Nova Scotia’s Liberal Finance Minister Diana Whalen has kicked up a hornet’s nest of fury and opposition with her proposal — included in this year’s provincial budget — to cut 75 per cent of Nova Scotia’s Film Industry Tax Credit program.

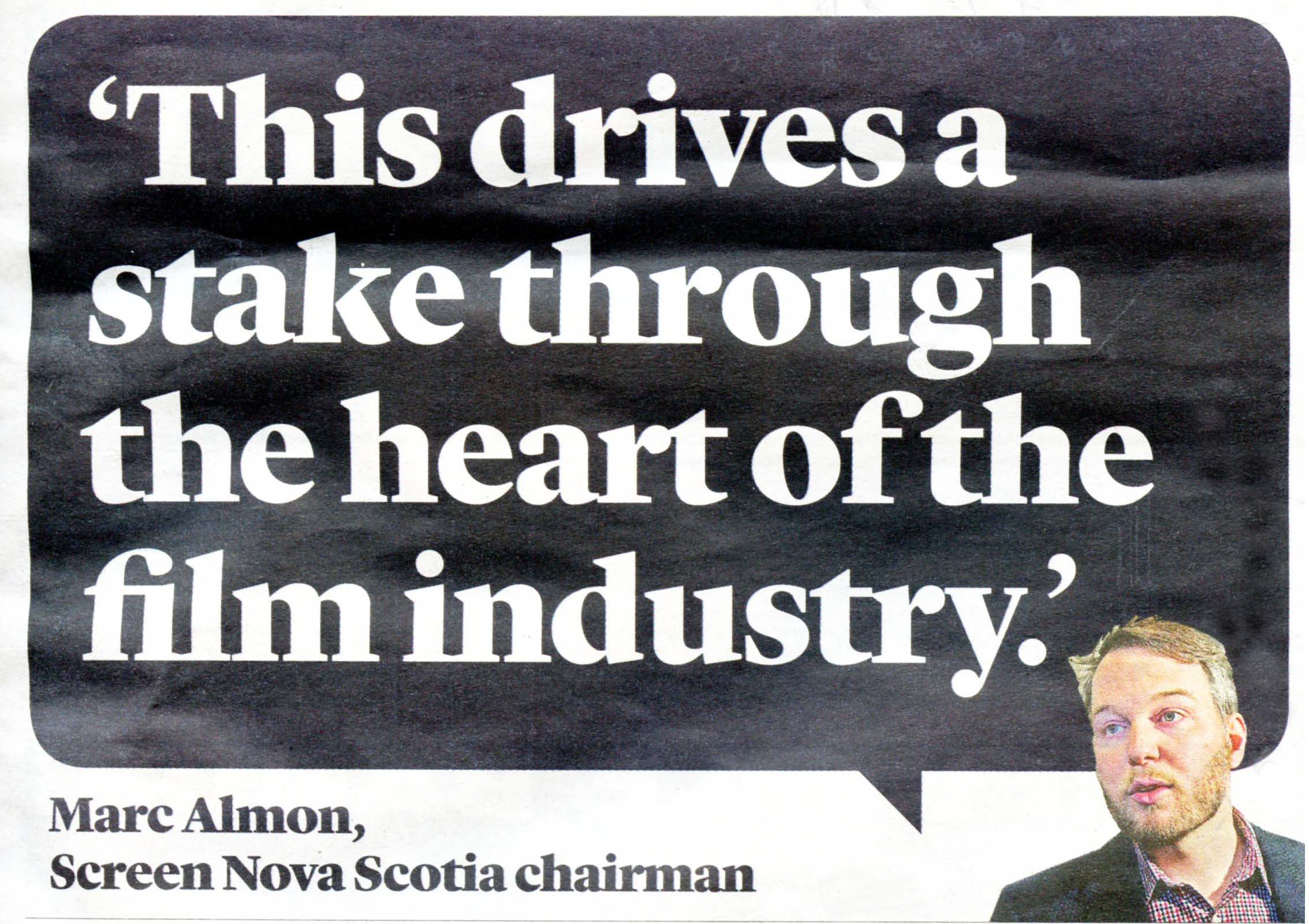

The entire film industry in the province and many participants in the creative economy are up in arms. Screen Nova Scotia’s chairman, Marc Almon, stated, “This drives a stake through the heart of the film industry.” Adding that, “It took 20 years of careful building for this industry to become the success it is today. In her budget speech, the Finance Minster took about 20 minutes to demolish it.”

Michael Donovan, chair of Halifax-based DHX, one of Canada’s largest media production, distribution, and broadcasting companies said, “The government has killed the Nova Scotian industry –- that may not have been their intention but that’s what they have done. The Nova Scotia government doesn’t understand the impact. Fundamentally, they have made the Nova Scotia film tax credit un-bankable in Canada.”

