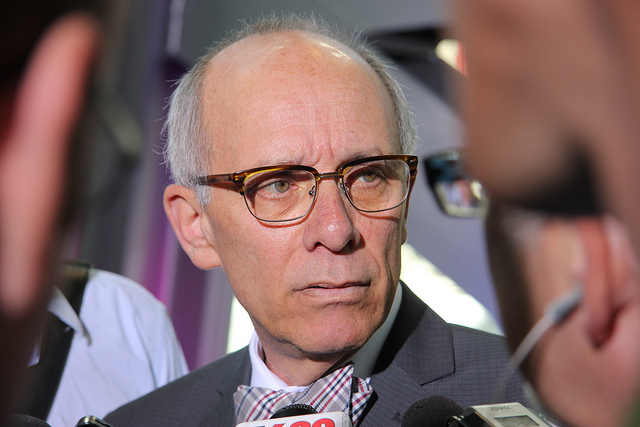

Why does Stephen Mandel, the newly minted Minister of Health, think it’s a good idea for Alberta taxpayers to support the lifestyles of wealthy Australian businessmen who earn more than $13 million a year; their executive teams who get ridiculous bonuses and stock options; and the Australian economy as a whole with corporate tax contributions?

This is the bizarre consequence of the Health Minister’s decision to award a $3 billion, 15-year lab services contract to a single service provider: Sonic Healthcare Limited.

Sonic who?

Sonic is a $6.7 billion company based in Sidney, Australia. It describes itself as “a leading participant in the pathology markets in Australia, the U.S.A., Germany, Belgium, Switzerland the U.K./Ireland and New Zealand, and in diagnostic imaging, medical centres and occupational health in Australia.”

Sonic refers to its non-Australian holdings as “offshore businesses” (which is appropriate given that Australia is the centre of Sonic’s universe but somewhat unsettling out here in the hinterland).

Sonic has a very simple business model. It provides lab services, administration services and facilities management services to medical practitioners. These services are paid for by patients, private health insurers or governments.

A serious risk to Sonic’s profitability is a government’s decision to reduce the cost of healthcare by implementing fee reductions or reducing the number of tests it will cover.

And therein lies the rub!

While the Alberta government is desperately trying to reduce the cost of healthcare (and its tax burden on Albertans) Sonic wants to increase the cost of healthcare with higher fees and more tests because these increase revenue which in turn increase profits.

And heaven help the offshore business that fails to deliver revenue as expected.

A Sonic “bust”

Sonic’s financial results took a hit in 2014 because its U.S. offshore business suffered an unexpected drop in revenue.

The U.S. failed to meet revenue expectations because of currency fluctuations, weak macro economic conditions, Medicare fee cuts in January 2013, April 2013 and January 2014 (how dare they!) and Superstorm Sandy which devastated the eastern U.S. in 2012 and depressed “volume growth” (Sonic’s term for more lab tests) because people had no heat, light, food or shelter (poor things were just trying to survive — how dare they!)

Not to worry, said Sonic’s CEO, I’m on it. He executed a $60 million “cost-out” initiative that he billed as the “most aggressive such undertaking ever”. Anyone who has worked in the corporate world knows that “cost-out” is code for slashing services and axing people.

Given that economic downturns, government changes to fee schedules and freaky climate conditions can strike anywhere, it is just a matter of time before Sonic will make a similar reference to the “Alberta offshore business” in a future Annual Report. Something like: Alberta had lower than expected revenues as a result of falling oil prices, federal/provincial fee reductions and massive flooding (or wildfires) in Northern Alberta. This will be followed by the CEO’s assurances that the Alberta offshore business losses will be offset by a mega-million dollar “cost-out” initiative similar to the one successfully deployed in the U.S.

In Sonic’s world, fee adjustments and fewer tests curb growth. Luckily for Sonic, we likely gave up the ability to reduce healthcare costs by agreeing that Albertans can be punished by “cost-out” initiatives if Sonic can’t make up the lost revenue elsewhere.

Oh and another thing…

While we’re on the topic of the lunacy; consider how much of the $3 billion Albertans will fork over for lab services will be diverted to cover the following expenses:

- Taxes: Sonic’s effective tax rate is 25 per cent. Alberta’s corporate tax rate is 10 per cent. It doesn’t take a tax expert to figure out that some of the $3 billion will go directly into the coffers of the Australian Taxation Office.

- Debt: Sonic is carrying almost $2 billion in debt. Its interest expense is around $60 million. Its carrying costs run as high as 8.74 per cent. The Alberta government can borrow money at two per cent to six per cent interest. It will cost Albertans significantly more for Sonic to borrow the money necessary to make the land purchases and build the superlab that underpins the lab services contract than if the government had borrowed the funds itself.

- Profit: Sonic’s profit for 2014 was $385 million. This was a 15 per cent increase over 2013. Good news for Sonic’s shareholders but irrelevant to Albertans who won’t see a penny unless they hold Sonic stock.

- Executive compensation: Sonic will hire an Alberta-based CEO and management team to run the Alberta offshore business under the watchful eye of the $13-million man (sorry CEO) and his well paid executives. The Alberta executives will receive salaries, bonuses, stock options and severance contracts commensurate with the private sector. Déjà vu anybody?

Tell me again

So on behalf of all Albertans, I ask Stephen Mandel a simple question: “This is a good idea, why????“