Giant banks are the most powerful institutions in in the world — in many ways as powerful economically and politically as the biggest governments. Unfortunately, the banks frequently use their power in ways that damage the economy and hurt folks living around the world.

Two prominent research projects carried out in recent years paint a picture of a ruthless banking and financial sector powerful enough to dictate the nature of key parts of the world’s economy and challenge the strongest politicians.

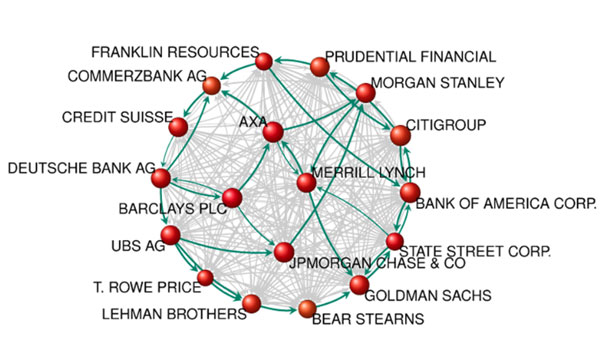

Research carried out by three Swiss economists reveals the links and structure the giant financial institutions dominate and use to their advantage.

The researchers looked at 30 million “economic actors” around the globe. Their remarkable research found that a group of 147 transnational corporations (TNCs) controlled nearly 40 per cent of the economic value of all TNCs in the world. More shockingly, financial institutions make up 75 per cent of the organizations at the core of this powerful group: what the researchers call, a “super entity.”

Barclays Bank of the UK had the most connections of any organizations. JP Morgan Chase of the United States and UBS of Switzerland, were both in the top 10. (See graphic below.) The Swiss did their research in 2011, relying on a corporate database compiled in 2007, before the recession. If anything, banks have increased their power during the intervening years.

U.S. economist and political activist David Korten, a former professor at Harvard Business School and the author of When Corporations Rule the World has spent much of his life criticizing how giant corporations use the privileged position the Swiss described.

Korten accuses wealthy bankers and financial traders of “colonizing ever more of the planet’s living spaces, destroying livelihoods, displacing people, rendering democratic institutions impotent and feeding on life in an insatiable quest for money and profits as a be- and end-all.”

Korten says that “only wealth and power matter” to the big bankers and the investors who surround them. “Whatever they want, they get, including the right to operate freely outside the law, manipulate markets, bilk investors, strip-mine nations and people for profit and get bailed out at public expense if they overreach.”

(It’s no surprise that Korten’s views on the corporate world and finance seldom, if ever, appear in the business press.)

Just five years ago, greedy banks blew up the West’s economy, some of them even destroying themselves. Many more teetered on the verge of collapse, without enough funds in reserve to cover their own debts. But the high-flying traders and investors profiting from the money machine didn’t want to see it stop spinning.

Facing ruin, the big banks and wealthy investors pressured and threatened nearly every Western country into giving them trillions of dollars of public money to fend off failure.

Now, while distressed governments and struggling individuals are still recovering, the bankers and wealthy elites are once again using every opportunity to further expand their power and influence around the globe.

Europe’s fire-sale of public assets

Leading up to the recession, the big European banks had loaned far too much money to already-indebted governments. The banks were desperate to grab the trillions they were owed so they could pay their own debts. Threatening a chokehold on national finances, they more or less seized forced the governments of Ireland, Greece, Portugal and later Cyprus, to adopt austerity programs that have devastated the lives of millions of people.

In addition, several European governments were forced to privatize valuable public assets to raise money to help pay the banks. Nick Buxton of the Transnational Institute says the agreements some governments reached with creditor banks demanded that key national assets and public services be sold off.

European banks and well-heeled businesses have been picking these assets up at bargain basement prices. As the economy improves, they stand to make a fortune from their resale. This amounts to theft from the people of heavily indebted countries.

Asked which countries are seeing a lot of privatization, Buxton says: “Perhaps the largest is Italy, where they’re projecting up to €570 billion coming from sales, largely of huge amounts of heritage and state national assets being sold off, but also energy, transport and any kind of national companies, like telecommunication companies, airlines, bus companies and so on.”

At the height of the crisis, the people of Greece got a taste of the power of their bank’s wealthiest shareholders. Greek Prime Minister George Papandreou called a citizens’ referendum to decide whether the country would accept or reject an austere bailout plan. This was a chance for Greeks to make a democratic decision concerning one their most important choices since the Second World War.

Euro leaders were furious, and the next day the stock market took a hit. There would be no democracy in the cradle of its invention: the referendum was cancelled.

The “super-rich” get special services

Meanwhile, the banks were helping the super-rich launder their newly acquired wealth and relocate it in traditional tax havens (although some governments are now catching on).

The super-rich who owned recently recovered old-Masters paintings stolen by the Nazis during the Second World War, will likely get their paintings back. When the European economy recovers, will Europe’s citizens get their “heritage” back from the rich?

The behaviour of Europe’s banks shows their anti-democratic influence, helping elite owners and other giant corporations extend their control over everyday citizens. Millions of ordinary people are being hurt, their democracies knee-capped.

Most Southern European countries are experiencing massive increases in the need for food aid. Mental health problems are on the increase. There is chronic unemployment, and a feeling of worthlessness among youth. Social safety nets will not be restored for years to come.

Canada’s Big Five wield unchecked power

Canada’s giant banks have a lot of influence with government. As I wrote in part one of this series, the Harper government secretly helped the top five Canadian banks maintain their powerful position by facilitating their rescue with an infusion of $114 billion during the last recession.

