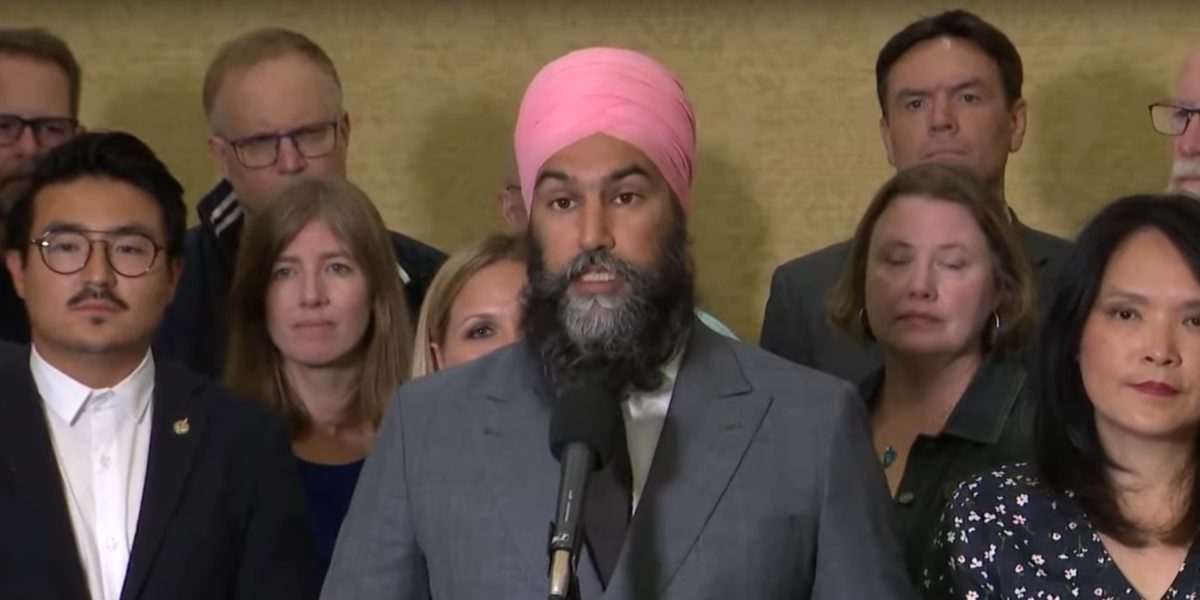

It’s a new year, and while Jagmeet Singh and the New Democrats occupy just 25 of the country’s 338 seats in the House of Commons, the Supply and Confidence agreement with the Liberals has the self-proclaimed workers’ party with a lot of leverage in lawmaking.

On New Year’s Day, the NDP tweeted a list of ten priorities for 2023. We took a closer look at their goals, how tangible they are, and ultimately, whether they benefit Canadians.

We accomplished a lot together in 2022. And we’re not done fighting for you. pic.twitter.com/bfNHGEzSHj

— NDP (@NDP) January 1, 2023

Permanent dental care program

Last fall, a Canada Dental Benefit was introduced to save up to $650 per year for children under the age of 12 in families without dental coverage that have annual incomes under $90,000.

The first phase of the Benefit came as part of the supply-and-confidence agreement between the federal Liberals and NDP.

It is expected that the full Canada Dental Benefit will be introduced sometime in 2023.

More health-care workers

The provinces are in charge of funding health care, as well as recruitment and retention efforts.

The NDP is calling for more health-care workers at a time when premiers are asking the federal government to pay a larger share of the sector’s budget.

While Trudeau has voiced his agreement that his government can do more to help, the prime minister has also gone on the record to say he won’t give additional funds to provinces without guaranteeing outcomes and targets that hold provincial leaders accountable.

Fix EI

The New Democrats have spent years pushing Employment Insurance reform.

According to the Canadian Centre for Policy Alternatives, less than half of unemployed workers across the country are eligible for Employment Insurance.

