Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

As election day approaches, rabble.ca presents a set of excerpts from a new book laying out what Canada’s political parties have not: a plan to transition Canada to a low-carbon society.

After the Sands: Energy and Ecological Security for Canadians is a roadmap to ending oil and natural gas exports and ensuring that all Canadians get sufficient energy at affordable prices in a carbon-constrained future.

Gordon Laxer, founding director and former head of the Parklands Insitutute and the author of After the Sands: Energy and Ecological Security for Canadians will be holding launches for the book in Ottawa and Toronto.

Laxer has picked out excerpts from his book that will inform the debate about Canada’s energy future. We’ll be presenting them this week at rabble.ca. Here is today’s excerpt:

As the age of easy oil passes, Canada is one of the few industrial countries with enough conventional oil to last decades. We could shut down Alberta’s sands entirely and still have enough oil to get Canadians through the transition to a low-carbon future. However, NAFTA’s proportional energy-sharing clause stands in the way. Canada squanders its advantage by virtually giving the United States first access to over two-thirds of all its oil, including the less-dirty conventional kind. Simultaneously, Canada imports a lot of oil. It was about 40 percent in 2014, but will likely fall somewhat in the next few years, though still not enough to limit exposure for many Eastern Canadians. Thus, despite our rich resource endowment, Canada can’t guarantee that in an international oil supply crisis Eastern Canadians will get first call on domestic oil.

To ensure oil security for Canadians and to combat climate change at the same time, Ottawa could order TransCanada’s proposed Energy East pipeline to fully supply Ontarians and Quebecers with domestic conventional (non-fracked) oil. It could also redirect all Newfoundland oil to Atlantic Canadians. Both measures would end all oil imports. Canadians would also have to markedly cut their oil use. Until those measures are in place, Canada could create and fill strategic petroleum reserves. But NAFTA’s proportionality rule undermines Canada’s ability to ensure that residents get priority access to their own carbon energy, curbing emissions and protecting habitats.

The government of no other developed country is forbidden from guaranteeing its citizens first access to their country’s energy resources. This matters because international oil supplies will almost certainly be disrupted in the near future. The only questions are when, how long shortages will last and the extent of the shortfalls. Canadians are expected to have faith that the market will provide. But the oil market is dominated by a few dozen petro-corporations that don’t care if Canadians get first access to their own oil or natural gas; their only mission is to sell to the highest bidder. NAFTA was written before 9/11 and the “security trumps trade” era. Using the same logic for Canadians, ecological and energy security should trump NAFTA. Only Ottawa can decide that energy and ecological security for Canadians overrides the market and NAFTA.

If Canadians were its only consumers, Alberta’s Sands could supply us for about three hundred years.1 Michael A. Levi, in a report on Alberta’s oil sands for the New York–based Council on Foreign Relations, explains the impossibility of reconciling rising Sands production with falling carbon emissions. He asks readers to “Imagine…that oil sands emissions rose as expected over the next two decades and then stabilized in 2030 while total U.S.and Canadian emissions dropped by 80% by 2050…. Oil sands’ emissions then become equivalent to about 10% of us emissions by 2050, representing almost all emissions from Canada at that point.”

Canada cannot shut down all other uses of oil just so Alberta’s Sands can reach whatever output level Big Oil wishes. But Canada can meet its target of reducing carbon emissions by 80 percent if it phases out Sands oil and relies instead on our slowly falling output of conventional oil and natural gas as transition carbon fuels to get Canadians to a low-carbon future run on renewables. Canadians cannot be convinced to seriously conserve if they don’t see a direct link between their actions and their country’s emissions. Unfortunately, NAFTA’s proportionality rule means the more oil we conserve, the more Big Oil will export whatever is saved. If the conserved oil is sent to the us, Canada’s export obligation under NAFTA’s proportionality rule will grow.

What Is Proportionality?

Proportionality is “unique in all of the world’s treaties,” writes Richard Heinberg, a noted California energy expert. Cyndee Todgham Cherniak, aToronto trade lawyer, says the energy chapter is unique for a trade agreement. There are only three free trade agreements in the world that have energy chapters, and the other two don’t have NAFTA-like proportionality clauses.

