rabble is expanding our Parliamentary Bureau and we need your help! Support us on Patreon today!

It’s the season for Chanukah, Christmas, and Kwanzaa! A time for family, friends, special foods, gifts, lights and celebrations. The time of year children wait for all year long. This is also a time when the divide between those who have and have not seems greatest.

Those who have, give to the food bank, mitten tree, coat and toy drives. We give to ease the burden of others, but we also give to ease our conscience. Unfortunately, these kind gestures do nothing to address either the year round issue of, nor the systemic causes of, poverty.

In November 2015, Campaign 2000 released its latest report on child and family poverty: Let’s Do This, Let’s End child Poverty for Good. To say that Canada is not making strides to end child poverty is an understatement of epic proportions.

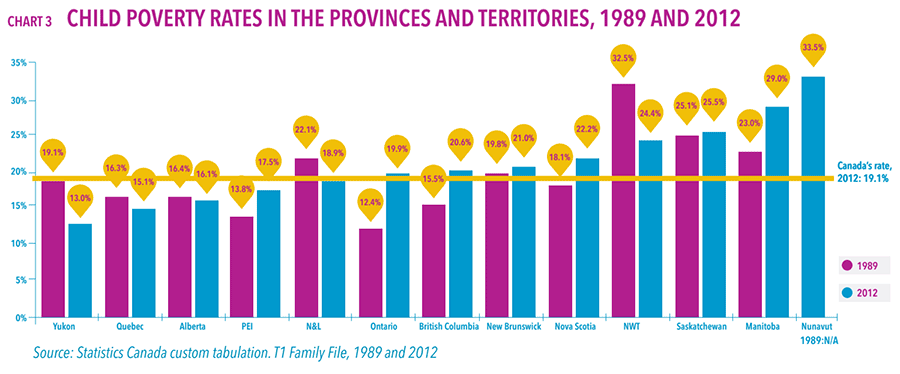

In 1989, Parliament unanimously agreed to end child poverty by the year 2000 and poverty for all Canadians by 2009. At that time 15.8 per cent of Canadian children lived in poverty. By the year 2000, the rate of child poverty had increased to 22.3 per cent. In 2013, child poverty dropped slightly to 19 per cent, but 1.34 million children, or one in five children, continued to live in poverty. One in two Indigenous children currently lives in poverty.

Children are the group at greatest risk of living in poverty in Canada. UNICEF ranks Canada 17 out of 29 nations when it comes to child well-being. This abysmal ranking shows just how little we, as a nation, value our children and how unwilling we are to invest in our own future.

Families trying to live on minimum wage, and those receiving social assistance or Employment Insurance (EI) benefits made extremely limited gains in the past 26 years. Any financial increases are attributable to the Canada Child Tax Benefit (CCTB) and National Child Benefit Supplement (NCBS) rather than increases to minimum wage rates or social assistance payments to parents.

Canada is without an official income poverty threshold. Using Statistics Canada 2015 figures for Low Income Measure-After Tax (LIM-AT) we can compare the poverty line for various individuals and families with what they would receive on social assistance living in Ontario:

Single adult, able to work $17,371

Ontario ODSP annual income (2013) $13,032; poverty gap $4,339

Lone parent with one child >13 $24,319

Ontario ODSP annual income (2013) $19,248; poverty gap $5,071

Lone parent with two children >13 $29531

Ontario ODSP annual income (2013) $21,216; poverty gap $8,315

Couple with no children; both on ODSP $24,319

Ontario ODSP annual income (2013) $23,568; poverty gap $751

Couple with one child >13; both on ODSP $29,531

Ontario ODSP annual income (2013) $25,536; poverty gap $3,995

Couple with two children >13; both on ODSP $34,742

Ontario ODSP annual income (2013) $27,588; poverty gap $7,154

Ideally, social assistance income should be at least 10 per cent above the poverty line, but clearly that’s not the case in Ontario nor any other province or territory.