A six-person equity investment firm in Toronto, Hamilton Capital Partners, took a risk by bluntly criticizing our top banks as being too powerful. In a 2012 report, Hamilton said that “over the past several decades, our financial system has become increasingly organized to the benefit of the five giant banks.”

The biggest weakness of the current system, the firm asserted, is that the banks are effectively protected against foreign acquisition. That has meant that “wide swaths of the wealth management and investment banking sectors have also become protected, creating what is now effectively a closed market.” This has enabled the biggest banks to achieve domestic market dominance against smaller domestic competitors. They argue steps must be taken to increase competition.

Curiously, Finance Minister Jim Flaherty, normally a fan of free market competition, has done the opposite. He has named six banks — adding the National to the traditional Big Five of the Bank of Montreal, Scotiabank, CIBC, Royal and TD, accounting for more than 90 per cent of total banking assets in Canada — as “systematically important.” The government will attempt to make all six immune to collapse during a crisis. Doubtless, their untouchable status will attract even more business along the way — making them even more dominant.

U.S. banks are bigger than ever

Meanwhile, U.S. banks have grown by 37 per cent over the past five years. They and their affiliates have increased their influence over government and broken out of their traditional realm to establish themselves as major owners in several industrial and development sectors.

U.S. political activist Miles Mogulescu writes that the U.S. has a dominant, perpetuating oligarchy at about eight powerful banks “which dominates the political system to protect its own wealth and power to the detriment of the national interest and democratic governance.”

Simon Johnson and James Kwak write on the website Futurecasts Journal that “the Wall Street banks are a group that gains political power because of its economic power, and then uses that political power for its own benefit. Runaway profits and bonuses in the financial sector were transmuted into political power through campaign contributions and the attraction of the revolving door.”

You could also say that U.S. banks don’t show much respect for the hand that feeds them.

A study on risk-taking by banks that received funds from the Troubled Asset Relief Program (TARP) revealed that, instead of becoming more cautious after being pulled from the brink, they increased their overall risk exposure — ie: they gambled harder — by about ten per cent. Bailed-out banks were supposed to pass the public’s money through to businesses, to help restart the U.S. economy; the study found they were no more willing lenders than banks that didn’t receive support.

Bankers and regulators: often the same

The continual flow of top-level executives moving back and forth between the U.S. federal government and the banks reinforces the latter’s influence.

President Obama’s chief of staff, Jack Lew, the second most powerful man in Washington, used to work for the banking conglomerate Citigroup. His predecessor worked for JP Morgan Chase. And his predecessor had also worked for a giant investment bank. That’s Washington.

Under Obama, no less than under George W. Bush, bank lobbyists help write the laws purportedly controlling the financial sector. A Treasury Department official who allowed a bank to falsify its financial reports was allowed to retire instead of being charged.

Banks’ political donations to Capitol Hill through the depths of the recession delivered dozens of key politicians to their pockets. Blogs and news sites have revealed the details of these payments again and again.

At the same time the banks were sucking up trillions of dollars in taxpayer aid from the U.S. government, they also managed to get away with violating the “foundational principle ofseparation of banking from commerce,” by buying up dozens of companies and other assets.

“Goldman Sachs, JP Morgan and Morgan Stanley are no longer just banks,” writes a widely read blogger who goes by the name of George Washington. “They have effectively become oil companies, port and airport operators, commodities dealers and electric utilities as well. This is causing unforeseen problems for the industrial sector of the economy.

“For example,” said the blog, “Coca Cola has filed a complaint with the London Metal Exchange that Goldman Sachs was hoarding aluminum. JP Morgan was being probed by regulators for manipulating power prices in California, where the bank was marketing electricity from power plants it controlled.”

The six largest U.S. banks now control assets totaling more than 60 per cent of the country’s Gross Domestic Product.

Minting their own money — literally

One of the reasons private banks are so powerful, and able to dictate to governments, is because governments have handed them the powerful role of what appears to be the creation of much of our money. However, under the fractional banking system, every time they “create” new money through a loan, they also have to enter a debit on their books. How much new money they can “create” is restricted by their investment-to-reserve percentage. The new money created is the interest on the loan.

When governments borrow from for-profit banks, instead of issuing bonds or printing money through their own national banks as most once did, they can end up in serious debt. Governments too often borrow more than they can afford and, under some conditions, interest rates can be very high. When this happens, as we have seen in Europe, the banks can dictate repayment conditions to a whole nation.

Private banks have additional powers we never think about. When they make loans they also get to decide who gets the money. That means they also determine what is produced, where it is produced and who produces it. These choices are all made on the basis of what is most profitable to the bank, rather than what is beneficial to the community.

As long as the giant banks have the power to create their own money, and use it to influence or coerce governments, they may be impossible to control: their sole reason for being and their loyalty are to making even more money. My next report will show how practically every one has been involved in unprincipled and possibly criminal activities to make billions of dollars.

What makes them do it?

With all their privileges and million-dollar-plus salaries, why do these men — they’re almost all men — behave so badly and do so much damage to the rest of us?

“I think they simply see themselves as being at the very top of the food chain,” says Dr. Ulrich Thielemann, who has taught philosophy and business ethics at the University of St. Gallen, Switzerland. “They feel like they’re able to trick others.

“That is the thinking of a caste of people who have been trained at business schools,” Thielemann adds. “It’s an economic theory that views the most rational action as [being] what is to your own advantage. Its aim is to maximize its own income and will; and, if it comes to that, walk over dead bodies to achieve this.”

Nick Fillmore is a Toronto blogger and sometimes investigative journalist. He worked in several capacities at the CBC over 25 years, and was a founder of the Canadian Association of Journalists. Please email Nick Fillmore or visit his blog.

This article originally appeared on The Tyee and is reprinted with permission.

Photo: flickr/Joe Schueller