It’s unclear how many other countries the U.S. has tried to impose an energy proportional sharing chapter on, but it is clear none has bitten. Heinberg concludes that “Canada has every reason to repudiate the proportionality clause, and to do so unilaterally and immediately.”

Proportional sharing requires NAFTA members to make available the current share of energy exports to other member countries even when facing energy shortages at home. Strictly speaking, “making energy available” is not a mandatory exporting obligation — but it might as well be. Canadians could theoretically buy up all the Canadian oil or natural gas made available for export, but buyers of crude oil and wholesale natural gas are not ordinary Canadians or small businesses. They are huge petro-corporations, most of them foreign owned and controlled, operating on a profit basis. Their buying decisions have nothing to do with supplying Canadians with our own energy. Unlike most major oil- and natural gas–producing countries, Canada has no government-owned energy firm to protect its citizens’ energy and ecological interests.

The proportionality clause says that if the government of any NAFTA member country takes action that cuts the availability of energy for export to another NAFTA member country, it must continue to export the same proportion of total “supply” that it has over the previous three years. If it cuts energy available for export to another member country, it must also cut the supply of that energy domestically to the same extent. When NAFTA came into force in 1994, it built upon and superseded the 1989 Canada – U.S. Free Trade Agreement ( FTA). Mexico was added and the agreement altered, but the FTA’s energy proportionality clause was retained.

The 1980s neoliberal thinking on energy that underlay the Canada – U.S. FTA was this: it’s good if a corporation decides to supply Market A rather than Market B, for profit reasons, but it’s bad if governments protect residents by ensuring that Market A is served for energy security, energy sovereignty or ecological reasons. Energy exports can rise or fall through changes made by the “market,” but elected officials cannot intervene to provide energy security to citizens who elect them. If TransCanada, for example, decided to ship more Western Canadian conventional oil to Eastern Canadians, it would not violate NAFTA’s proportionality rule. But if Ottawa ordered TransCanada to send Eastern Canadians conventional oil for energy and ecological security reasons, it would likely contravene NAFTA. The clause casts a chill over debates on Canadian energy and ecological options, but has never been invoked. Since the FTA and NAFTA began, no Canadian government has been inclined to put Canadian environmental and energy interests first.

In addition to proportionality, NAFTA’s article 605 throws another curveball. Exporters can’t disrupt “normal channels of supply” or “normal proportions among specific energy” goods by, for example, substituting light crude for a heavier variety. Proportionality is based on total “supply,” not “production.”

The distinction matters and shows proportionality’s bizarre logic. Supply includes domestic output, drawdowns of domestic inventory and imports. The almost 700,000 barrels of oil a day that Canada imports are added to domestic oil to form Canadian “supply.” In 2011, Canada had to offer 73 percent of its total domestic oil output to the U.S.

The gap between total supply and domestic output is much less for natural gas because we import only 15 percent of total supply, though such imports are rising. When imports are subtracted from Canada’s natural gas exports, Canada sends just under half of its net natural gas output to the U.S. In future, it will be easier to end liquefied natural gas exports to Asia than to stop natural gas exports to the us because it would not violate a treaty.

Mexico Exempt from Proportionality

When NAFTA started in 1994, Mexico was America’s third-greatest supplier of foreign crude oil. It still is. Canada was second then but has since zoomed past Saudi Arabia to become America’s greatest foreign supplier by far. During NAFTA negotiations, Mexico resisted strong U.S. pressure to sign on to proportionality. Consequently, Mexico is a full member of NAFTA but is exempt from the energy proportionality rules. With an eye on domestic opinion, Mexico issued “five Nos.” One “No” was a rejection of proportional sharing. Formally guaranteeing oil exports to the U.S. contravened Article 27 of Mexico’s Constitution:

“Under no circumstances may foreigners acquire direct ownership of lands or waters.”

