The Liberal government recently announced plans to recover Canada Emergency Response Benefits (CERB) from recipients the Canada Revenue Agency (CRA) considers ineligible. New census data released last week found that an overwhelming percentage of Canadians relied on pandemic relief payments, particularly in the early days of government-mandated COVID-19 lockdowns that shuttered many businesses and cut off employment income to millions of workers in Canada.

According to the 2021 census, over two-thirds of Canadian adults received income from at least one pandemic relief program. Of the 30.3 million Canadians aged 15 and older, more than 20.7 million people received payments from at least one of these programs. More than four million Canadians also received provincial or territorial relief payments.

Additionally, more than one-in-four Canadian adults applied for federal emergency and recovery benefits, with the bulk of those being CERB payments. The median amount received in 2020 was $8,000.

More than half of Canadians received top-ups as part of existing federal programs. More than 90 per cent of seniors aged 65 and older received top-ups, with a median amount of $500.

Pandemic relief programs also helped push income inequality down at its highest five-year period rate since 1976, a factor Statistics Canada concluded was largely driven by the CERB and the Canada Child Benefit.

The number of Canadians living on low incomes also dropped to 11.1 per cent in 2020, down from 14.4 per cent in 2015.

The newest data from the 2021 census comes after an April report from Statistics Canada that found that more than one-in-five Canadian workers are between the ages of 55 and 64. That’s the highest percentage of workers in that age group ever recorded in Canada.

While government-issued relief payments helped drive down low-income rates across the country, it wasn’t all good news for every age group. The 2021 census shows that the low-income rate among Canadians aged 65 and older in 2020 went up, albeit by half a per cent, compared to 2015. The low-income rate among seniors aged 80 and older rose by a larger margin, from 17.3 per cent in 2015 to 19.3 per cent in 2020.

More detailed data from the census is expected to be released later this year. The additional report will examine changes to Canada’s official poverty line.

The need for pandemic relief payment amnesty

In December 2021, Campaign 2000 national director Leila Sarangi sent a letter to members of parliament, urging the federal government to not only forgive any past pandemic relief payments, but also, continue providing it.

“We strongly recommend that the federal government continue income benefits for individuals and ensure that past emergency benefit programs are not penalizing people who have low incomes and leaving them in greater distress,” Sarangi’s letter reads.

Campaign 2000: End Child and Family Poverty is an ongoing coalition of more than 100 organizations lobbying for government action to eliminate poverty across Canada. The campaign began over 30 years ago, in 1991, with an objective of reaching their goal by the end of the decade.

They also wanted to make sure that any relief payments “do not result in clawbacks of the Guaranteed Income Supplement (GIS) and refundable tax credits such as the Canada Child Benefit (CCB) and the Canada Worker’s Benefit (CWB).”

Among the recommendations made in the letter, which was delivered months ahead of the 2022-23 budget being tabled, was that the federal government should “cease pursuing people living on low incomes for repayments of the CERB.”

Campaign 2000 also called for the reinstatement of a $500 per week Canadian Recovery Benefit (CRB) until Parliament reforms Employment Insurance (EI) legislation.

The coalition’s calls are reminiscent of a spring 2021 petition delivered to NDP MP Daniel Blaikie (Elmwood—Transcona).

The petition, signed by over 1,000 people, was presented to the House of Commons in June 2021. It called for a CERB repayment amnesty for any individuals in Canada living under or just above the poverty line, as well as for all youth transitioning out of care.

For ineligible recipients with an annual income that is less than 15 per cent above the poverty line, the petition called for reduced payment plans to help relieve possible financial barriers for those individuals and families.

Feds granted 100,000 students CERB amnesty in June

While more than one million Canadians have been found to be ineligible for their relief payments, it wouldn’t be the first time this year the federal government forgives past invalid payments.

Last month, nearly 100,000 post-secondary students who applied for the CERB rather than the CSRB would be exempted from repaying any of the extra $750 per month they received in relief payments.

The summer of 2020 proved to be a nightmare for students due to the pandemic. With limited on-campus job opportunities and an interrupted Canada Summer Jobs Program, it became even more difficult for students to save money for the upcoming academic year.

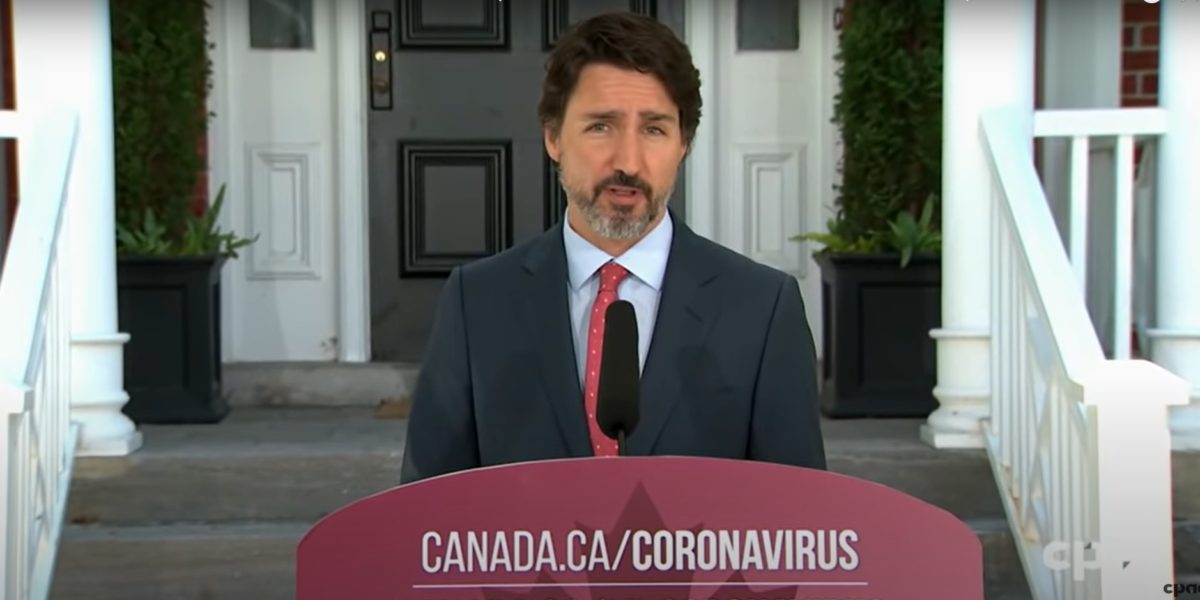

After Prime Minister Justin Trudeau’s nearly $1 billion agreement with the organization past workers have compared to a cult, We Charity, to deliver a Canada Student Summer Grant (CSSG) fell apart, the federal government shifted course and implemented a $1,250 per month Canada Student Recovery Benefit (CSRB).

While the CSRB was just 62 per cent of the CERB, it proved to be better than the CSSG, which would have paid students $1,000 for every 100 hours of work—the equivalent of $10 per hour.

The federal government has already shown its willingness to forgive penalties related to pandemic relief payments. What’s stopping them from doing the same for everyone else?

July 21, 2022 – Editor’s note: This article was previously titled ‘Just 5% of pandemic support payment recipients were ineligible.’ This was an error. The real number is closer to 10%. The headline has since been corrected.