Introduction

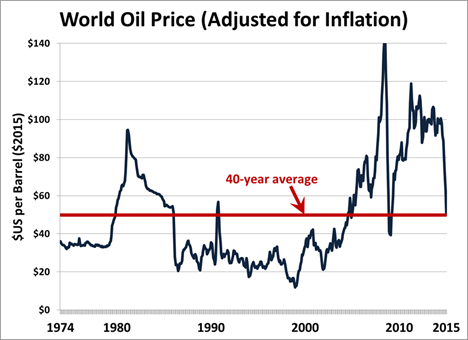

Canada’s economy has been thrown into turmoil by the dramatic decline in oil prices over the last six months. World crude prices have plunged by half: from around $100 (US) per barrel in summer 2014, to around $50 today (see Figure 1). Worse yet, Canada’s oil output receives an even lower price: our unprocessed heavy oil exports sell for only about $35 per barrel in the U.S. market (because of its lower quality and a regional supply glut).

Economists and finance ministers are scrambling to understand the oil crash, how it will affect Canada’s economy, and what policies would help to address the resulting consequences. Some of the effects are positive, some are negative. Whether low oil prices help or hurt depends on where you live, and where you work. This fact sheet explains why prices fell so dramatically, what it will mean — and how Canada can learn from this latest downturn to build a more stable and diversified economy.

The world oil price has fallen dramatically for several reasons:

Figure 1. Source: Unifor Research from U.S. Department of Energy and Bureau of Labor Statistics data.

Demand: Worldwide consumer demand for oil has been lower than expected — for both good reasons, and bad. Conservation and efficiency measures (motivated in part by high prices, and in part by environmental concerns) have reduced consumption. Demand has also been held back by disappointing economic growth in many parts of the world (including Europe, Japan, China — and right here in Canada).

Supply: High oil prices over the last decade have stimulated new sources of oil supply around the world. Unconventional sources of oil (including U.S. shale oil, Canadian bitumen, deep water offshore, and other high-cost sources) have grown rapidly. New supply has also come on stream from war-torn countries in the Middle East (including Iraq, Iran, and Libya). North American production has grown the fastest, and this has contributed substantially to lower world prices. So the very rapid expansion in production right here at home planted the seeds for the current price downturn. Every oil boom, it seems, is followed by a bust.

Geopolitics: Previous surges in oil prices were usually associated with wars, revolutions, and other dramatic events — usually in the Middle East. Things are no more stable over there than ever. But the oil market has not experienced major supply disruptions recently, and this has further reduced prices. The power of OPEC (the cartel of major oil exporters) has diminished in recent years.

Financial speculation: Most buyers and sellers in the global oil market are neither oil producers nor oil consumers. Rather, they are financial investors: they buy complex energy assets (including oil futures and other derivatives) in hopes of making a paper profit from rapid changes in prices. Speculation, not real supply and demand forces, thus explains the violent nature of oil price swings — both on the way up, and the way down. The influence of speculators is economically destructive. It is irrational that our whole national economy is held hostage to their whims.

Whatever the causes of the current downturn, the fact that oil prices have been volatile shouldn’t surprise anyone. And neither governments nor employers can legitimately use this volatility to justify “emergency” sacrifices by workers or communities. Figure 1 portrays the historical roller-coaster of oil prices: rising during times of global tension or strong growth, falling in other times. In fact, adjusted for inflation, oil prices over the past four decades have averaged just under $50 (US) per barrel: almost exactly where they are right now.

So perhaps current prices are not actually “low” at all. And any company or government which assumed prices would somehow stay at $100 per barrel or more (well above historical norms) was dreaming in Technicolor.

What it means for Canada

Canada has a complex, diverse economy, and the impacts of lower oil prices will also be complex and diverse. Some industries and regions will be hurt, others will benefit:

Oil production: Lower prices will have no major impact on Canadian oil output — at least not for several years to come. Existing oil wells and bitumen facilities will keep pumping crude, because their owners have already invested large sums of capital in those operations and they need to recoup those costs. In fact, Canadian oil output will actually keep growing for several years (growing by as much as 1 million barrels per day by 2018), due to partly completed new projects that are gradually coming on line. This stability of production also prevails in most other producing regions around the world. Any hopes that lower prices will quickly reduce high-cost output (and hence re-establish supply-demand balance) are far-fetched.

New petroleum investment: The most dramatic effect of lower oil prices on the oil industry will be on spending on new exploration, drilling, and capital spending. Current production won’t decline, but new capital spending will fall rapidly — partly because companies are concerned they will not be profitable, and partly because companies have no free cash flow to pay for new projects. It will take many years before slower investment translates into reduced production. But in the meantime there will be much less activity in drilling, construction, and support services. Workers in those parts of the oil industry will suffer layoffs and insecurity.