In an open letter sent to the Finance Minister and Premier Stephen McNeil, Susanna Fuller, a former Commissioner on the ONE Nova Scotia Commission on the economy, wrote:

“I strongly urge you to reconsider the reduction of the Film Tax Credit. … While the tax credit is generous, it has built a strong film industry in Nova Scotia. It has spawned new businesses and given us a foothold in the global arena of film. Our film festivals are second to none. The film industry is one of the few that is distributed across our rural and urban communities — allowing us to maximize our assets and adding incredible value to the potential for our communities to make the most of their scenic attributes and historical settings. Perhaps most importantly, this industry attracts and maintains young creative people who want to live here. We need this more than anything right now as we are not going to move ahead and achieve new ways of doing things without our creative class.”

Graham Steele, the former Finance Minister under the previous NDP government, calls the cut of the film tax credit a “calamitous mistake” adding that:

“In the midst of it [the budget] is this awful, clanging error with the film tax credit. This could be the Liberals’ own ferry debacle. I have never seen a budget changed after it was introduced. There’s a first time for everything — and this is the time.”

Is this alarm justified or is this self-interested hyperbole on the part of the film industry? Here’s a short attempt to unpack what the Film Industry Tax Credit is and what it does.

Is this alarm justified or is this self-interested hyperbole on the part of the film industry? Here’s a short attempt to unpack what the Film Industry Tax Credit is and what it does.

Note: this is a “back-of-the-envelope” analysis using rough data that the Nova Scotia government has provided with respect to Nova Scotia’s film industry in 2014. It could doubtless be improved with more exact information and with a more comprehensive look at the impacts of the industry on Nova Scotia. Nonetheless, it provides the general outline of the program and helps determine whether the government’s approach is credible or whether the film industry’s panic is justified.

Nova Scoria’s Film Industry Tax Credit (FITC) is available to film producers (who meet other criteria) who make films in the province. In 2014 this industry had a value of $122 million. Recent productions include films and series such as Book Of Negroes, This Hour Has 22 Minutes, Mr. D., Heartbeat, Inspector Gadget, The Trailer Park Boys, Haven, Forgive Me, Relative Happiness, Hope for Wildlife, Call Me Fitz, The Ha!ifax Comedy Fest, and The Lizzie Borden Chronicles.

Film producers spend money in Nova Scotia on a wide variety of things: equipment rental, location expenses, food, accommodations, salaries, etc. Salary expenditures can be claimed by the production company as a tax credit. A portion of these salary expenditures [the base rate is 50 per cent; an additional 10 per cent is available to productions filming outside the metro Halifax region; five per cent is available to companies that have made three or more films over a two year time frame] are then rebated to the production companies.

Since the program’s establishment in 1995, 100 per cent of salary expenditures have been eligible under this tax credit program. When Whalen’s budget is passed by the Legislature (and with a majority government the legislation cannot be defeated) the allowable portion will drop to 25 per cent — a very sizeable reduction. In 2014 the government reported that salary expenditures totaled $39.4 million and $23.5 million was returned to the production companies through this tax credit program.

Note: the government argues that only a portion ($66.8 million) of this industry is related to the stimulus that the tax credit provides. It is doubtless true that some of the activity in the sector is generated by news, sports, and current affairs programming done in-house by broadcasters like CBC and Eastlink. However the government bean counters suggest that the value of the funding from the Canadian Media Fund (a federal investment program in film, television, experimental, and digital media) also lies outside this envelop. However, if the provincial investment climate is such as to drive productions outside Nova Scotia, then these federal funds will also depart the province.

Of the $39.4 million in salaries, a significant portion is remitted back to the government through income and sales tax (and through other consumption taxes such as those on alcohol, tobacco, fuel, etc.). In 2014 the government calculates that this was $5.95 million (15.1 per cent).

Additional funds also flow back to the government from HST on the other goods and services ($27.4 million) spent in production. At the 10 per cent provincial portion of the HST this would be $2.74 million (a further $1.37 million also goes to the federal government). Additional funds are also returned to the government through income tax from the individuals employed by businesses that provide these goods and services. The government bean counters don’t provide this information, but if we use the same ratio of 15.1 per cent that is returned through income tax on salaries (see above), then something on the order of $1.94 million flows back to government coffers through this channel: thus a total of $4.68 million ($2.74 + $1.94 million).

It’s also the case that many productions filmed in Nova Scotia are produced or co-produced by Nova Scotia film companies, who in turn also pay income tax (and purchase goods and services on which HST is charged): how much is unclear. Even setting these aside, the tax returned to the provincial government is $5.95 + $4.68 = $10.63 million. This is slightly less than a half of the $23.5 million cost of the program to the government, i.e., leaving a net cost of approximately $12.87 million that the province of Nova Scotia would have invested in the film industry in 2014.

So, the province invests $12.87 million in an industry valued at $122 million — around 10.5 per cent of the value of the industry. To put this $12.87 million in perspective, Nova Scotia’s provincial budget is almost $10 billion; thus this represents approximately 0.1 per cent of provincial expenditures. This then anchors an industry that directly employs between 1,500 and 2,000 people (depending on the year and level of production activity). These are well paying jobs that employ highly educated young people, many graduates from institutions like the Nova Scotia College of Art and Design University (NSCAD), community college film programs, etc. And every film and television production made serves to advertise Nova Scotia to the world.

