The living wage calculation is based on the needs of two-parent families with young children, but the idea behind it is that this wage would also support different types of families throughout the life cycle so that young adults are not discouraged from having children and older workers have some extra income as they age. In most communities, the living wage is enough for a single parent with one young child to get by as well because a single-parent family would qualify for a number of government tax credits, benefits and subsidies that supplemented their earned income. Up until the 2012 living wage update, this was the case in Metro Vancouver as well.

Importantly, however, the living wage since 2012 is no longer sufficient for a single parent with one child in Metro Vancouver. This is because too many programs intended for low-income families have income thresholds that are much too low and the subsidy amounts provided have remained frozen for a number of years while costs of living have climbed. Indeed, government policies and programs have a direct impact on the standard of living of lower- and modest-income families, and as a result, on the living wage calculation.

A single-parent family earning the Metro Vancouver living wage of $20.68 or $37,636.60 per year would still receive the maximum GST credit and B.C. low-income carbon tax credit, and be eligible for a partial national child benefit supplement under the CCTB, but their family income is considered too high for MSP premium assistance or the maximum child-care subsidy. As a result, the government supports received by this single-parent family would leave the family’s total income about $3,600 short of meeting basic expenses.

The B.C. child care subsidy, for example, has been capped at a maximum of $550/month for a four-year-old since 2005, while median group child-care fees in Vancouver have increased by 50 per cent, from $604/ month in 2005 to $905/month in 2014 (according to the Westcoast Child Care Resource Centre’s fee surveys). So while the subsidy covered almost the entire child-care fee in 2005, it covers only 61 per cent of the costs of child care today, leaving a Vancouver single parent with a bill of $355/ month out of pocket over and above the maximum subsidy amount, or $4,260 per year.

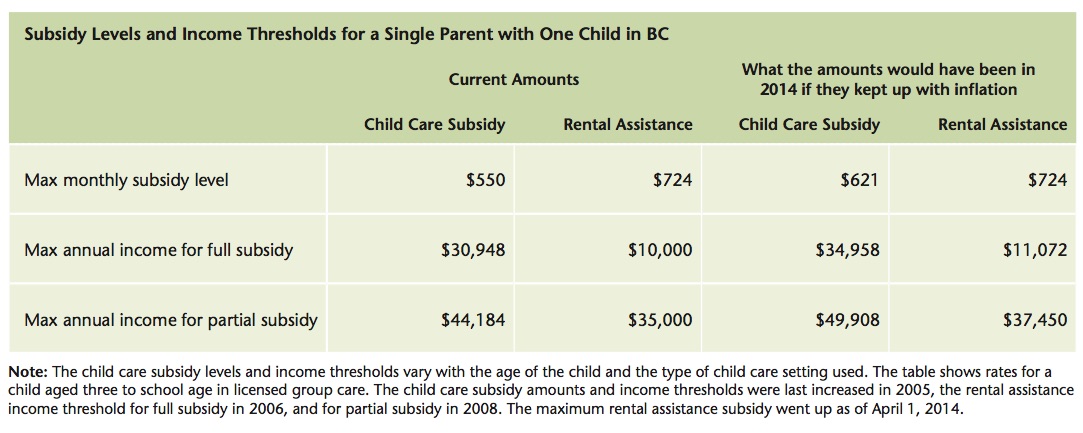

And while clawback thresholds for family supports provided through the tax system (e.g. the Canada Child tax benefit or the GST credit) are annually adjusted for inflation, thresholds for provincial subsidy programs like rental assistance and the child-care subsidy have remained frozen for a number of years, making them less accessible to families in need. The table below shows what subsidy amounts and income thresholds for the B.C. child-care subsidy and rental assistance program would have been in 2014 had they kept up with inflation (the subsidy levels would be even higher if they kept up with the increase in median rent and child-care fees, which have been much higher than inflation).

Partly because of frozen thresholds, a Metro Vancouver single-parent family earning the $20.68 living wage is no longer eligible for rental assistance or MSP premium assistance (so faces the full $1,566 MSP premium per year), and is starting to see the already inadequate child-care subsidy amount clawed back (the family would be eligible for a subsidy of $506.44/month). Single parents in Metro Vancouver are now caught in the paradoxical situation of being considered too well-off for many government transfers while being unable to cover their basic family expenses, which are growing faster than inflation every year.

But it does not have to be this way. In fact, the problem is very straightforward to fix. All that is needed is regular adjustment of provincial subsidies to ensure that the amounts provided are keeping up with the costs of the expenses they are meant to defray (such as child-care fees or rent), and that they are not clawed back at income levels that leave many families struggling with a bare-bones budget.

Had the child-care subsidy and rental assistance program kept up with inflation, the Metro Vancouver single-parent family would only be about $750 short of meeting all its expenses and not $3,600 short (that’s with the full $621 child-care subsidy and rental assistance of $123 per month due to steep clawbacks of the rental assistance program). Qualifying for the minimum level of MSP premium assistance and a slightly more generous rental assistance subsidy of $150/month is all it would take to make the $20.68 living wage work for a single-parent family.

After years of being frozen, B.C.’s low-income subsidies are in urgent need of an increase.

Photo: Davide Cassanello/flickr