Gasoline prices: Consumers have benefited from a substantial decline in gasoline prices (down by about a third since last summer). The decline in gas prices has not been as large, proportionately, as the decline in oil prices (partly because oil refiners are pocketing higher profit margins). Less spending on gasoline and other petroleum products will modestly help household finances (although household debt in Canada continues to rise), and may spill over into increased consumer spending on other products and services.

Inflation: The plunge in gas prices will drive inflation down to near zero, at least for a while. This is not a good thing. In fact, economists around the world are increasingly worried about the opposite problem, called “deflation” (a situation when average prices stagnate or even fall). Deflation has terrible impacts on spending, debt, and job-creation.

Other industries: Some parts of Canada’s economy will benefit from lower energy prices, including airlines, other transportation providers, and some manufacturing. At the same time, some industries depend on the energy sector (such as factories which manufacture pipes and other oil equipment); they will feel the negative effects of the slowdown in oil investment. The sum total of positive and negative effects across dozens of different industries is probably a “wash” for Canada’s economy as a whole.

Jobs: Here, too, the fall in oil prices will have a mixture of positive and negative effects. Some jobs will be lost in the energy sector — especially on new drilling and construction projects. So far, Unifor members working in the oil industry have largely avoided lay-offs (since they work mostly in completed production facilities), but anyone in the oil patch will experience tremendous uncertainty in coming years. Meanwhile, new jobs will be created in sectors which benefit from lower energy costs (like transportation and some manufacturing — industries where many Unifor members also work). On a net basis, there will not likely be a major impact on overall employment levels (which continue to suffer from Canada’s poor economic growth, the side-effects of government austerity, and other negative factors).

The oil industry is the most capital-intensive, least labour-intensive sector in Canada’s whole economy. Each million dollars of petroleum output corresponds to just one-half of a job, versus ten jobs per million dollars in sectors like transportation and manufacturing (and even more in public services, hospitality, and retail). So while petroleum industry revenues and profits will fall sharply in coming years, the impact on overall employment will be much less severe.

Gross Domestic Product: Canada’s total economic output (called “real GDP,” adjusted for inflation) will not change much with the fall in oil prices. Some industries will shrink, while others will grow. However, the nominal value of GDP (measured in unadjusted dollars) will be reduced by lower oil prices and hence lower overall price levels. This will cut into national incomes and spending power.

Government budgets: Because nominal GDP will be lower, government tax revenues will also be lower. That will hurt government budgets — to varying degrees, in different parts of the country. The federal government depends only marginally on oil revenues; budget effects at the federal level will be minor. In oil-producing provinces, however (including Alberta, Saskatchewan, and Newfoundland & Labrador), the budget effects will be huge. Those provinces relied too much on volatile petroleum royalties to fund day-to-day public services (like health care and education), and hence will face large deficits in coming years. Threatened cuts in public spending in oil-producing provinces will be one of the worst side-effects of the oil price downturn. Citizens in those provinces must be ready to defend their public services against inevitable calls by conservatives for cutbacks and privatization. Government austerity in those provinces would only make the downturn worse (by eliminating public sector jobs on top of oil industry downsizing).

Oil-producing provinces should quickly move to restructure their tax systems, to collect more revenues from steady tax programs (rather than unpredictable oil royalties), and thus insulate future budgets from the ups and downs of oil prices.

The loonie: The biggest economic benefit to Canada from lower oil prices has been the corresponding decline in the Canadian dollar. For the last decade our loonie was valued far too high on international markets — mostly because financial speculators came to identify our currency with the global price of oil. That overvaluation made all of our other products (including manufactured goods, services, tourism, and more) seem too expensive to foreign buyers, and those sectors suffered a terrible downturn. Now the loonie has come back to earth (and hopefully stays there in future years). This won’t bring back the half-million manufacturing jobs we lost since 2004, but it will help defend the ones we have left.

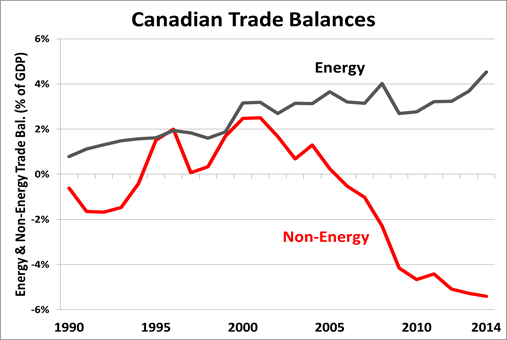

Foreign trade: One negative side-effect of the oil boom (while it lasted) was the damage it did to Canada’s trade performance. Oil and other energy exports grew rapidly. But at the same time, all our other exports (manufactured goods, services, and tourism) declined significantly — partly because of the overvalued currency. Canada’s trade balance was pulled in two directions: we had a huge surplus in an energy, but an even larger deficit in everything else (see Figure 2). Even when oil prices were high, energy revenues were not enough to pay off huge deficits in non-energy goods and services. As a result, Canada began to experience large deficits in international payments (beginning in 2008). With low oil prices, our deficit will get even worse — until we rebuild other export industries to fill the gap.