Sovereignty over Mexico’s energy resources was and still is a revered part of Mexico’s heritage and identity. Acceding to proportionality would have violated one of the proudest chapters in Mexican history. Every March 18, Mexicans celebrate Energy Independence Day to mark the day in 1938 when Mexico expropriated the foreign-controlled oil companies. Publicly, Mexican governments portray themselves as the nation’s resolute defenders. Privately, they were opening up Pemex, the popular, nationalized oil company set up in 1938 to replace big foreign oil. Fabio Barbosa, an energy expert at UNAM university in Mexico City, wrote me to say that “at the start of the nineties,” when Mexico was loudly rejecting proportionality, it “was exporting everything it could.” In 1990, Teresa Gutiérrez-Haces, a political economy professor at UNAM, invited Canadian critics of the FTA to Mexico City. It was the first time Mexicans had heard about energy proportionality. Gutiérrez-Haces and others set up RMALC, the Mexican network on free trade, to stop Mexico joining NAFTA. She contends that the Canadian critics, who had just lost the FTA battle in Canada, alerted Mexican activists and government to proportionality’s dangers.

Did Mexico cede anything to get out of proportionality? Yes. It had to allow bids from U.S. and Canadian corporations for government procurement contracts, a departure from allowing only domestic bids. Mexico also had to open parts of its petrochemical and electrical industries to foreign ownership.

However bad it was for Mexico, debt agreements were temporary deals that lacked the greater permanence of proportionality for Canada. Canadian energy researchers Terisa Turner and Diana Gibson write that “though Mexico was forced to agree to some compromises, it maintains control over the three key aspects to energy resource sovereignty: pricing, production and export levels, confirming that Canada could choose a different path.”

America’s Version of Proportionality

Unlike Mexico, the U.S. has no formal exemption on proportional energy sharing. Until recently, it may as well have. But now the U.S. sends Canada about half the oil it imports and growing amounts of refined oil, including gasoline. However, since the U.S. is and will remain a net importer of a quarter to a third of its crude oil, it in effect re-exports to Canada the oil it imports. NAFTA’s proportionality rule therefore does not really apply to the U.S. It has not really applied to the U.S. regarding natural gas either. But that is rapidly changing. Fracking in the Barnett shale play near the U.S. Gulf coast and the Marcellus and Utica shale plays in New York, Pennsylvania, Ohio and West Virginia are spectacularly boosting U.S. natural gas output and displacing natural gas imports from Canada. The U.S. is projected to become a natural gas net-exporter by 2019.

Gas exports to Ontario and Quebec from nearby Pennsylvania and New York are becoming significant. This means that NAFTA’s proportionality rule could in future apply to significant quantities of U.S. natural gas exports to Canada. This obligation could hinder even U.S. energy security when American natural gas output starts to fall. By 2007, when the U.S. reached its peak of importing natural gas, Canada supplied 83 percent of it. U.S. dependency on natural gas imports at their height — 15 percent — never matched their import level of oil, 60 percent.

When the Canada-U.S. Free Trade Agreement was negotiated in the late 1980s, U.S. natural gas production had been declining for fifteen years, and it was not expected to recover. Getting unlimited access to Canada’s natural gas through proportional sharing was one of Washington’s major goals in the FTA. To do so, it needed to end Alberta’s and Canada’s long-standing protections of natural gas for domestic consumers. In 1949, Alberta’s Social Credit government had passed legislation that assured Albertans’ first right to their own natural gas and placed other Canadians’ needs above those of exports. Ten years later, John Diefenbaker’s Progressive Conservative government in Ottawa copied Alberta’s special protection of natural gas. When his government set up the National Energy Board in 1959, it reserved twenty-five years of “proven” supply of natural gas for Canadians, before it would issue long-term export permits.

These Alberta-first and Canada-first policies were in place until the late 1980s, when the Canada – U.S. FTA was being negotiated. Greenhouse gas emissions are growing faster from producing Sands oil than from Canadians using oil. Does NAFTA’s proportionality clause allow Canada to cut oil exports to the us for conservation reasons, or because the oil is dirty? No. The only grounds for reducing the oil available for export to the U.S. is to be running out of it. Unfortunately, the Sands’ abundant oil won’t let us do that. Canada is allowed to cut oil output under proportionality, but Canadians would suffer. If Canada cut oil output by 10 percent, it would mean a twenty-seven-day oil shortage in Canada. If, on the other hand, we

adopt a Canada-first oil policy by exiting from NAFTA’s proportionality rule and phasing out oil exports, we can cut oil output by over two-thirds without shuttering any gas stations in this country. While proportionality prohibits Canada from reducing energy exports for conservation reasons, the GATT (the General Agreement on Tariffs and Trade) allows it. Canada would revert to GATT rules if it ends proportionality or leaves NAFTA.

