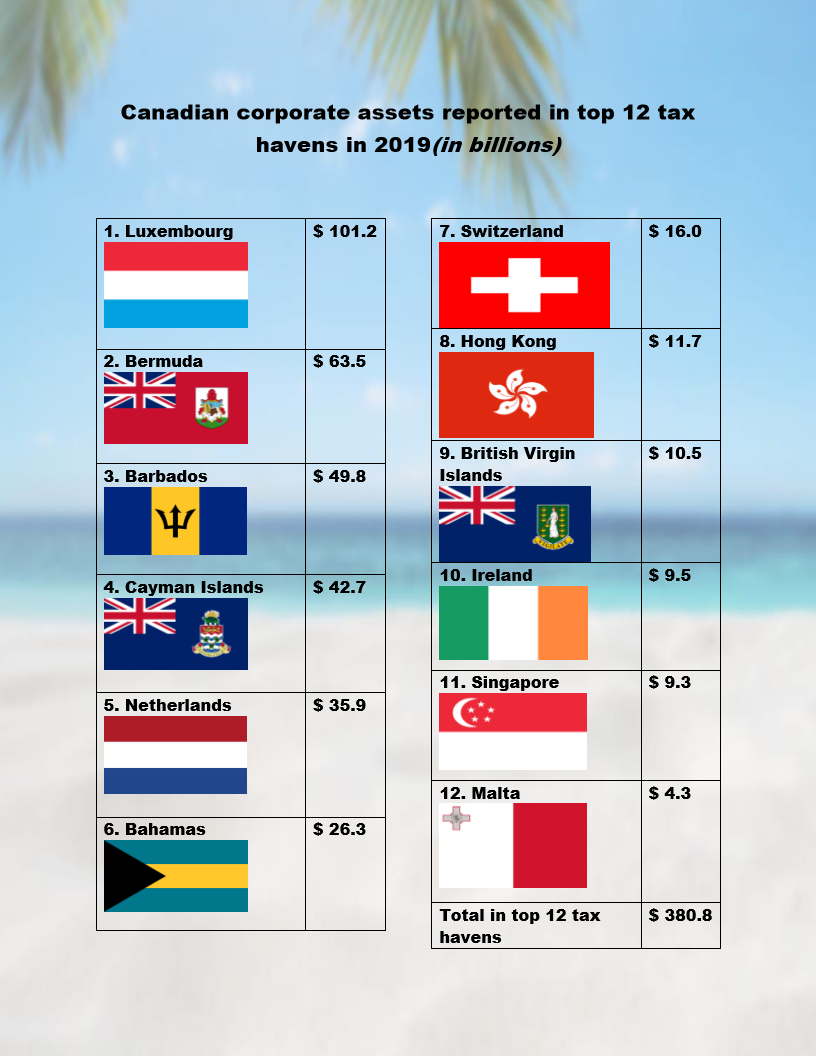

Before Covid-19, the middle class and poor were bearing a disproportionate part of the tax burden as corporate taxes continued to be decreased by both Liberal and Conservative governments for decades, while trillions were hidden away in tax havens with almost nothing been done to collect a fair share of taxes for the super-rich. The financial burden now created by Covid-19 makes it even more imperative to start rectifying this situation.

If you think the struggle against COVID-19 has been hard thus far, wait until we get to the post-pandemic recovery stage. That's when the real battle will get under way. On one side we will have those who, echoing the Canadian Liberal government of the 1990s, argue that public debt is the main challenge, adding that any increase in taxes on corporations or the wealthy would stifle economic growth.

That is, not surprisingly, U.S. President Donald Trump's view. He manages to get (white) working class men to support him, nonetheless, by wrapping his elitist economic policies in nationalist, xenophobic and racist rhetoric. It is also the view of the Canadian conservative movement. Former prime minister Stephen Harper has already put it out there, and right-of-centre think tanks, from the Fraser Institute to the C.D. Howe Institute to the Macdonald-Laurier Institute, are all weighing in on the side of what they characterize as fiscal probity.

There are also many in the Liberal party who subscribe to this view, although they are, publicly, keeping their powder dry for the moment.

