Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

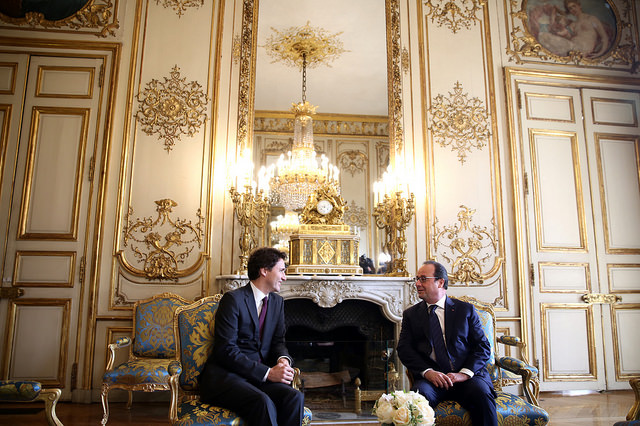

The issue of inequality was a sub-theme of the Oct. 19 election campaign, but none of the parties took it particularly seriously. Subsequent tax fiddling by the new government changed little. But Justin Trudeau will have met the phenomenon headfirst all last week at the World Economic Forum in Davos, Switzerland, where inequality was both a subject of discussion and a living presence. In fact, the Prime Minister, as he surely knew, was taking selfies with many of the .0000001 per cent who own or control much of the world.

This year began with the indispensable economics researcher Hugh Mackenzie reminding us yet again what inequality means in practice in Mr. Trudeau’s sunny Canada. Mr. Mackenzie remains bewildered by the staggering compensation received by Canada’s top chief executive officers. Just check out some of his mind-boggling data.

The average full-time Canadian worker in 2014 was paid $48,636. The average minimum wage worker got $22,010. By contrast, the average top-100 CEOs had earned the average worker’s pay by 12:18 p.m. on Jan. 4, 2016 — the second paid day of the year — and the average minimum-wage worker’s pay by 2:07 p.m. on New Year’s Day itself.

Yet no one is occupying the streets of Canada.

When Mr. Mackenzie began this series in 2008, the top 100 CEOs in Canada made on average $7.3-million — 174 times more than the average full-time wage earner. By 2014, Canada’s top 100 CEOs were taking home on average $8.96-million, or 184 times the average worker.

But this is not just a Canadian phenomenon, as Oxfam reminded us on the eve of the Davos conclave. While they love fraternizing with each other at Davos and discussing the world’s great problems, the .00000001 per cent tend to ignore the central role they themselves play in those matters. Oxfam’s new report points out why economic inequality remains one of the world’s great continuing scandals that absolutely nothing is being done to change. Yet there can be no democracy in such an unequal world.

According to “An Economy for the 1 per cent: How Privilege and Power in the Economy Drive Extreme Inequality and How This Can Be Stopped,” the poorest half of the world’s population have seen their wealth drop by one trillion dollars, or 41 per cent, since 2010 while the richest 62 people have seen their wealth increase by half a trillion dollars. How can they even count it?

Five years ago, 388 people owned as much wealth as the poorest half of the world’s population. Now, it’s 62 people who own as much as 3.5 billion of their fellow citizens. This tiny band could fit onto a single bus, as Oxfam says, though I’m guessing super-plutocrats don’t use buses that much.

But Oxfam is on a mission, as we all should be. “We cannot continue to allow hundreds of millions of people to go hungry while resources that could be used to help them are sucked up by those at the top.”

The Oxfam report nicely supplements Mr. Mackenzie’s frightening research. It observes that in 2015 five Canadians held the same amount of wealth as the bottom 30 per cent of Canadians, say 11 million people. The total wealth of Canada’s top five billionaires was $55-billion, the exact same amount — $55-billion — held by the bottom 30 per cent.

The wealth of those five richest Canadians has risen by $16.9-billion since 2010 — a 44-per-cent increase. Yet the bottom 10 per cent in Canada make only $2.30 more a day than they did 25 years ago. And they’re still not occupying Bay Street. What will it take?

Maybe this: Billions of rich people’s dollars never get adequately taxed, as we’re reminded once again both by Oxfam and by Gabriel Zucman, an assistant economics professor at the University of California, Berkeley, in his The Hidden Wealth of Nations: The Scourge of Tax Havens. Among the umpteen ways the system at all levels is rigged on behalf of the ludicrously rich are tax havens. These places, which welcome unreported foreign accounts, allow avaricious zillionaires to get out of paying anything like a fair share to the public domain, costing the world around $200-billion a year in forgone tax revenue.

As much as 30 per cent of all African financial wealth is estimated to be held offshore, costing around $14-billion in lost tax revenues every year. As Oxfam notes, this is enough to pay for health care for mothers and children in Africa that could save four million children’s lives a year and employ enough teachers to get every African child into school.

Though the Davos elite criticized tax havens last year, nine out of 10 World Economic Forum corporate partners have a presence in at least one of them.

Now that’s real affluenza at work.

To add insult to injury, an American study now says the much-heralded Trans-Pacific Partnership — the TPP — will cost Canada 58,000 jobs while increasing income inequality. Another example of how everything is rigged for the nabobs.

We can be confident that the Trudeau government will not find tackling this grotesque injustice a priority. But it must surely be a pressing and passionate concern for the NDP, Canada’s newly self-styled “progressive opposition.” Its activists expect nothing less.

This article originally appeared in The Globe and Mail.

Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

Image: Flickr/pmwebphotos