Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

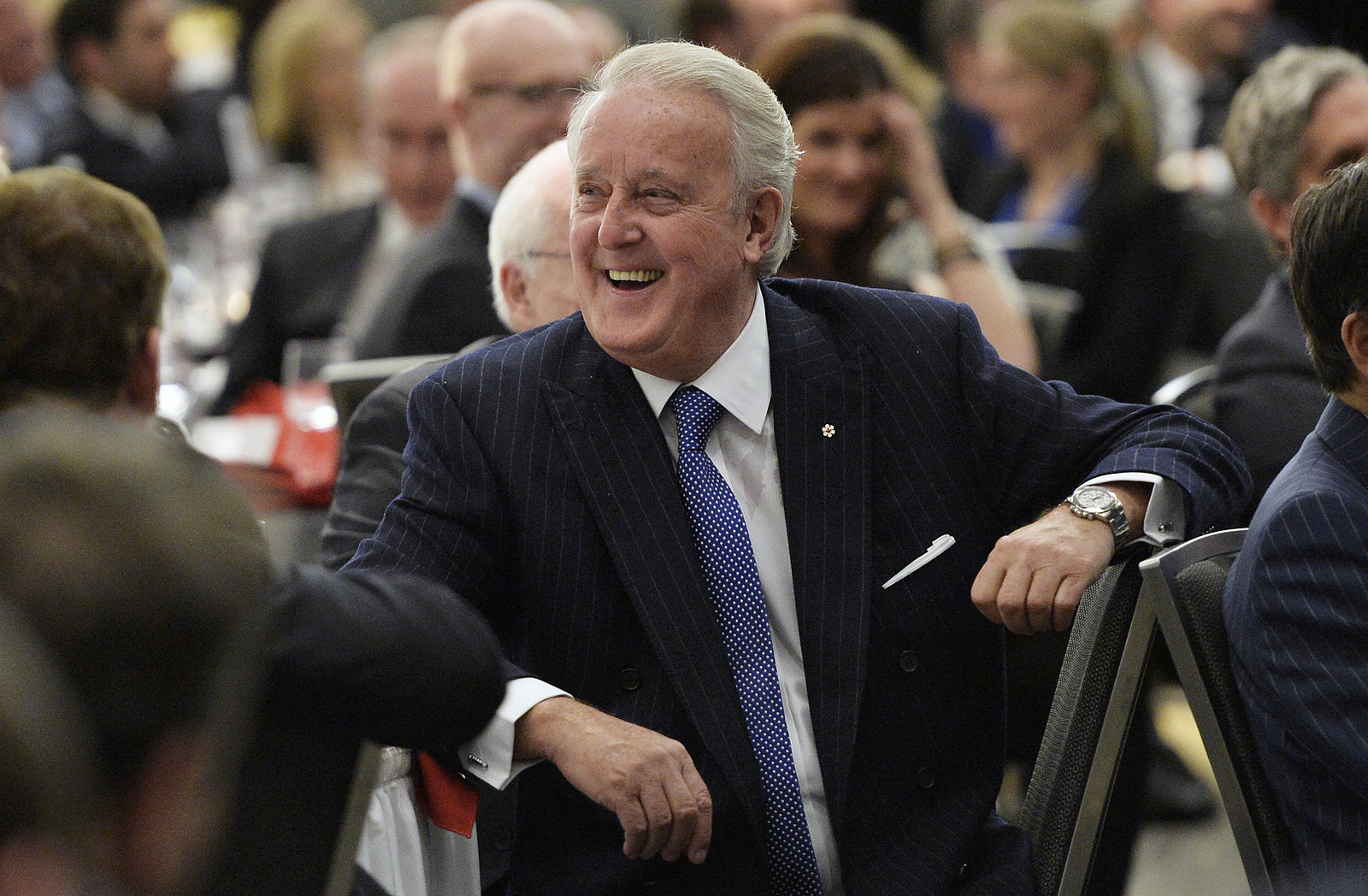

Brian Mulroney will surely be best remembered for the suitcase full of thousand dollar bills he received in a New York hotel room.

The riveting image of the former prime minister accepting wads of cash from a notorious lobbyist — admitted by Mulroney under cross-examination at a 2009 public inquiry — was so eye-popping that it completely eclipsed another fascinating aspect of the story: the sweetheart tax deal Mulroney got from the Canada Revenue Agency after he failed to report the cash.

Although Mulroney had hidden the cash payments (totaling $225,000) from tax authorities for six years, his lawyers managed to cut a deal that allowed the former PM to avoid any fines or penalties, and only required him to pay half the taxes he would have paid if he’d obeyed the tax laws — laws that chumps like you and me are legally obliged to obey.

It certainly looked like favouritism to a former PM. But another possibility is now emerging: that’s just the CRA’s standard kid-glove treatment for the wealthy and powerful.

That conclusion is harder to avoid in light of recent revelations that 26 wealthy Canadians were offered full amnesty from prosecution or penalty after they were caught hiding at least $130 million in offshore tax schemes set up by the giant accounting firm KPMG.

We only know about this sweetheart amnesty offer due to intrepid reporting by the CBC’s Harvey Cashore.

Intriguingly, CRA officials insisted the 26 wealthy tax dodgers keep the sugar-coated deal secret, indicating they realized it would annoy ordinary Canadians who think of tax haven countries mostly as exotic places to vacation, if only they had the money.

KPMG also appears to have gotten off scot-free, even though internal memos show that the firm planned to collect 15 per cent of all taxes dodged.

The KPMG amnesty case — currently being studied by a House of Commons committee — is emerging as a test of whether Justin Trudeau’s team really is a new-style, transparent government or just another bunch of cronies with cosy ties to Bay St.

The KPMG amnesty was put in place under the Harper government. So this would seem like a perfect opportunity for Trudeau to show a new toughness against rich tax dodgers by using the government’s full investigative powers to unmask this and other shady offshore scams.

But, so far at least, the Liberal-dominated committee has failed to show any such toughness, or interest in aggressively probing the booming tax-avoidance industry — even after revelations earlier this week that KPMG advised clients to use its tax haven schemes to hide money from ex-spouses during contentious divorce battles.

Its tameness stands in stark contrast to the aggressive probing of the tax avoidance industry by a parliamentary committee in Britain and a congressional committee in the U.S.

The KPMG scam is undoubtedly just the tip of a gigantic tax-avoidance iceberg. Canadians for Tax Fairness, a labour-sponsored group, calculates Canada loses more than $7 billion a year in revenue due to wealthy individuals and corporations using tax havens.

Under the Harper government, this sort of tax avoidance by the rich tended to be viewed as a benign activity, a victimless crime, part of the notion that taxes are inherently bad. But, of course, that’s only true if you’re willing to go without schools, hospitals, roads, bridges, pensions and other public goods that require tax revenue.

The flourishing, highly lucrative tax avoidance business can also be blamed for the complexity of the tax system, so frequently bemoaned by right-wingers.

Our tax laws wouldn’t need to be nearly so complicated if it weren’t for an industry of hyper-clever sharks constantly devising ways to drive a truck through them on behalf of their wealthy clients.

Ultimately, it boils down to a question of fairness. Why should Brian Mulroney and his ilk manage to avoid the heavy hand of our tax laws?

I guess CRA has some good reasons for being lenient with the wealthy and the powerful. And no doubt they’d be just as understanding with other Canadians.

Hell, at the end of April, I calculated how much tax I owed, and then sent the CRA a cheque — for exactly half that amount. I haven’t heard back yet, but I’m sure they’ll be fine with that.

This article originally appeared in The Toronto Star.

Image: Flickr/Canada 2020