Government transfers including the HST/GST credit, CCTB, the Working Income Tax Benefit (WITB), and EI help keep working families from extreme poverty. An additional 795,000 children would be living in poverty if not for these transfer payments.

Thirty-seven per cent of children living in poverty have one parent who works full-time, full-year. Close to a million employed Canadians have two or more jobs. Over two million can find only temporary employment. Youth unemployment is at 13.2 per cent with low-skilled, precarious, temporary jobs making up 30.8 per cent of all youth employment.

As employment becomes increasingly low wage, short-term contract, precarious positions it’s impossible to make a decent living that will cover rent, child care, transportation, food, and the costs of living.

Over 730,000 renter households have such low incomes that they spend over 50 per cent of their income on rent putting them at risk of becoming homeless. Each year 235,000 people find themselves homeless. One in seven people using shelters in Canada are children.

Statistics Canada recorded real median after-tax income growth from 1982 to 2013 and found that the:

Top 0.01 per cent had an increase of 162.1 per cent

Top 0.1 per cent 95.3 per cent

Top 1 per cent 49.1 per cent

Bottom 99 per cent 8.0 per cent

Bottom 90 per cent 6.8 per cent

Bottom 50 per cent 15.2 per cent

The Organization for Economic Co-operation and Development (OECD) found that Canada has a long way to go in order to reduce income inequality. Non-standard workers in Canada have the highest rate of poverty in the OECD; 35 per cent compared to an average 22 per cent for OECD countries.

Canada has one of the largest gender pay gaps with women earning 19 per cent less than men in Canada versus an average 15 per cent in OECD countries. In Ontario the gender pay gap averages 30 per cent.

Recently announced changes to federal income tax rates will help 25 per cent of tax payers all of whom fall within the $45,000 to $90,000 income bracket. These middle income earners will keep an additional $50 to $670 annually. Unfortunately, these changes do nothing to help those most in need, Canadians with annual incomes below $45,000.

Food insecurity is reality for 12.5 per cent of households which includes approximately one million children. Childhood food insecurity has been linked to obesity, anemia, diabetes, chronic stress, depression and other physical and mental health issues.

Food bank use is 26 per cent higher than in 2008 when the great recession began. 16 per cent of those using the food bank earn the majority of their income from employment. Let’s be honest, it’s virtually impossible to have a healthy diet when you rely on food banks that are primarily stocked with prepackaged and canned goods as opposed to basic ingredients, fresh fruits and vegetables. This in itself is a cause for concern because poor nutrition so often leads to developmental as well as health issues in children.

Ending child poverty means ending poverty in Canada. To be effective, the entire family needs to live well enough above an established poverty line in order to be able to afford the necessities of life, have a cushion for emergencies and a few treats once in a while.

Implementing these suggestions will not only end poverty, but create a more equitable Canada:

-

Create a national guaranteed livable income (GIL)

-

Create a national living wage

-

Raise social assistance rates in every province and territory until the GIL is fully implemented

-

Restore the national standard of no minimum residency requirement to be eligible for social assistance benefits

-

End provincial and territorial claw backs of child support, CCTB and NCBS from social assistance benefits

-

Streamline access to EI and increase benefit periods

-

Close the gender wage gap

-

Create a comprehensive national housing strategy

-

Increase the number of emergency shelters and transition housing facilities for women and children leaving domestic violence

-

Develop a national universal child care strategy

-

Develop a national pharmacare program

-

Increase personal taxes for the top one percent

-

Cut taxes for Canadians with incomes below $45,000

-

Increase provincial and federal corporate taxes

-

Increase funding for post-secondary education for low and middle income families

-

Implement a national school lunch policy

-

Revive family studies programs including nutrition, cooking, life skills programs; and make parenting a mandatory course for high school graduation

Write, email, text, tweet, Facebook or send a holiday greeting to your government representatives and tell them you want to end poverty in Canada for good. Include the 17 solutions and ask them how many items we’ll be able to strike off this wish list next holiday season.