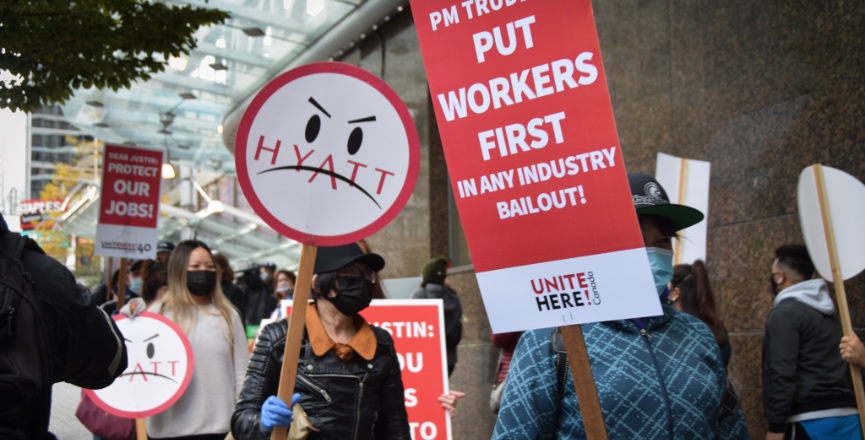

In this fall’s fiscal update, the federal Liberals offer assistance to the hard-hit hotel and hospitality industry, but workers fear that help will go to wealthy financial institutions, not them.

That’s what UNITE HERE!, the union that represents 18,000 of those workers, says in a new report entitled Demystifying Canadian Hospitality Bailouts: Who Benefits, Banks or Working People?

Federal aid for the industry is supposed to come through a new highly affected sectors credit availability program (HASCAP). The question the union and the 300,000 hotel and hospitality workers ask is: Will that aid help workers keep their jobs or get their lost jobs back?

The union’s analysis indicates the answer could very well be no.

It is quite likely the main beneficiaries of HASCAP will not be the 70 per cent of workers in hotels and related businesses who have lost their jobs, but rather the biggest banks in Canada, to whom the corporations that own hotels are heavily indebted.

Hotel ownership and operations are separate

There is a widespread impression that Canada’s hotel industry consists of many small, independent businesses. In fact, the union report tells us the owners of a good many Canadian hotels, especially in larger cities, are a motley crew of “real estate investors, foreign investors, high-net worth individuals, private equity companies, institutional investors searching for high-yield assets, and large hotel corporations.”

More to the point, there is quite often a separation between the companies that own hotel properties and those that manage them.

When you see the logo Marriott or Fairmont on a hotel, that does not necessarily mean those companies own the property. More often than not, hotel owners have offloaded day-to-day operations, including hiring and payroll, on those specialized companies.

Those owners now “face a protracted downturn without cash flow” and the union says they “will be more focused on servicing large debt payments and covering fees to hotel managers and franchisors and other fixed costs than on maintaining ties to their hotel staff.”

The union notes that the hotel industry has made a point of spurning the existing federal COVID-19 wage subsidy program, the Canadian Emergency Wage Subsidy (CEWS), which was designed to maintain the connection between employers and employees during the pandemic-caused slow down.

The fact that they have not availed themselves of the CEWS tells the union that hotel owners want to use the pandemic as an excuse to downsize for good. The owners appear to want to shed workers, or replace their current workforce — some of which is unionized — with cheaper, and certainly non-union, labour.

And so, the union proposes to the federal government that it should condition the relief for the hospitality and hotel sector on preserving current workers’ jobs.

The big banks might have extended billions in credit to hotel owners, but the banks are doing quite well right now. Their profits are, in fact, higher than ever. The government can legitimately ask the banks to put hotel owners’ debts on the backburner, while it targets taxpayer money to day-to-day hotel operations and the hard-hit workforce.

“Unless government requires recipients of sectoral relief to enroll idled workers in CEWS and guarantee those workers the right to be recalled to their pre-COVID positions,” the union report states, “there is a danger that any sectoral relief for hotels will simply go into the vaults of North America’s largest banks.”

The report continues:

“With laid off Canadians struggling to make ends meet, the last place money from government relief programs should go is into the vaults of banks like the Royal Bank of Canada and Bank of Montreal … If sectoral relief is not conditioned on helping workers first, hotel owners will prioritize making mortgage and lender payments … and ultimately enrich profitable banks … that have already paid out higher dividends during the pandemic compared to last year.”

Too much pandemic relief money has gone to wealthy corporations

The hotel and hospitality union has three simple, realistic recommendations for the Trudeau government:

-

HASCAP should be conditioned on full participation in CEWS; government loans should help front costs of wage subsidies for those employers who claim they can’t otherwise afford to do so.

-

The government should tie HASCAP to recall protection. Laid-off workers should have the right of first refusal to return to their jobs. Otherwise, those fired during the pandemic recession will be replaced for less when industry conditions rebound.

-

The legislation creating HASCAP should require it to fully and transparently report on what happens to the government money it doles out. HASCAP must report on who obtains government backed loans and how many pre-COVID jobs are restored.

We know that billions of dollars in emergency COVID-19 aid, both here in Canada and in the U.S., have gone to corporations making healthy profits.

CBC’s news service has done some digging on this and is currently doing an excellent series on taxpayer-supported pandemic profiteering. (The Canadian public broadcaster has been knocked about quite a bit lately. It deserves credit when it does brave and original work of this sort.)

The Liberals’ fiscal update, of which HASCAP is a part, is now before Parliament. It is not too late to make some key changes to the proposed legislation.

Profitable corporations do not need even more Canadian taxpayer assistance than they have already received during the pandemic. Laid-off workers do need the help.

Karl Nerenberg has been a journalist and filmmaker for more than 25 years. He is rabble’s politics reporter.

Image: UNITEHERECanada/Twitter