Change the conversation, support rabble.ca today.

The painful toll that job loss and unemployment can unleash on Canadian families has traditionally been managed with Canada’s once quite functional Employment Insurance (EI) program. However, Statistics Canada’s EI report for October, confirms that government policy have produced new lows in Employment Insurance coverage of the unemployed.

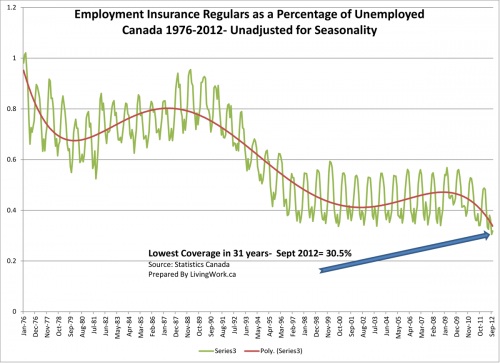

Last month’s report showed that September coverage fell to a new historical low of 30.5 per cent. Some speculated that it was an aberration, but the October report confirms that we have indeed entered an new era as the rate of EI coverage for the unemployed came in at a mere 31.8 per cent, the second lowest in more than 30 years (seasonally unadjusted). The trend is clear in the data (see graph) as we are witnessing the destruction of a once effective social safety net. There are strong seasonal factors in EI claims, but the trend line in the chart below clearly shows we are sinking to new lows in coverage for this program.

The official Statistics Canada numbers estimated that October’s EI regular beneficiaries increased by 4,600 to 535,000 or 0.9 per cent from September. Given the stubbornly high unemployment counts of over 1.3 million people following the recession, this produces an EI coverage rate for the unemployed for both September and October of 30.5 per cent and 31.8 per cent. These are the two the two lowest rates recorded for at least 30 years.

Policymakers have been hacking and slashing away at worker income protection afforded by EI program for the last 10 years and the result is a new high in dysfunction. It is getting so bad, that potentially another name change is needed. The EI program in policy circles is known as a labour market adjustment mechanism, as it was originally designed to help those in the nasty jaws of unemployment successfully transition and find new work. However, it is difficult to call such a program an insurance system if a mere 30.5 per cent of the unemployed are collecting Employment Insurance benefits. It is mean-spirited and whole lot more difficult for a family and to make such life changes with no help from government. Unemployment is indeed one of life’s more hectic and complicated changes with unquantifiable social costs. In terms of economic efficiency and the demands of a modern economy, one requires a functional EI program to help people with job searches, and skills matching. We have one of most educated workforces in the world, and when there are skills and job demands that require matching; time for successful job searches can become more complicated and time focused.

We also have a large population of the workforce employed in more seasonally affected work which automatically includes employment breaks and the possibility of transition periods due to the ups and downs of the economy. This is especially more critical as we become a more resource extraction based economy that has high concentrations of seasonal industries.

So as we pass into the holiday season, Harper’s cuts to EI will continue to heap more pain on Canadian workers as what was once a quite useful and efficient program becomes a shell of itself. And imagine this during what some have labeled the “great recession.” Policymakers keep waiting for the great lift off, out of this stagnation, but with labour market dysfunction like this, it is little wonder why we cannot reach critical velocity.

This is a guest post by Paul Tulloch on the deterioration of Employment Insurance coverage, also responding to Statscan’s release of EI figures for October 2012.