This tax credit approach is standard across North American jurisdictions (indeed, in Canada, in Québec and Manitoba it is even more generous). So, if the government cuts the tax credit program by 75 per cent (as the Liberals propose), Nova Scotia becomes quite uncompetitive as a place to produce films.

The film industry is highly mobile and can rapidly shift locations for productions to other provinces in Canada or to the United States. Thus, much of what has been Nova Scotia-based production activity can evaporate overnight, and with it the 1,500-plus jobs, and the $10.63 million in tax revenues that go to the government, and the $27.4 million spent on other goods and services in Nova Scotia.

Now, governments, at all levels, and of all political stripes, invest money in the economy in various ways, through various mechanisms, and with various degrees of legitimacy. For example, Canada’s subsidies to the fossil fuel industry in 2013 were pegged at $34 billion (yes, that’s “billion” with a “B”) by the International Monetary Fund. In Nova Scotia, the previous Dexter government contributed $304 million ($260 million as a forgivable loan — in the words of Frank Magazine, “Forgivable, meaning, you know, it’s on us.”) to Irving Shipbuilding as part of the federal National Shipbuilding Procurement Strategy. The Irving family conglomerate, it should be noted, is, at $8.07 billion, the second wealthiest enterprise in the country, hardly in need of corporate welfare — but I digress.

A useful comparison to FITC is the $13 million subsidy (just slightly more than the government invests in the film industry) that the Nova Scotia Liberal government has just announced it will contribute to STM Quest this year for the Yarmouth Ferry. This is on top of a $28.5 million contribution that the Liberal government made last year that was supposed to have lasted for seven years, but was consumed during the first season of the ferry’s operation. This operation creates 20 jobs based in Nova Scotia.

Now, there’s no question that the government’s investment in the Yarmouth Ferry is important, since beyond the tiny number of direct jobs that this generates, the ferry service conveys (2014 data) 59,000 passengers that the government estimates spent $13 million in Nova Scotia, thus helping to support the tourist industry, particularly in the southwest of the province.

Compare this, however, to the 1,500 that are directly employed in the film industry in the province and the $122 million value that this industry represents. The purpose of the comparison is not to pit one industry against the other, but to highlight that both investments are essential for different reasons.

One supports a tourist industry in a financially vulnerable portion of the province; the other supports an industry that employs a large number of highly skilled, talented, and creative individuals that make a contribution to showcasing Nova Scotia to the world. The products of the film industry — when they are screened across the country, continent, and world — buy more ‘advertising’ for the tourism industry in the province than the government could ever afford. Given the nearly identical level of government investment in both, it would be foolish to single out the film industry for such drastic, life-threatening financial surgery.

The political character of this decision is demonstrated by the comments made by Diana Whalen when she was an opposition MLA in 2012. On April 30 she stood in the Nova Scotia Legislature to criticize the then Minister of Finance, Maureen MacDonald, for processing tax credit applications too slowly!

“Mr. Speaker, what we’re talking about today around the Film Tax Credit really amounts to red tape, to slow processes, to an inability to respond to business. The film industry in our province is worth millions of dollars and the producers of these films are putting hundreds of thousands, and sometime millions, of dollars on the table to do productions in our province, and if we can’t process those applications in a timely fashion people will go elsewhere.

“This isn’t a new tax credit. This is a tax credit we’ve had in place for almost 20 years — we were the first province in the country to have it and it has been a good thing. I don’t know what has gone wrong at the Department of Finance, but I’d like to ask the minister, will she consider the letter I tabled today and respond without delay, and immediately get to work to eliminate these unnecessary delays that are frustrating a very important industry?”

Three years later her position is precisely the opposite of what it was in 2012.

In a broader context, what this illustrates is how frequently the creative economy has been, and continues to be, on the bleeding edge of government cutbacks and repression in Nova Scotia. In 2002, the Progressive Conservative government of John Hamm abruptly liquidated the Nova Scotia Arts Council, the only time an independent arms-length arts council had been destroyed anywhere in North America (and perhaps the world?). To his considerable credit, Darrell Dexter (as Leader of the Opposition) promised that if elected he would reestablish an arts council in the province — which the NDP did in 2011 with the creation of Arts Nova Scotia.

Driving a stake through the Nova Scotia film industry’s heart, Stephen McNeil’s Liberals appear poised to replicate the folly of the John Hamm Conservatives, cutting off their creative bluenose to spite their face.

[Note: the calculations in this story have been slightly revised since the provincial portion of the HST is now 10 per cent and not 8 per cent (the previously level which was used in the original calculations). This means that the HST tax back to the government in 2014 would have been approximately $540,000 more than originally reported. Therefore the proportion of the FITC in film financing is 12.87 per cent rather than 13.41, further strengthening the film industry’s case. Apologies for the error.]

[Part II of this series on the Nova Scotia film industry and the austerity agenda of the Nova Scotia government is, Straight through the heart: Liberals take aim at Nova Scotia’s economy.]

Christopher Majka is an ecologist, environmentalist, policy analyst, and writer. He is the director of Natural History Resources and Democracy: Vox Populi.