Like our economic coverage? rabble is reader-supported journalism. Chip in to keep stories like these coming.

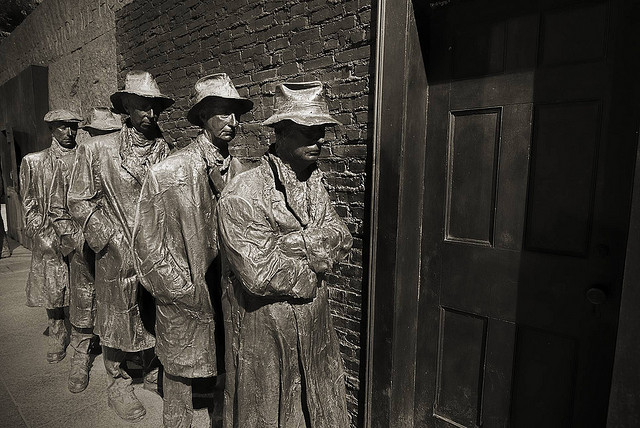

Since the October 2008 federal election, Canadian politicians have been struggling to come to terms with what, to all accounts, has turned out to be a “lite” version of the 1930s, whose major difference is that today we have a much larger government sector that is now about one-fourth rather than one-tenth of gross domestic product, thereby offering somewhat of a makeweight (despite the adoption of fiscal austerity over the last five years). Also, we have today an indomitable Canadian consumer who continues to spend somewhat because of the easy credit that the banking sector creates in additional purchasing power to supplement an otherwise stationary, if not declining, real personal disposable income, as long as households are able to service their debts at such record low levels of interest rates set by the Bank of Canada.

However, much like the 1929 crash, we experienced a worldwide financial crisis centered in the U.S. in 2008. As it is well known, the financial crisis triggered a collapse of economic activity, which after a short fiscal stimulus immediately after the financial crisis in 2009, governments are now back to being obsessively concerned about government deficits. Given their fears of being financially in the red for a significant length of time, fiscal policy inaction has become the norm nowadays just as it was during the 1930s. Indeed, during that era, those Herbert Hoover/R.B. Bennett policies of austerity, implemented in the name of strengthening investors’ confidence, did little of that, since investment spending remained abysmal. By initially putting a lid on public spending, what these policies did was to help to keep economies in a state of long-term stagnation during the Great Depression despite some short-lived socially desirable New Deal measures put in place until Western governments justified, on a more massive scale, net public spending by implementing a less socially desirable, yet equally efficient, brand of what has been sometimes described as “military Keynesianism” during the Second World War. Some seven years after the financial crisis in 2008, we seem to have a repetition of what, in appearance, looks more and more like the 1930s scenario that even the former secretary to the U.S. Treasury and former director of the U.S. National Economic Council, Lawrence Summers, has decried as a trend towards a state of secular stagnation.

There are three important lessons from the Great Depression to which our political leaders seem to be oblivious because of what seems to be a collective amnesia. First of all, to kick start an economy stuck in a state of secular stagnation (that is, a situation in which private businesses are unwilling to undertake significant spending), it is up to the state to do so. During the first two decades of the postwar period, governments espoused some hybrid form of the basic principle of “functional finance,” which simply affirmed that budget deficits (or surpluses) should not be consider as ends in themselves but rather as means or instruments to achieve socially desirable macroeconomic goals, such as low rates of unemployment and high rates of economic growth. Hence, unless one lives in a country without its own currency (such as Greece) or in a dollarized regime (such as Ecuador), the federal government should abandon the principle of seeking to achieve budget balances or a budgetary surplus for all seasons.