The 2017 data showed that just 28 per cent of workers who earned $15 or less per hour could get EI, leaving an already vulnerable population of workers — who pay into EI — in an even more precarious financial position.

Speaking at the B.C. Federation of Labour Convention in November, Singh indicated he would pressure the Liberals to overhaul and reform the EI system “with a low, universal qualifying-hours threshold, a minimum benefit amount and a higher income replacement rate.”

The new system would also include a benefit for self-employed Canadians.

Implement Missing and Murdered Indigenous Women and Girls Calls for Justice

A December report from the Yellowhead Institute found that just two Calls to Action were completed in 2022, down from three in 2021. Overall, 13 of the 94 Calls to Action have been completed since their introduction by the Truth and Reconciliation Commission of Canada in 2015.

The report concluded that, at the current rate, it will take 42 years, or until 2065, to complete all of the Calls to Action.

While it’s unclear which specific calls the NDP will prioritize in 2023, the party has made it clear the federal government needs to do more to ensure the Calls to Action are met in a timely manner.

Canada Pharmacare Act

According to the federal government, one in five Canadians aren’t taking the medication they need because they simply can’t afford to pay for their prescriptions.

The federal government has committed to pass a Canada Pharmacare Act in 2023, while also introducing a bulk purchasing plan for essential medicines by 2025.

And while Canada is the only industrialized country that offers medicare that doesn’t include universal public coverage for prescriptions, the NDP says it’s past time to deliver on the two decades of empty promises by the Liberals.

Double the GST rebate (again)

After a successful push to double the Goods and Services Tax Credit (GSTC) last fall, Singh is calling for a second round of a doubled GSTC.

The move would put an extra $234 in the pockets of single Canadians without children, an average of $225 for seniors, and up to $467 for couples with two children.

Remove GST from home heating (doesn’t do much)

As fuel prices remain near record highs, the cost of home heating oil has also skyrocketed.

And as provinces introduce financial assistance to alleviate the impacts of inflation on the cost of living, the NDP believes Canadians shouldn’t have to pay a Goods and Sales Tax to keep their loved ones warm.

But while the party warns home heating costs have jumped between 50 and 100 per cent, removing a five per cent tax will do very little to help low-income earners heat their homes.

Increase GIS for seniors

The current threshold for single, widowed or divorced Canadians aged 65 and up to receive a Guaranteed Income Supplement (GIS) is below $20,832.

The maximum available GIS is available to earners making less than $49,920 annually, provided their spouse or common-law partner does not receive an Old Age Security pension.

Immigrants to Canada face further restrictions on accessing a GIS.

The NDP is calling for a rise in the GIS for seniors, while also increasing the threshold for eligible applicants.

Make ultra-rich CEOs pay what they owe (should the NDP define ultra-rich?)

At their 2021 party convention, NDP members voted in favour of a tax resolution that includes a marginal tax rate of 80 per cent for individuals with personal incomes over $1 million, as well as a one per cent tax on those with a net worth of over $20 million.

The push comes as the gap between earnings for workers and CEOs reach unprecedented levels, with CEOs making more than 225 times the average income of Canadian workers.

Meanwhile, the NDP says the ultra-wealthy are hiding more than $300 billion each year in tax havens, while also using loopholes to avoid paying taxes. By implementing an ultra-rich tax, billions of additional taxpayer dollars can be allocated to health care, housing, and more.

Invest in Indigenous housing

A 2021 report from the Parliamentary Budget Officer (PBO) found that nearly 20 per cent of urban, rural and northern Indigenous households in Canada are either unaffordable or unsuitable.

Nearly 125,000 Indigenous households are living in substandard units, including 37,500 people who are unhoused.

The PBO calculated the annual affordability gap for Indigenous households at $636 million, while less than one per cent of the funding in the National Housing Strategy’s ten-year plan is dedicated to Indigenous housing programs.

The NDP are calling for more adequate funding to lower the number of substandard Indigenous households.