The captains of industry are fond of promoting the notion that capitalists, but never government, generate wealth.

So what to make of two of The Globe and Mail‘s recent Report on Business stories about government support for venture capitalists?

At the end of June, the federal government announced the five venture-capital firms that will receive $350 million it previously allocated to fund start-up firms. As part of the accord, the government is offering a dollar for every $2.50 private investors put in. Ottawa’s money is supposed to be an investment, but the public only begins to be repaid after the purported “risk takers” see the return of their capital plus seven per cent on top.

The recent initiative extends an even more generous five year subsidy program for “venture capitalists,” who are widely hailed by supporters of capitalism as dynamic wealth creators. But, after a downturn some years ago “the country’s venture capitalists pressed Ottawa for help after Canadian institutional investors largely abandoned the asset class after years of poor returns,” noted the Globe. Alongside support from Ontario, Stephen Harper ramped up social assistance to these “wealth creators.”

The Business Development Bank of Canada (BDC) anchors the venture capital program. Formed by Parliament in 1944 to stimulate investment in Canadian businesses, the BDC (previously the Industrial Development Bank) is the “largest single venture capital investor in Canada.” BDC analyst Peter Misek told the Globe that “BDC invested when no one else did and shouldered the burden when no one else would. There would be no capital in the Canadian VC [venture capital] ecosystem were it not for BDC over the last 10 years.”

While the image of so-called dynamic, risk taking, venture capitalists pleading for social assistance is particularly difficult to square with capitalism’s official ideology, a superficial look at the economy demonstrates they aren’t the only corporate welfare bums. Recently, the federal government nationalized the Trans Mountain Pipeline when Kinder Morgan said it was not financially viable. Canada’s leading aerospace and rail firm has long benefited from massive direct social assistance. According to one estimate, Bombardier has received $3.7 billion worth of subsidies in recent years. For decades Bombardier, and other major corporations, sold unwanted products internationally through Canada’s aid agency.

Aerospace counterpart Pratt & Whitney Canada has garnered $3.3 billion from Industry Canada since 1970. Additionally, Pratt & Whitney, Bombardier, and General Motors Canada have benefited greatly from military contracts over the years. One aim of defence procurement has been to stabilize the economy, spread regional industrial benefits, and subsidize advanced technology sectors.

In his book The Computer Revolution in Canada: Building National Technological Competence, John Vardalas details the military’s important role in stimulating technology development and expertise. After World War II, for instance, the Defence Research Board sponsored the University of Toronto Electronic Computer, the first working computer in Canada.

Since its creation prior to World War I, an important objective of the Navy has been to support Canadian shipbuilding, which has many industrial spinoffs. When the Conservative government launched a $33 billion — now $60+ billion — National Shipbuilding Procurement Strategy in 2012, to last for 30 years, a CBC headline noted: “Shipbuilding deals will stabilize industry, [Prime Minister] Harper says”. An assistant deputy minister at Public Works and Government Services Canada, Tom Ring, wrote, “Canada’s shipbuilding industry is now on the cusp of resurgence thanks to the federal government’s National Shipbuilding Procurement Strategy.”

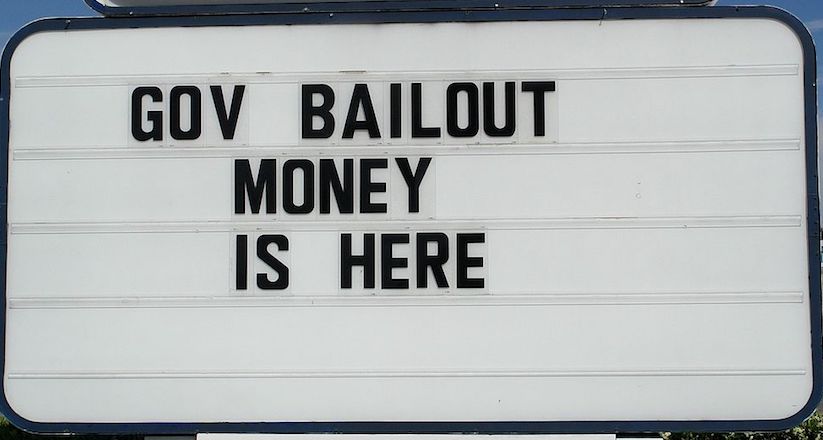

The automotive sector is another pillar of Canadian capitalism that receives social assistance. To save the sector’s leading lights, Ontario and Ottawa ploughed over $10 billion dollars into Chrysler and General Motors Canada, after the share selloff taxpayers lost about $3.5 billion. The 2009 bailout is the tip of the auto industry subsidy iceberg. Over the past few decades, almost every new factory or major factory upgrade has received a significant welfare cheque. And the industry’s reliance on public care goes beyond direct assistance. From traffic lights to licensing drivers, car centric zoning regulations to endless billions spent on roads, the industry has required massive government intervention.

Then there is the financial sector, where contrary to popular perception, Canada’s banks received a massive infusion of social assistance when some of their international counterparts ran into trouble in 2008. “Canada’s biggest banks accepted tens of billions in government funds during the recession”, noted a CBC story about a 2012 CCPA investigation. In the biggest move, the Crown Corporation Canada Mortgage and Housing Corporation withdrew $69-billion worth of mortgages the big banks didn’t want on their balance sheets.

Despite abundant evidence that nothing approaching the fantasy of free market capitalism exists, the myth persists. The reason is that it serves to legitimate the private appropriation of socially created wealth. Justin Trudeau, for example, responded to questions about Bombardier paying its executives huge sums after receiving a major welfare payment by saying, “we respect the free market and the choices that companies will make.”

The fairy tale about “capitalism” is a way to justify rich people running the country and to dupe us out of our money to subsidize them doing it.

Image: Freedom Homes/Wikimedia Commons