Environment: Like the economy as a whole, the environment will experience both positive and negative effects from lower oil prices. By slowing down the feverish pace of investment in new bitumen projects, lower oil prices will help to curtail Canada’s future greenhouse gas emissions. (The bitumen industry has been the largest contributor to growing emissions in the last decade, offsetting reduced emissions in other sectors like electricity generation.) On the other hand, lower prices will reduce the incentive for consumers to use less energy, and might lead to more pollution. With falling oil prices, Canada should finally implement a credible climate change plan, so that emissions don’t shoot up in the future (regardless of oil prices).

Figure 2. Source: Unifor Research from Statistics Canada data.

What comes next?

No one knows where oil prices will go next — but everyone knows that oil will keep riding the roller-coaster. Natural resource prices have always been volatile. This is one reason why any country should be cautious about investing too much in one unpredictable industry.

World petroleum supply will respond only very gradually to lower prices; existing projects will keep operating. Similarly, world oil demand is not very sensitive to low prices, either. Continuing efficiency gains will limit demand, as will global economic weakness. Therefore, oil prices are likely to remain depressed for some years to come. Indeed, some energy experts have warned that the current level of prices is the “new normal.”

For that reason, there’s little point sitting around dreaming of a return to high oil prices. We should be spurred by the recent drama, and the uncertainty and dislocation we now face, to rethink our whole national approach to the energy industry. Instead of riding one short-lived boom after another — always followed by tough times and dislocation — we should find better ways to manage the ups and downs of oil, and build a more stable and sustainable prosperity.

How Canada should respond

It is the duty of government to manage the economy in the interests of Canadians, and to protect Canadians against the gyrations of market forces. Governments are not powerless in the face of global forces. They can and must take pro-active, constructive actions: to respond to low oil prices, to protect our jobs and services today, and to reposition the national economy so it is less susceptible to future boom-and-bust cycles.

Here are some of the main priorities:

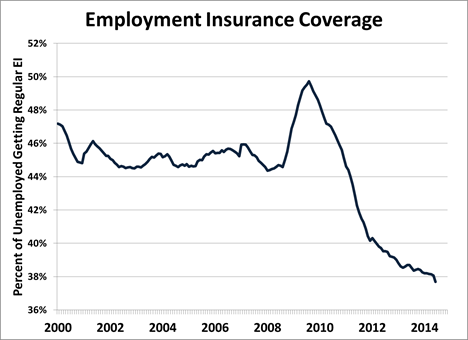

Repair the safety net: Lower oil prices will produce some job losses and some job gains. Losses will be more concentrated in specific industries and regions than the gains (and will be more painful as a result). The purpose of Employment Insurance and other adjustment measures (like retraining and relocation assistance) is to help Canadians who have been displaced by economic changes. Shamefully, however, our safety net has been so damaged by years of cutbacks and restrictions that it is now out of reach for most Canadians who need it.

Figure 3. Source: Unifor Research from Statistics Canada CANSIM; 12 month moving average.

Figure 3 shows the proportion of unemployed Canadians who are able to qualify for regular EI benefits. It has declined dramatically since 2010 (because Ottawa further tightened the screws on qualifying). Due to precarious work, irregular hours, and super-strict qualifying rules, less than 40 per cent of unemployed Canadians are able to receive any EI at all. At a time of turmoil and uncertainty in the labour market, this is totally unacceptable. The federal government should expand access to EI benefits, and invest more in retraining and adjustment programs.

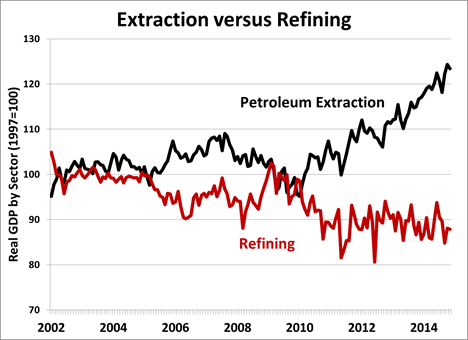

Add value to Canadian resources: The more raw crude we ship to the U.S. (especially unprocessed bitumen and heavy oil), the lower the price falls. This is a short-sighted, self-defeating strategy — and building more pipelines to export even more raw crude (to the U.S. or elsewhere) will only make things worse. When oil prices fall, companies which upgrade and refine petroleum actually benefit from larger profit margins (because gasoline prices never fall as much as crude oil prices). So the downturn in prices reinforces the case for more value-added upgrading, refining, and petrochemical investments in Canada.

