This year’s budget ended as it began — difficult to define and understand. It provided the Mayor and his allies with an opportunity to claim victory for their austerity agenda. It provided some important wins, which once again demonstrated the importance and impact of community organizing. In comparison to the process and proposals in the 2012 Budget, it provided a veneer of increased cooperation, compromise and shared understanding of what the City needs.

Passing with much less comment, was a profound shift in the way that the City’s capital expenditures are financed. In a period of historic low interest rates, with a yawning infrastructure deficit, the administration’s focus on reduced debt and financing capital out of operating expenditures is incomprehensible. To understand the folly of this perspective it is important to remember that the City, unlike the provinces or the federal government, cannot run an operating deficit and must balance its operating budget every year. Any debt that the City takes on is therefore for capital expenditures. And, these expenditures, by definition, have long useful lives that are rightly paid for over a number of years (a life guard at a city swimming pool is an operating expenditure while the pool itself is a capital expenditure).

Insisting that capital expenditures be paid for out of current revenues, and without taking on more debt, defy fundamental principles of both accounting and public finance. It is the equivalent of a family insisting that a mortgage is an irresponsible way to buy a home, and that the only home you can truly afford is one that you can pay for with cash.

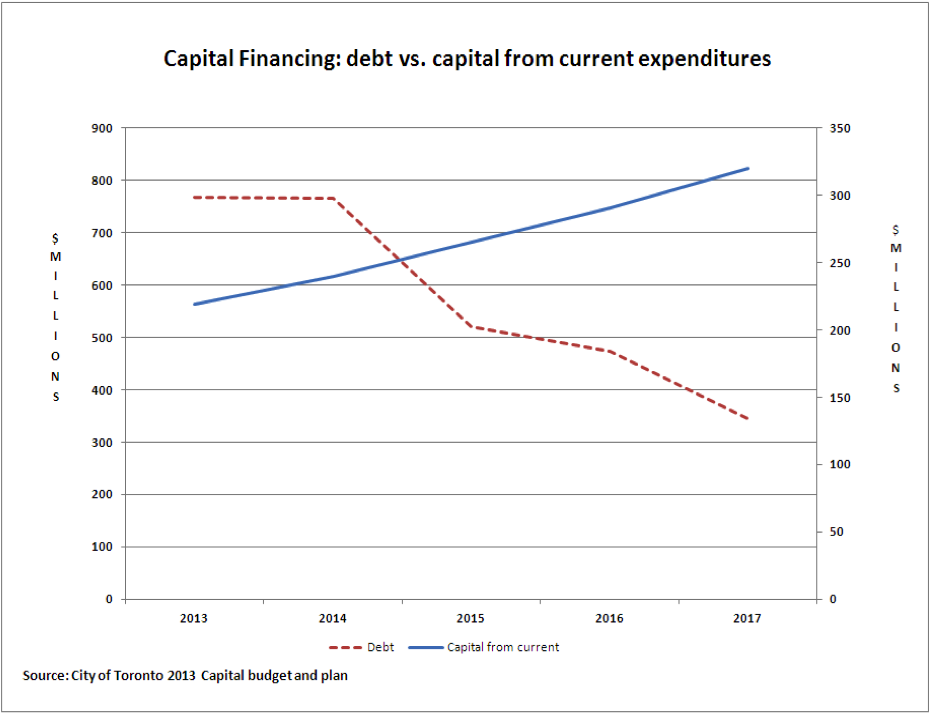

This approach does a disservice both to our city’s need for capital expenditures and operating spending. There are two ways in which the 2013 budget redirects spending away from services and toward capital. The first is the use of the entire 2012 surplus for capital expenditures, whereas over the last 5 years $50 to $350 million of the prior year’s surplus was used for operating spending. The capital budget and plan shows a move even further down this road of supporting capital expenditures at the expense of services. It shows a move away from debt financing and toward financing capital from the operating budget.

The programs that received enhanced funding in this budget will have important, positive health impacts. They include: increases to the grants that fund essential community services across this city, limited increases in access to recreation, and student nutrition programs, among others. We should, however, be clear about the scale of these successes – a $12 million increase in spending on a $9.4 billion budget is less than one half of one percentage point. This budget means that the services that our City relies on will continue to erode.

This erosion of real, per capita services will have a longer-term impact on our City, as will under investment in infrastructure. As we close the books on this budget, we can hope for a better result next year. Perhaps the report on the transparency of the budget process that we can expect from Councillor Mihevc’s motion will support a deeper discussion of capital financing and better outcomes.