While Alberta’s premier was talking up the need to recruit more women for public sector governing boards yesterday, a new study released at almost the same time shows the policy Jim Prentice is most determined to preserve — the so-called flat tax — is hurting women almost across the board in Alberta.

Surely this ironic juxtaposition is a hint that the commitment of the Prentice Government to strengthening the rights of women and their role in society is not very deep or particularly sincere.

Prentice admitted to a meeting of the Women’s Executive Network in Calgary that while more than two thirds of public sector workers are women, they make up only a third of the Albertans appointed to the province’s publicly financed agencies, boards and commissions. (That’ll teach snotty bloggers to suggest he only likes to make policy pronouncements to clubs populated by well-off men!)

The premier said he was challenging members of his Progressive Conservative cabinet to find more women candidates for the boards of Alberta’s publicly funded organizations. Unsurprisingly, though, given his background, Prentice didn’t mention the situation in the corporate world, where even a cursory Internet search suggests a much lower percentage of women serves on boards.

But where gender equality really matters, on the front lines of the working world, women are not faring very well at all in Alberta, and the principal villain is none other than Prentice’s beloved “flat tax,” which tilts the economic field steeply in favour of the very wealthy.

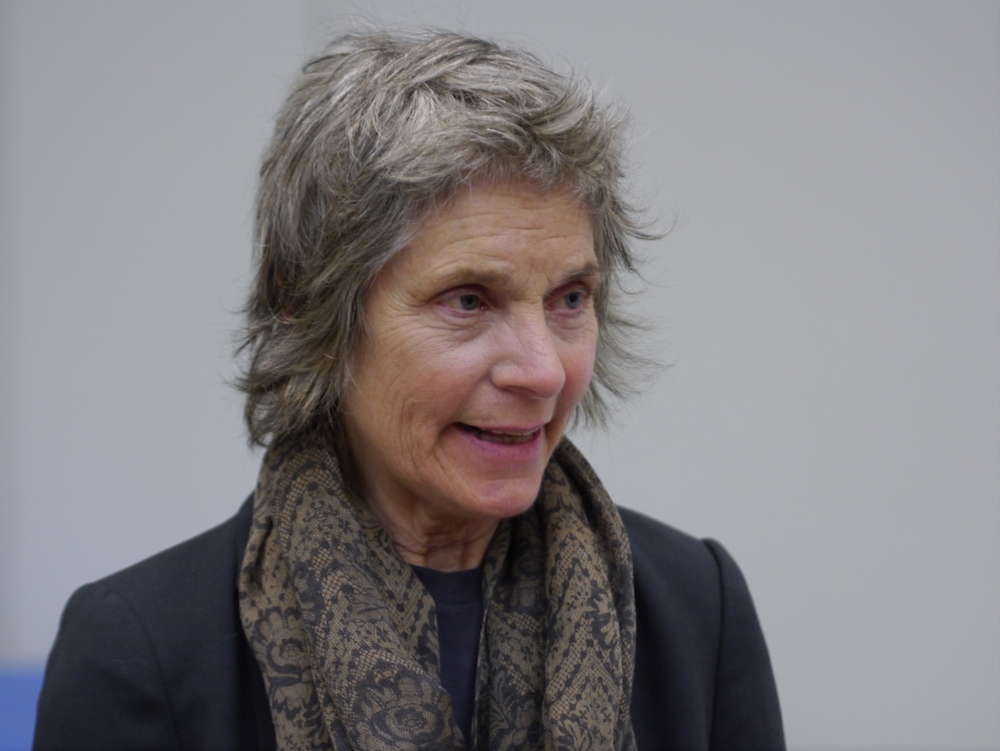

The income gap between women and men is the deepest in Canada, and it’s getting deeper, concluded Queen’s University tax law professor Kathleen Lahey in a study released yesterday by the Edmonton-based Parkland Institute.

The report, The Alberta Disadvantage: Gender, Taxation, and Income Inequality, makes the case that Alberta’s flat tax has disproportionately hurt the province’s women. Moreover, the situation is getting worse, accounting for what the organization called “a troubling slide in women’s economic equality in Alberta since its peak in the mid-1990s.”

“Women in Alberta have been disproportionately impacted by the 2001 shift to a single rate tax regime in the province, and now face higher income gaps, unpaid work gaps, and after-tax income gaps than women in the rest of Canada,” the Parkland Institute said.

“In moving to a single corporate and personal income tax regime, the government has walked away from at least $6 billion in annual revenues — roughly the size of the forecasted deficit for next year — and actually increased the tax burden for those income-earners at the bottom end of the scale, who are predominantly women,” Lahey explained.

Her comprehensive study shows that in Alberta in 2011, women’s full-time earnings were only 63 per cent of men’s. That compared with 80 per cent in Saskatchewan, 75 per cent in Quebec and 74 per cent in Ontario. In addition, more women are in part-time work in Alberta, and do more hours of unpaid housework each week, Lahey’s study shows.

But if the flat tax is at the root of the gender imbalance that concerns the premier when it becomes visible on public boards, he’s not about to make any changes to it. While Prentice has been working hard to create a sense of crisis about the province’s current fiscal situation — and blames Albertans themselves, not mismanagement by successive PC governments, for creating the current situation — he has been determined to rule out changes to the province’s corporate and income tax regimes.

As for Alberta’s non-renewable-resource royalties, the lowest in the world, he has solved that problem by never talking about it.

Indeed, Prentice has also opened another front in the PC War on Women with his recent campaign against public-sector unions, which have worked hard and effectively to close the pay gap between men and women, and which represent predominantly female memberships, especially in health care.

If Prentice’s efforts to reduce wages on that front are successful, we can expect to see the relative position of women slip farther and faster in Alberta.

Alas, the premier is unlikely to listen much to the advice of distinguished academics with real university jobs like Lahey, who suggests solutions to Alberta’s problems should include making income taxes more progressive by reinstating graduated personal and corporate income tax rates to pre-2000 levels, creating subsidized child care and elder care programs, enacting living wage laws for those who work more than 35 hours a week, and saving more royalty revenues in the Heritage Fund to help smooth out volatile resource prices.

In other words, by running the province as a competent grown-up manager would.

Instead, Prentice revealed Monday in a speech to an Edmonton Rotary Club, his favourite “institute” is the Fraser Institute, which hires “senior fellows” to compose press releases lauding the glories of the flat tax and a one-industry economy.

Sunday is International Women’s Day.

This post also appears on David Climenhaga’s blog, AlbertaPolitics.ca.