Figure 4 indicates the divergent trends pursued by oil and gas extraction from Canada, versus petroleum processing and refining. Since the global oil bubble started to inflate in 2002, real output in raw petroleum extraction has grown by 25 per cent — and will likely keep growing in coming years, despite lower prices. But perversely, real output from Canada’s refining sector actually shrank during that time (due to low throughput and refinery closures). We are exporting more and more raw resource, but adding less value to it here at home. This is a good time to reverse that negative trend. Moving ahead with more investments in upgrading, refineries, and petrochemicals, ensuring that Canadians get maximum jobs and income from our own resource, should be a priority.

Promote more investment: The biggest national economic risk from oil prices will be the sharp decline in business spending on new energy investments. Government must aggressively stimulate alternative forms of capital spending to offset this coming decline. This includes more effective measures to elicit new business investments (in manufacturing, services, transportation, and other sectors). The current approach of cutting corporate taxes, with no strings attached, has not worked: companies are sitting on over $600 billion in excess cash, not reinvesting it. A better way to spark investment is to tie fiscal benefits to new investment (through measures like investment tax credits, a national manufacturing policy, and more). Major public investments in infrastructure (like transit, housing, and utilities) can also fill the gap left by reduced oil investment.

Stabilize the pace of future petroleum developments: The oil downturn will be all the more painful in oil-producing provinces partly because of the overheated nature of the oil boom before prices started to fall. There was no rational planning to manage the pace of growth in previous years. This led to a “gold rush” mentality that caused inflation, cost overruns, poor economic and housing infrastructure in resource regions, and other negative side-effects. A more planned, gradual, and careful approach to future energy developments would enhance the benefits, reduce the costs, and leave us less vulnerable to future boom-and-bust cycles. Development approvals, environmental approvals, and project staging systems would contribute to smoother development in the future; the present “pause” in the industry is a good time to implement these measures.

Figure 4. Source: Unifor Research from Statistics Canada data.

Climate change policy: Even the oil industry has been hurt by the failure of the federal government to take any meaningful action on Canada’s climate change obligations. The uncertainty resulting from the absence of any climate policy is clearly a major question mark hanging over any long-run energy investment plans in Canada. With lower oil prices, this is a great opportunity to remove that uncertainty. The government should implement a price on carbon (since the impact on consumers and companies will be muted at current energy prices), and implement firm overall targets on greenhouse gas emissions. It’s a myth that taking action on climate change means “shutting down the oil industry.” In fact, a clear, firm plan will create the certainty that the industry needs to move forward with future investments: carefully and responsibly. Revenues from climate change measures should be devoted to fostering public and private investments in pollution reduction, transit, and other priorities.

Diversify our economy: Since 2002, Canada’s overall economic structure has taken a big step backward. For decades we tried to escape our historic status as a “hewer of wood, drawer of water.” We developed sophisticated, value-added industries: in manufacturing, services, and technology. Once the commodities boom got going, however, this progress was squandered. Governments and business alike swallowed the myth that Canada’s economic future could be guaranteed by resource extraction alone. Canada’s performance on productivity growth, R&D spending, and exports has been among the worst of any industrial country.

Canadians have been cruelly reminded this year that in the world of resource commodities, what goes up, must come down. Resources will always be a crucial part of our economy. But our resource wealth must be managed carefully to get the most sustainable value from it. And at the same time we need to actively foster other crucial sectors: including manufacturing, high-value services, tourism, and transportation. The federal government put too many eggs in one economic basket: the extraction and export of raw petroleum. Now is the time to define a more balanced, diversified, and stable economic path for Canadians.

Conclusion

Some have panicked in response to the downturn in oil prices: worrying that Canada’s entire economy will be thrown off track as a result. This is based on the flawed assumption that the oil industry was the key ingredient to Canada’s entire economic well-being. This was never the case.

In reality, while petroleum supports many good jobs in certain regions of Canada, it is just one of many industries underpinning Canada’s overall GDP and employment. The downturn in prices will have serious implications in some sectors (especially for those working in new oil drilling and investment projects). But at the same time it will have beneficial impacts for other sectors. The net effect on overall Canadian GDP and employment will be modest. And there should be no surprise that oil prices did not stay at $100 per barrel. That could never last.

Instead of panicking at the present downturn, and crossing our collective fingers for another boom in the future, we should utilize this moment to rethink how we manage our resource wealth, our economy, and our social safety net. Government must first move quickly to protect those who will be affected by the current downturn (including by fixing our broken EI system). It should develop new strategies for managing future energy developments, stimulating more Canadian value-added, and regulating the environmental impacts of oil production. And it should learn the obvious lesson that we need Canada’s economic engine to be firing on all cylinders — not just one.

Jim Stanford is an economist with Unifor. This bulletin on the economic effects of lower oil prices was first published by Unifor.

Photo: elston/flickr