The following is something I’ve prepared for the next issue of CUPE’s Economy at Work, a popular economics quarterly publication I produce.

In his annual Economic and Fiscal Update (EFU), finance minister Joe Oliver told Canadians that while the federal government will finally record a surplus next year after seven years of deficits, we can’t expect the economy to grow much faster than the slow growth we’ve experienced since the financial crisis, with economic growth expected to average just 2.4 per cent over the next four years.

Economic growth in this recovery is a third slower than in the recoveries of the ’80s and ’90s while job and wage growth has also been dismal. And despite all the spending cuts they’ve made, we also can’t expect the federal government to have much extra money because the additional tax cuts they’ve promised are eating up a lot of the surplus.

If we have a balanced budget and federal taxes have been cut to the lowest share of the economy in 70 years, why is our economy growing so slowly? It certainly isn’t because interest rates are low: instead they’re close to historic lows, so low they could fuel another asset boom and bust. It isn’t because businesses lack money to invest: they have a record $600 billion of excess cash they aren’t investing in the economy. It isn’t because we’re lacking labour: there are over 1.2 million officially unemployed with hundreds of thousands more underemployed.

So if everything is in place according to the Conservatives’ economic ideology — balanced budgets, low taxes, low interest rates, corporations flush with cash, excess labour, free trade, low wage growth — why does the economy suck?

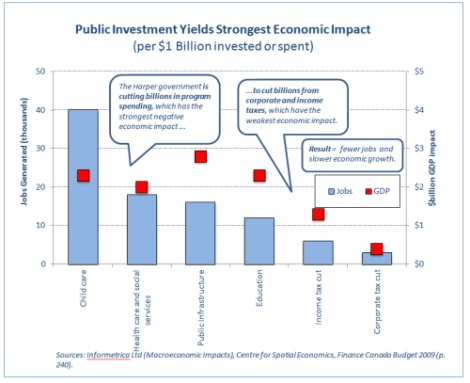

The answer is right under Joe Oliver’s nose, in his department’s publications and media releases — and is illustrated with the chart above.

In his Economic and Fiscal Update (and in many of his recent public announcements) Oliver boasts about how much the Harper government has cut federal government spending and how much they’ve cut taxes. The EFU emphasizes how they’ve balanced the budget by cutting program spending “Federal direct program spending has declined for four consecutive years, a trend that has not been achieved in decades” while also cutting taxes by billions, including through income-splitting. In fact the EFU illustrates (on page 63) that under the Harper government’s plans, federal program expenses as a share of GDP will fall to an historic low.

But the above chart (based on “economic multipliers” from Finance Canada and two highly respected private sector economic analysis firms) shows that public spending has a much stronger impact on the economy than tax cuts do. This means that cutting public spending while also cutting taxes will lead to slower economic growth, higher unemployment and lower wage growth.

For instance, if the federal government cuts $1 billion from health care and social services, it will lead to a loss of an estimated 18,000 direct and indirect jobs and a decline in the economy of $2 billion. Meanwhile an income tax cut of $1 billion will only generate an estimated 6,000 jobs and boost the economy by $1.3 billion. So if the government cuts spending by $1 billion while also cutting income taxes by $1 billion, it will lead to a net loss of -12,000 jobs and a net decline in the economy of -$0.7 billion.

Investments in child care have the strongest impact in terms of jobs and one of the strongest in terms of economic growth while corporate tax cuts have the weakest impact. When the economy is suffering from deficient demand, as it is now, these differences are magnified even more than the multipliers above show.

Our economy doesn’t suck because we suck. Canadians are skilled, hardworking, conscientious and productive (and, yes, polite too). Our economy sucks because our federal government’s economic policies suck — and it just might be time to do something about it.