Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

When not denying the problem exists at all, its apologists tend to state that inequality is the result of overall market forces which the government has little control over.

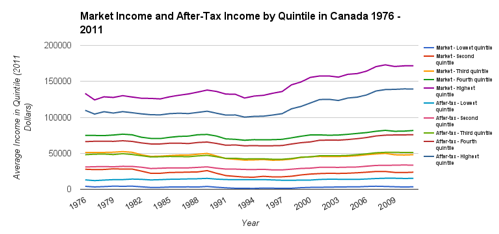

In other words, we should not be too concerned — despite a rapid increase in Canada’s inequality coefficient from 1976. That is, average market incomes have actually dropped for the bottom 60 per cent of Canadians since the mid-1970s. In fact, it is only in after-tax and transfer terms that low and moderate income Canadians have made any income gains at all in the past 30 years.

However, income statistics from one year may not fully capture the financial state of an individual or household. One might appear “wealthy” according to year-end income, but have far less net wealth due to high debts or high living costs. Wealth measures have their flaws as well, in particular that they take into account non-liquid assets (such as a primary residence), but they are often a better guide when it comes to inequality.

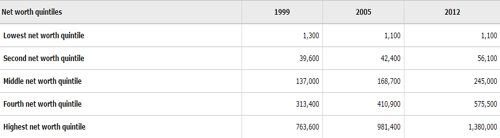

Statistics Canada does not have full data prior to 1999 in terms of its Survey of Financial Security (SFS), which tracks and measures financial assets and debts within Canadian households. That said, the statistics we do have paint a rather alarming picture.

Median net worth (that is, household assets minus debts), actually dropped in absolute terms from 1999 to 2012 for the bottom 20 per cent of earners, while nearly doubling in the upper 20 per cent This means that the median net worth of the upper 20 per cent of income earners is now 25 times that of the lower-middle 20 per cent and nearly 1250 times (no, that is not a typo) the lowest 20 per cent. Commentators can deny the reality of income inequality all they want, but there’s no fiddling with the hard numbers here.

In terms of the makeup of those debts, despite near-constant warnings of high household debt levels in the country, as well as the faint hint of moral opprobrium at supposedly frivolous spending that tends to accompany them, the reality is complex. A large driver of increased debt levels in Canadian households, particularly in those households with lower net worth, has been student loans. This is particularly galling given that educational investment is often, however erroneously, cited as the solution to inequality woes.

Money held in wealth investments does not “stay put” simply gathering dust and interest in bank vaults, either, but rather sloshes through any number of areas of public concern, often in surprising ways. For example, wealth is often vested in physical holdings, most especially real estate and land, meaning that increasing wealth inequality plays a part overheating property investments resulting in unaffordable housing prices in Canadian major cities.

It is particularly interesting here to note that median wealth held in real estate other than a primary home more than doubled in both Canada as a whole and in British Columbia (home of infamously expensive Vancouver) between 1999 and 2012. This is just one example, leaving for another day the corrosive effects of wealth in terms of monetary involvement in elections and a myriad of other public policy areas.

Wealth inequality, then, affects everything it can touch and therefore demands a policy response all its own. Unlike many of our OECD brethren, Canada does not currently levy an inheritance, estate or wealth tax of any sort. Where they do exist, wealth taxes are increasingly under both rhetorical and technocratic threat.

Since governmental tax and transfer powers remain the only things that have taken some of the sting out of increased income inequality, it’s well past time to put a similar dent in inequalities of wealth. Wealth taxes are one of strongest tools to combat the surfeit of economic and political power on the side of capital.

Let the left push for them, in unapologetic fashion.

Carter Vance is a student in the Social Work Program at Algoma University, Youth Officer of the Sault Ste. Marie New Democratic Party Riding Association and active in a variety of social movements. He also hosts the podcast The Affair’s Current.

Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

Image: Flickr/Forsaken Fotos