running their own democracy! But Snert, realize that the behind the scenes manipulations of global finance forces is not a laughing matter, since it should be understood as an act of foreign aggression to undermine Greek sovereignty, the opening question to this topic thread puts it clearly enough.

The fact that Greece easily staved off the crises as manufactured by outsiders to try to get Greece to 'sell' its islands + that they also know there is interest in bond purchases equal to at least three times what they just raised, actually makes the 'finance powers that be' in the 'big' EU countries nervous, why would France even feel a need to make a political statement that the EU should not let Greece go through a debt default situation right after it became clear that Greece has the available resources to avoid this? This is the real story here and, think in terms of the likelihood that a prime motivation to destabilize Greece may have even more to do with the financial elite's interests in destabilizing the Balkans...

also, a relevant aside here: Remember the big French bank who made headlines because of one of it's trading officers having supposedly lost billions right around the time that Bear Sterns went under? Whatever became of all of that? In hindsight that 'incident-development' is beginning to look incredibly suspicious, not as readily 'believably'=apparently obvious from the outside as is the role played by Goldman Sachs in Greece's recent finance problem, but surely is more sensational and is being recollected now, as the 9/11 cover up is blowing open, as more likely probably a finance industry false flag operation?!

and are thus a "new democracy" in the sesnse that they're still recovering from the consequences of "anticommunist" fascism"

[url=http://en.wikipedia.org/wiki/Greece]Sounds like they bounced back.[/url]

Greece became the tenth member of the European Communities (subsequently subsumed by the European Union) on 1 January 1981, ushering in a period of remarkable and sustained economic growth. Widespread investments in industrial enterprises and heavy infrastructure, as well as funds from the European Union and growing revenues from tourism, shipping and a fast-growing service sector have raised the country's standard of living to unprecedented levels.