This week the New York Times published a study on American income inequality and the middle class which reported that America’s middle class is no longer the ‘world’s richest’ — Canada’s middle class is. Not surprisingly, this sent Twitter abuzz.

According to the authors, “Middle-class incomes in Canada — substantially behind [the United States] in 2000 — now appear to be higher than in the United States. …. Median income in Canada pulled into a tie with median United States income in 2010 and has most likely surpassed it since then.”

At the heart of the study is data on median after-tax income, adjusted per person and by “a common adjustment known as purchasing power parity,” which the authors explain, “takes into account the relative cost of similar items — say, a Toyota or a Big Mac — in different countries.”

Simon Fraser University Economist Anke Kessler noted that several high-ranking European countries were excluded from the analysis, including Norway, Luxemburg and Switzerland, which rank higher in OECD pre-tax data.

Economist Kevin Milligan noted that past success doesn’t necessarily guarantee future increases. “By some measures, we’ve had a decent run in last 15 years. But for next 15 years do we a) put a 3rd spouse to work or b) find oil in Oshawa?” he tweeted. Even Minister of Employment, Social Development & Multiculturalism, Jason Kenney, got in on the Twitter discussion with a series of tweets about Canadian income growth and he used the article as an opportunity to criticize Justin Trudeau.

However, there is a different interpretation of the New York Times data.

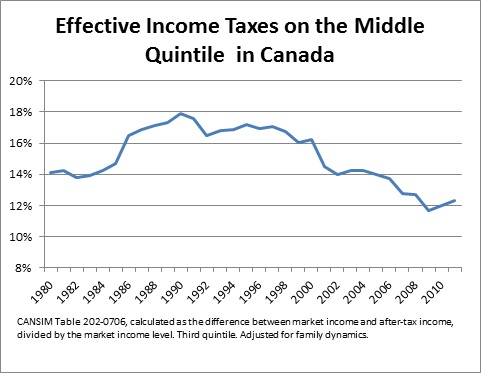

Since the researchers measured after tax income, this data measures disposable income rather than earnings per se. And over the course of this data period (1980 to 2010) the amount of taxes paid by the median quintile has decreased, in real terms even as incomes have increased.

Average effective income taxes on the middle quintile has decreased from between 16 per cent and 17 per cent during much of the 1990s, to 12.0 per cent in 2010. Essentially the effective taxes of the middle class have been cut by about a quarter. At the same time, federal revenue from personal income taxes has shrunk from 8.6 per cent of GDP in 2000-1 to 7.0 per cent of GDP in 2010-11(2012 Federal Budget, Fiscal Reference Tables. “Table 4: Revenues”).

While this may have helped Canada edge above our international counterparts in terms of middle-class disposable income — it has also weakened the state and our social programs.

The government may think that this study shows that they’re doing a good job on the economy, but the reality is that it shows that Canadians aren’t overtaxed as the right wing likes to pretend.

Kayle Hatt is a Research Associate with the Canadian Centre for Policy Alternatives’ National Office and was the CCPA’s 2013 Andrew Jackson Progressive Economics Intern.