Long-time US Attempts to Grab Canadian Energy Resources

Washington has aimed to gain control over Canadian energy resources since 1952, when the Paley Report identified Canada as the most secure source for many of the kinds of raw materials their military economy needed. In 1970, three years before Arab countries in OPEC embargoed oil exports to the U.S., Labor Secretary George P. Shultz warned that oil-exporting countries were banding together. He recommended that the U.S. seek “safe” supplies from Canada. Joe Greene, Canada’s energy minister in Pierre Trudeau’s government, was eager to give the U.S. access to Canada’s energy resources and criticized U.S. quotas that limited oil imports from Canada. Schultz’s and Greene’s wishes came true two decades later in the 1989 Canada-U.S. Free Trade Agreement (FTA).

The FTA and NAFTA are not the only ways for the U.S. to secure control over Canada’s oil and natural gas resources. U.S. corporate ownership is also very effective. The U.S. has U.S.ed American-owned oil corporations as extensions of its foreign policy since before World War II. U.S. FTA negotiators insisted on “proportional sharing” to prevent Canada from reducing oil exports to the U.S., as it had after the 1973-74 Arab oil embargo. To ward off the genuine threat of oil shortages in Quebec and the Atlantic provinces, Canada had redirected oil it had been exporting to the U.S. to those provinces instead. For U.S. negotiators and their corporate backers, getting proportionality was the major coup of the 1989 FTA. It hadn’t occurred to the U.S. National Association of Manufacturers (NAM) that “free trade” could include a guaranteed right to Canadian energy. But R.K. Morris, NAM’s director for international trade, was delighted when it did. “When we got such a great deal on energy [in the FTA],” he told journalist Linda McQuaig, “We were crusaders for the deal.”

Leaving NAFTA

Exiting from NAFTA would not automatically release Canada from its proportionality obligations. Canada would also have to withdraw from the earlier FTA with the U.S. An Act of Parliament, to participate in an agreement, can be changed more easily than changing the international agreement itself. The real issue is political and not narrowly legal. An informed Canadian public could put pressure on politicians who appear to amend or even dispense with NAFTA while preserving proportionality. The U.S. got much better access to foreign oil through the FTA and NAFTA than it did by starting the International Energy Agency after the 1973-74 Arab oil embargo. U.S. Secretary of State Henry Kissinger persuaded other industrial countries to sign a non-binding oil-sharing pact to counter OPEC’s oil cartel power, obliging IEA members to share oil if international supplies fall 7 percent or more.

Although it is a net oil exporter, Canada has been an IEA member from the start. This means Canada is obliged to share oil in a severe shortage with fellow members, most of whom are net-consuming countries. It’s a bit like being the chicken in the middle of a wolf pack. Today’s IEA is stuck with an emergency response system set up to meet 1970s conditions. Western governments assumed then that oil supply disruptions would be short-lived, oil-producing countries would always want to sell their oil, and the West could remove any government that held it to ransom by bombing, invading or seizing its oil supplies. All these assumptions have been disproven. The peaking of deliverable conventional oil in the world shows that supply disruptions are likely to be long-term. The 2003 invasion of Iraq actually reduced its oil output for four years.

The IEA’s sharing system has never been tested fully. When Hurricane Katrina devastated New Orleans in 2005, international oil supplies fell by only 1.5 percent, well below the IEA’s 7 per cent trigger level. Out of goodwill, Canada and European IEA members voluntarily sent the U.S. additional oil for sixty days. But no general sharing among IEA members occurred. Unlike trade agreements, where failure to comply can spark trade sanctions, the IEA has no enforcement mechanism. From the U.S. perspective, leaving natural gas out of the IEA agreement has been a shortcoming. In contrast, NAFTA covers all forms of energy, including natural gas, and it gives the U.S. continuous rather than just emergency access to Canadian oil.

