After weeks of trying to look tough on rich tax avoiders, the Trudeau government got walloped this week with revelations about wealthy Liberal fundraisers — notably the Bronfman family — stashing millions in offshore tax havens.

The dramatic leaks from the “Paradise Papers” have exposed a world where the rich manage to store much of their wealth offshore, either legally or illegally, beyond the reach of national tax authorities.

With Canadian tax authorities unable or unwilling to collect an estimated $8 billion a year in revenue because of tax havens, the familiar political refrain “we can’t afford it” — heard whenever requests are made to fund vital public programs — starts to ring hollow.

The Paradise Papers have made tax avoidance by the rich suddenly a hot, politically charged topic, after years when it attracted little more than envious glances from those in the business world.

Certainly the Bronfmans have long been known in business circles for dexterity in reducing their taxes — all the way back to the 1940s when they established a complex web of trusts allowing control to pass tax-free from generation to generation, in apparent defiance of Canadian tax law.

The Bronfmans were also reported to be the family behind a controversial 1991 tax gimmick under which $2 billion from a family trust was transferred out of the country without taxes being paid.

The auditor-general suggested the federal government may have shown favouritism in granting the family advance approval to use the gimmick, saving them a stunning $700 million in Canadian taxes.

Certainly, if the family was the Bronfmans, as widely reported, they had exceptional political connections through their longtime political fixer Leo Kolber.

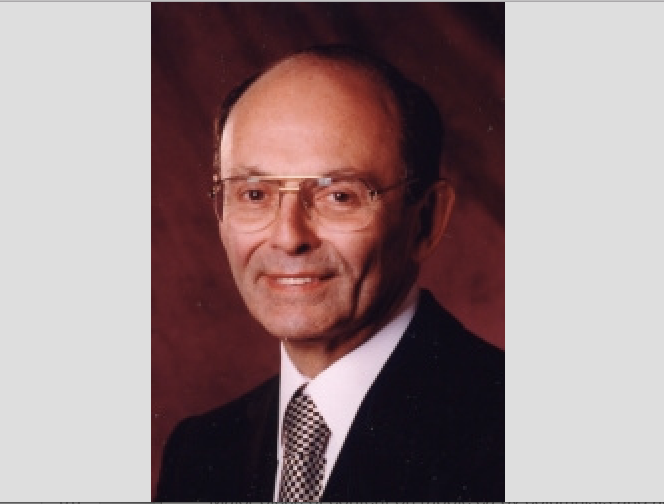

Kolber, prominent in the news this week for his involvement with the Bronfmans in a tax haven trust, has long managed the Bronfman fortune — a role that’s allowed him to become wealthy and powerful himself by being (in his own words) “the Bronfmans’ boy.”

For decades, Kolber has also cultivated the family’s close political ties to Pierre Trudeau, Jean Chrétien and Brian Mulroney, who was prime minister at the time of the 1991 tax gimmick approval.

In a 2010 interview for a book I was writing, Kolber described to me the close connections he (and the Bronfmans) had to Mulroney, after donating $100,000 to his 1983 leadership campaign.

Kolber also explained the key role he played in overcoming anti-Mulroney resistance within the Conservative party that threatened to block Mulroney’s rise to power. Particularly fierce in that resistance was prominent Toronto lawyer Eddie Goodman.

Mulroney asked Kolber to use his influence to win over Goodman — something Kolber was well positioned to do, since Goodman was the lawyer for the Bronfmans’ Cadillac Fairview Corporation, over which Kolber presided.

At Mulroney’s request, Kolber phoned Goodman and got him to agree to meet Mulroney. Kolber then flew Mulroney to Toronto on the company jet for lunch with Goodman in Kolber’s private dining room at Cadillac Fairview. By the time Kolber joined them for coffee after lunch, Goodman had abandoned his resistance, paving the way for Mulroney to go on to win the Conservative leadership.

Favours like that are rarely forgotten by politicians, particularly someone like Mulroney, who famously said, “Ya dance with the one who brung ya.”

Kolber also explained how his influence with Jean Chrétien later helped him reduce capital gains taxes — a move that benefited wealthy Canadians, including the Bronfmans and himself.

By then a senator (appointed by Pierre Trudeau), Kolber was intent on reducing capital gains taxes but, he told me, this was not a priority for Chrétien — indeed it was “the furthest thing from his mind.”

At Kolber’s request, Chrétien elevated him to chair the Senate banking committee, where he pushed for the capital gains tax cut. Before the 2000 budget, Kolber urged a meeting of the Liberal caucus to support his proposed tax cut. Kolber recalled that after he spoke, Chrétien advised the caucus to “listen to Leo on this.”

At that same caucus meeting, Kolber recalled, Finance Minister Paul Martin expressed reservations, saying the public would see the tax cut as “a sop to the fat cats.”

Still, the tax cut made it into the budget, which Kolber attributes to Chrétien. It certainly turned out to be a sop to the fat cats, since half of all capital gains are received by the top 1 per cent. From 2000 to 2010, the top 1 per cent was saved a massive $7.9 billion in taxes — largely due to the diligent efforts of the Bronfmans’ boy.

Linda McQuaig is the co-author, with Neil Brooks, of The Trouble with Billionaires. This column first appears in the Toronto Star.

Like this article? Please chip in to keep stories like these coming.