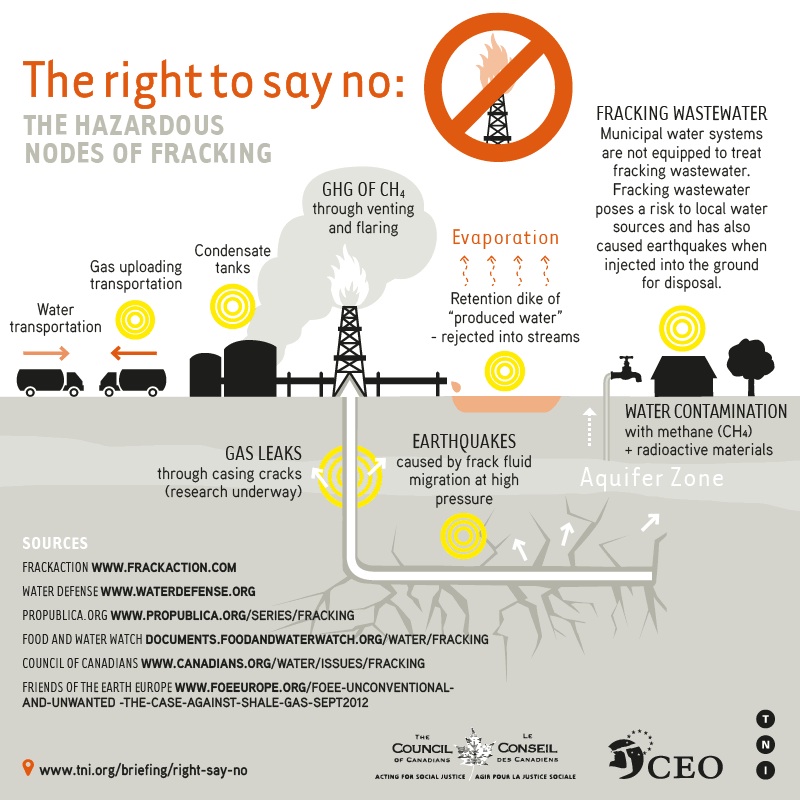

On Monday this week, the Council of Canadians co-launched a timely briefing note on investment treaties and fracking bans with the Brussels-based Corporate Europe Observatory and Amsterdam-based Transnational Institute. As we hoped, the report, The Right to Say No, is making an impact in Europe, where many countries are deciding to ban shale gas development because of the public health and environmental impacts.

Our report makes the case that these completely reasonable, precautionary decisions by governments are threatened by an investment protection chapter in the proposed Canada-EU Comprehensive Economic and Trade Agreement (CETA) that will let Canada-based fracking companies sue the EU or European member states for hundreds of millions of dollars in lost profits on dirty gas.

Investor-to-state disputes under CETA “could be triggered by changes to incentives or government policy, and environmentalists fear that bans on fracking by companies that claim to operate out of Canada might be caught in the net,” writes EurActiv.com, an online news source reporting in 15 languages. The news site quotes Pia Eberhardt, a co-author of our fracking report who works at CEO, explaining how this system corrupts the democratic process.

Fracking with democracy

“Allowing for such disputes under CETA would empower oil and gas companies to challenge European fracking bans and regulations through the back door,” she said. “The public would not only pay for the related environmental and health damages, but also run the risk of having to pay compensation to Big Energy when communities say no to fracking.”

As the EurActiv article (and our report) explains, this is no longer a “what if” situation. Last November, the pseudo-U.S. firm Lone Pine Resources announced its intention to sue Canada for $250 million under the investment protection chapter in NAFTA, claiming Quebec’s moratorium was “arbitrary, capricious and illegal.” The Lone Pine case is one of eight active NAFTA disputes against Canada with claims totaling about $5 billion.

I say Lone Pine is only pseudo-American because for all intents and purposes it is a Calgary firm but holds onto a corporate registration in Delaware that it must feel gives it access to NAFTA’s investor-to-state dispute process. (Under NAFTA, only U.S. or Mexican firms can challenge Canadian policy outside the courts and in front of largely unaccountable, paid arbitration panels.)

Our report, which urges Canada and the EU to stop negotiating these kinds of investment protections in CETA, suggests the same dynamic would come into play across the Atlantic, with U.S. firms using Canadian subsidiaries to access the investor-to-state dispute process in the Canadian agreement.

This fear is backed up in the EurActiv article by Nathalie Bernasconi-Osterwalder, a senior international lawyer for the International Institute for Sustainable Development, commenting on a February 7 leaked version of the Canada-EU investment protection chapter.

“You can’t just set up a mailbox in Canada and say you’re a Canadian company,” she said. “You need some presence there. But you could still be a US company that has invested in Canada and then invests in the EU.”

CETA announcement at G8 summit?

The Globe and Mail reports that the Conservatives want to wrap up a deal with the EU before the House of Commons sits for the summer. That’s June 21. There are rumours that Prime Minister Harper would announce the conclusion of negotiations at the June 17-18 G8 Summit in Northern Ireland. That would presumably start the long (up to eight months) translation process (into all EU languages) before CETA could be signed.

Take action: We should make a lot of noise in between those dates, to see the text and demand opportunities to change the parts of the EU deal we don’t like, since it’s impossible to make any changes to trade and investment deals once they are signed. You can start now by asking Harper to Walk Away From CETA. Feel free to steel the square image on that page to share on Facebook, Twitter or make it your profile pic. Now is a good time to use the action since Trade Minister Ed Fast and Foreign Affairs Minister John Baird will celebrate Europe Day in Ottawa tomorrow.

But there is no guarantee that Canadian and European negotiators will meet this new start-of-summer deadline. The trouble zones are not only, as the Globe reports, things like beef and dairy market access for Canadian and European producers. There is still no consensus that we know of on investment protection. We hope our new report on how fracking moratoriums and environmental regulations are threatened by investor-to-state dispute settlement can raise the volume on this debate, and add to global calls to get rid of these excessive investment protections in trade and investment deals.

To read our report, The Right to Say No, online, click here. To get a PDF copy, click here (French version here). Please share it with your local councillors, provincial politicians and Member of Parliament and urge them not to create unnecessary risk to environmental policies and fracking bans in the Canada-EU trade deal. There is a sample letter on our Facebook page here.