But why is deficit spending not a problem? This brings us to a second lesson. In an advanced monetary economy as ours, at the macroeconomic level there must be at least one sector of the economy that spends more than it receives. If economic agents in an economy spend only what they receive as incomes, then at best such an economy will remain stuck in a stationary state, without growth. In reality, we know that certain groups, who save, may actually want to spend less than their total revenues or incomes, and hence there must be some other sector that must spend more than it receives to sustain spending growth in an economy. How can one envisage growth in an economy in which both the private sector and the public sector refuse to spend more than their receipts, thereby refusing to run deficits? Where will the net spending come from? That was the waiting game and scenario of the 1930s during which period the economy only began to grow significantly once large doses of net government spending were undertaken at the end of the 1930s because of the Second World War.

As a corollary, there is a third simple lesson. Let us imagine the economy as being regrouped into two very large sectors, namely the private sector (households and firms representing, say, three-fourths of the economy) and the public sector (all levels of governments representing the remaining one-fourth), while abstracting for now the net spending behaviour of foreigners. In this economy, if, say, the consolidated public sector spends more than it receives (that is, a situation in which the government sector runs a deficit), then the private sector will find itself receiving more than it is spending, that is to say, that it will be building up savings that would permit private agents to deleverage if they are in debt. Needless to say, if we also add foreigners who are willing to buy more of our wares than we buy of theirs, then the positive net exports would further compound this deleveraging of the private sector domestically. If, on the other hand, the government sector begins to run surpluses, this would be destroying private saving and increasing household debt.

As former prime minister Paul Martin has said very clearly in his support of the Liberals’ program during this election campaign, the reason why he was able to achieve federal budgetary surpluses for over a decade since the mid-1990s was because households had been running up huge debts as interest rates were falling and the U.S. economy was running on six cylinders by generating record levels of positive net Canadian exports, especially during the Clinton years of the late 1990s. Nowadays, none of these elements are in place. Households are overextended, interest rates cannot go any lower and our neighbours to the south have also been suffering anemic long-term growth. These are not unlike the conditions prevailing during the 1930s, when the private sector faced an increasing debt burden, interest rates had reached bottom, and countries internationally had been seeking to “beggar thy neighbours,” as all these countries were seeking to achieve trade surpluses, which of course is logically impossible for the planet as a whole, and all that it did was to spread deflationary pressures internationally!

Indeed, a policy of seeking to run budget surpluses until 2020 as targeted by both by Stephen Harper’s Conservatives (of about $4.7 billion annually) and Tom Mulcair’s NDP (at around $3.5 billion annually, pulled from the NDP Fiscal Framework), will do nothing but to destabilize further the private sector by preventing Canadian households from deleveraging via increased savings through higher overall income growth. Why would the federal government want to prevent private households from deleveraging? There is something particularly pernicious about such a proposed fiscal policy of striving to achieve budgetary surpluses largely on the backs of the household sector. There is nothing “sound” about a policy whose actual effect will be to de-stabilize the finances of the private sector. Interestingly, Justin Trudeau’s Liberals have at least understood the need to stimulate the economy in the current context and they should be applauded for recognizing this. Yet, even they have not fully abandoned the principle of “sound finance” in favour of the principle of “functional finance,” since presumably the latter are themselves committed to balancing the books by 2019 after which they will have also reached the Nirvana of budget surpluses as they had achieved during the Chrétien and Martin years!

Why has our current crop of Canadian political leaders gotten themselves trapped in this rhetorical box of “sound finance” that will merely guarantee that our economy will remain stuck in a state of secular stagnation? Must we wait for some outside shock to end fiscal austerity as had happened at the end of the 1930s? In defence of his 2009 fiscal stimulus, in 2008 Prime Minister Harper himself affirmed that one of the causes of the Great Depression was that policymakers “undertook to balance the books at all costs — raising taxes and contracting government economic activity at a time when fiscal stimulus was absolutely essential.” Why is it that a fiscal stimulus was appropriate in 2009, but that it is inappropriate today and that we must now target fiscal surpluses during this recession?

This is a guest blog post from Mario Seccareccia, Professor of Economics, University of Ottawa.

Photo: Brian Talbot/flickr

Like our economic coverage? rabble is reader-supported journalism. Chip in to keep stories like these coming.