On the other side there are those who take a social justice point of view. They say we will need continued massive public investment, and for quite a while. As economist Jim Stanford put it in an article for Policy Optionsmagazine: "For many years to come, Canada's economy will rely on public service, public investment and public entrepreneurship as the main drivers of growth. They will lead us in recovering from the immediate downturn, preparing for future health and environmental crises and addressing the desperate conditions in our communities. The chronic weakness of private business capital spending in recent years was already indicating a growing need for public investment to lead the way. After COVID-19, it is impossible to imagine that private capital spending could somehow lead the reconstruction of a shattered national economy."

Now, an international team of progressive economists has weighed in on the social justice side, focusing, in particular, on the issue of taxation. The group is called the Independent Commission for the Reform of International Corporate Taxation. It is supported by a worldwide coalition of non-governmental organizations, ranging from Oxfam to the World Council of Churches. The commission has just issued a manifesto entitled "The Global Pandemic, Sustainable Economic Recovery and International Taxation," which argues forcefully that now is not the time to reduce taxes in order to stimulate investment and economic growth. To do so, says the group -- which includes French economist Thomas Piketty and Nobel winner Joseph Stiglitz -- would be neither economically effective nor socially desirable.

Instead the commission proposes that all governments impose higher taxes on those massive corporations that dominate their sectors. As well, governments should set a minimum corporate tax rate of 25 per cent. The economists also recommend to the governments of the world that they impose digital services taxes on the huge economic benefits monster corporations such as Google and Facebook now enjoy. Finally, the commission advocates that all countries report fully on corporations that currently get government support, and, more important, publish complete information on all corporations' offshore wealth.

Cutting taxes exactly the wrong medicine

The manifesto emphasizes that governments will find themselves cash-strapped because, except for e-commerce multi-nationals and medical suppliers, the pandemic is creating economic havoc. The solution for governments, which will need the resources to pick up the slack from the struggling private sector for a long time to come, is not to further hobble themselves by cutting already low corporate taxes.

"There is no evidence that the recent trend of lowering corporate tax rates has in fact stimulated productive investment and growth," the economists write. "As the world economy slowly recovers, tax cuts will not stimulate corporate investment because there is already excess capacity and expansion plans are constrained by uncertainty." The commission explains that "essentially, corporate taxes are a withholding tax on dividends, and thus, in effect, an income tax on the wealthy." The reason for this, they explain, is that wealth from shares in companies is even more unequally distributed than earned income.

The state, the economists say, has made the modern corporation, and the way it operates, possible. It has done this through the legal device of limited liability, which protects the personal assets of corporate executives and shareholders, and by government support in national crises. These are privileges which should also impose obligations on corporations, particularly taxation to fund necessary social services such as schools and hospitals.

The hubris of the off-shore based cruise industry

The commission makes a powerful argument about tax avoidance and evasion, pointing to one industry that the pandemic hit hard, and which then went cap-in-hand to the U.S. government: "By exploiting tax havens in order to reduce their fiscal contribution, corporations logically give up their claim to support from the governments where most of their activity takes place. This contradiction is vividly illustrated by claims of cruise lines under flags of convenience for support by the U.S. It seems logical to forbid state support to corporations that are headquartered, or have subsidiaries, in tax havens, as some governments have already proposed." ...

"If the wealthy are not to bear a proportionate share of the economic burden of the pandemic, local income taxes and even international corporate tax coordination will not be sufficient," the manifesto argues. "Effective taxation of wealth, and in particular offshore wealth, needs to be put in place."

Just as wealthy New Yorkers fled to their country homes during the pandemic, the wealthy have been seeking shelter unavailable to the rest of us during the accompanying economic crisis. Offshore tax havens provide that shelter. In the words of the worldwide team of economists: "The use of offshore structures allows not only the real ownership of this wealth to remain hidden, but also its location and perhaps its very existence. This same secrecy," they point out, "also creates fertile ground for tax evasion, avoidance, and for financial crimes."

Over to you, governments of the world, including a Canadian federal government that has done precious little about these "financial crimes."

https://rabble.ca/news/2020/06/pay-recovery-boost-corporate-taxes-and-en...