Many long-held tenets of neoclassical orthodoxy have fallen by the wayside in the past three years, but perhaps one of the biggest dominoes that is at least teetering precariously (if not fully tipped over) is the consensus that inflation targeting should be the exclusive focus of monetary policy.

The policy was closely associated with the so-called “New Consensus in Macroeconomics” — the premature and presumptuous claim that rational-expectations-augmented analysis had produced the “end of history” in macroeconomics (analogous to Francis Fukuyama’s preposterous claim about global politics). The idea was that by anchoring inflation expectations at the target, the central bank minimizes the extent to which monetary conditions interfere with the normal efficient operations of the real economy, thus promoting in the long-run stronger real behaviour (including inter-temporal behaviour, like savings and investment), which might be affected by fluctuating or inaccurate expectations of future prices.

Since Lehman Brothers, however, it is increasingly clear that the policy fails along several dimensions:

– The model assumes that the real economy settles autonomously at some kind of full-employment equilibrium (positioned at the NAIRU), and that monetary conditions can have no long-run impact on that equilibrium position.

– The model assumes that inflation adjusts predictably in response to a gap between real and potential output (thus allowing the central bank to steer inflation back to the target, simultaneous with steering the real economy back to “full” employment).

– The model assumes that uncertainty over future price levels is a major or dominant inhibitor to efficient decision-making by consumers and businesses, and that minimizing that uncertainty will produce significant real economic benefits.

All of these assumptions are clearly rejected by recent real-world experience, and a surprising number of mainstream economists (perhaps the most notable being Olivier Blanchard of the IMF) have been publicly questioning the conventional wisdom that low, stable inflation is optimal, and attaining it should be the focus of monetary policy.

This is the year in which the government of Canada and the Bank of Canada were set to renew their rolling 5-year agreements on the inflation target, and hence there was cause to review the theory and practice of inflation targeting. Recent comments by the Bank of Canada’s own leadership (regarding the need for flexibility in targeting, and the need to explicitly include financial stability as a factor in the Bank’s purview) suggested that even they might be losing (or at least softening) their religion somewhat. [These comments were almost as surprising as Governor Mark Carney’s endorsement of the Occupy protests as “entirely constructive”!] However, most in the mainstream economics and financial community in Canada continue to strongly support the targeting regime.

Pressed by the NDP official opposition, the Finance Committee of the House of Commons grudgingly (given the Conservative majority on the committee) agreed to hold a single token hearing on the topic of renewing the target — surely one of the most critical economic policy issues going. The hearing was held this past Tuesday, November 15. However, it was pre-empted by the Conservative government’s decision, announced 4 days before (on November 11), that the target would be renewed at 2 per cent (within a range + or – 1 point) for another five years. This made the Committee’s hearing moot, but any opening to raise questions about this most sacred of orthodox macroeconomic beliefs is worth walking through.

I was one of 5 economists invited to participate in the hearing. Interestingly, another Progressive Economist (Mario Seccareccia from the University of Ottawa) was also on the panel, meaning the PEF accounted for 40 per cent of all the presentations! (This probably was also testimony to the NDP’s new muscle in Parliament.)

My presentation to the Committee is here. An audio transcript of the whole hearing is available here. The other speakers were Chris Ragan (McGill), Craig Alexander (TD), and Scott Sumner (from Bentley University in the U.S.). Mario and I argued for broadening the Bank’s mandate to include employment promotion as its top priority. Chris and Craig argued for the status quo.

Scott made an interesting but unconvincing argument that the Bank should target growth in nominal GDP instead of inflation, in order to give it more flexibility during contractions. If inflation targeting unduly restricts monetary policy during a contraction (as Sumner argued), we should just abandon it, because targeting nominal GDP could cause all kinds of problems. For example, think back to 2006 and 2007, when Canada’s nominal GDP was growing as fast as 6 per cent per year (due to the commodities price boom). Nominal GDP targeting would have dictated powerfully contractionary policy … just in time for Canada to enter the recession. While nominal GDP targeting is often portrayed as a “kinder, gentler” version of inflation targeting (since it allows the central bank to consider real conditions directly in its target, rather than indirectly in its Taylor Rule reaction-function), in practice it would not make any difference.

Even worse are some of the more extreme Walrasian fantasies still thrown about (including to some extent by Prof. Ragan at this hearing), such as targeting zero inflation, or targeting a certain price level (which would require the central bank to actually engineer a deflation, to offset any unintended inflation which occurred). These dangerous views are all the natural culmination of a pure faith in the automatic real equilibrium, in which case any inflation is bad because it undermines the value of money and disrupts inter-temporal decision-making, and hence should be prevented or even reversed.

My presentation emphasized the high costs of attaining and maintaining near-zero inflation (including the zero lower bound such a target imposes on monetary policy, and the effect of prioritizing inflation-control over job-creation on income inequality), as well as discounting the hard-to-detect benefits of targeting in the real economy.

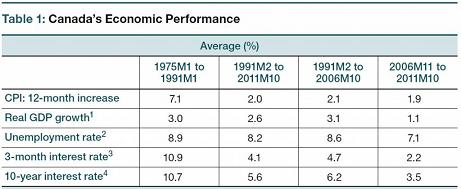

In that latter regard, it is both interesting and puzzling to review the evidence marshalled in the Bank of Canada’s own background paper, produced earlier this month in support of the renewal of the inflation target. (Andrew Jackson and several commentators also helpfully addressed this issue in an earlier blog.) Here is Table 1 from the Bank’s report:

It compares two periods of time: pre-targeting (1975 to 1991) and post-targeting (1991 to 2011). The Bank’s report interprets this table as evidence for its claims about the real benefits of targeting — but in fact the table shows no such thing. Note that the pre-targeting period begins arbitrarily at the height of 1970s stagflation (in 1975); if a longer pre-targeting period had been chosen (going back to the 1960s or even earlier), then the comparison would be even less favourable to the targeting regime.

But even as it stands, Table 1 indicates that real GDP growth under targeting has been slower than in the previous period, real long-run interest rates (equal to 10-year rates minus the inflation rate) were exactly the same, and the average unemployment rate barely changed (despite massive reductions in unemployment insurance and, later in the period, a global boom in demand for Canadian resources). The table does not report productivity growth, the rate of capital formation, or real compensation: all those measures have worsened, not improved, under inflation targeting, casting more doubt on the view that predictable prices are very important in allowing real agents to make efficient and productive decisions.

Defenders of targeting will argue that the post-targeting numbers have been dragged down by the current recession. But the pre-targeting averages were dragged down by two recessions (1981-82 and 1990-91). In short, the real economic benefits from inflation targeting (like so many other tenets of neoliberal economic policy) are invisible to the naked eye, quite contrary to the self-congratulatory text of the Bank’s report.

For those interested in deepening our heterodox critiques of inflation targeting, Chapter 17 of Economics for Everyone contains an accessible review and critique of the New Consensus thinking, exploring the commonalities and differences between it and traditional monetarism, and predicting that the apparent triumph of inflation targeting was not nearly as complete as was claimed at the time (2008). I benefited greatly in writing that chapter from reading the work of Philip Arestis and Malcolm Sawyer, such as this useful paper for the Levy Institute.

Jim Stanford is an economist with CAW. This article was first posted on The Progressive Economics Forum.