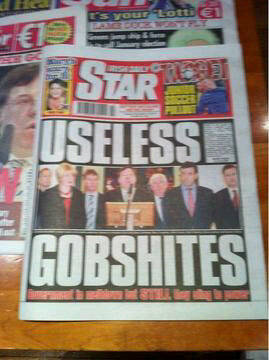

This Irish paper gets it right in commenting on the government as it prepares to pass a renewed austerity budget:

Here's the plan:

Key points of the recovery plan include:

- 24,750 public sector jobs cuts

- 2.8bn euros of savings in social welfare spending

- 1.9bn euros to be raised from income tax changes

- 1 euro cut in the minimum wage to 7.65 euros an hour

- VAT rise from 21% to 22% in 2013, and to 24% in 2014

- the corporation tax rate remains unchanged at 12.5%

- a new "site value" property tax to raise 200 euros from most homeowners by 2014.

The Irish government probably hoped this would all please bond traders, but it didn't - perhaps because they think it's insufficient or undeliverable.