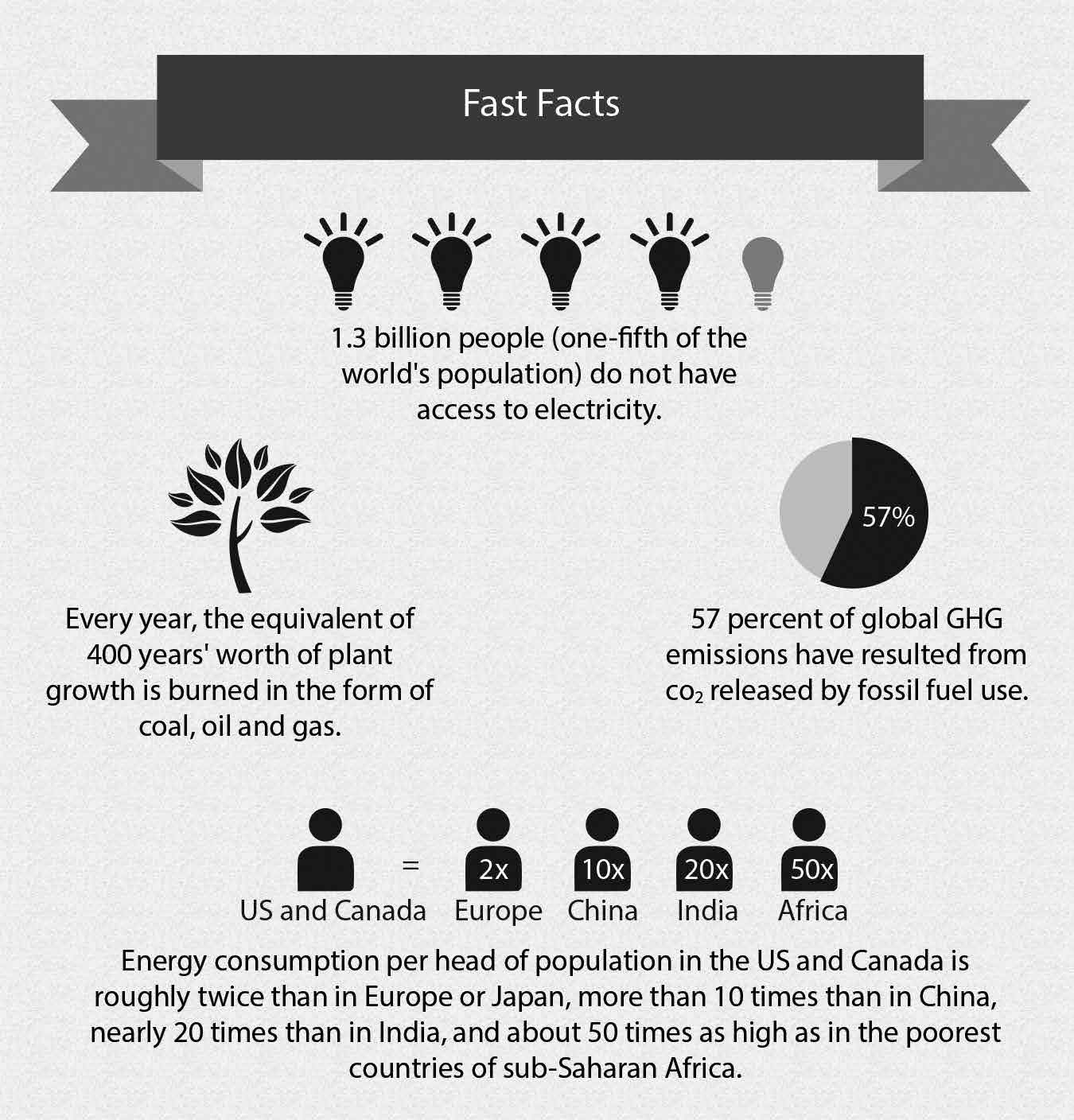

Proportionality is a lasting way to get someone else’s oil. It doesn’t take an extraordinarily deep shortage to trigger it. In contrast to its long-standing Middle East policy, the U.S. gets first access to foreign oil, Canada’s, without costly invasions or military bases. However, because of its “addiction to oil,” the U.S. is still vulnerable to politically motivated oil embargoes. If Americans reduced consumption by a third they could live entirely off their domestic oil output and still use more than twice the world’s per capita level.

Gordon Laxer will be holding launches for After the Sands: Energy and Ecological Security for Canadians in Ottawa and Toronto.

We’ll be featuring an excerpt from the book each day this week. To read them all, click here.

Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.