Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.

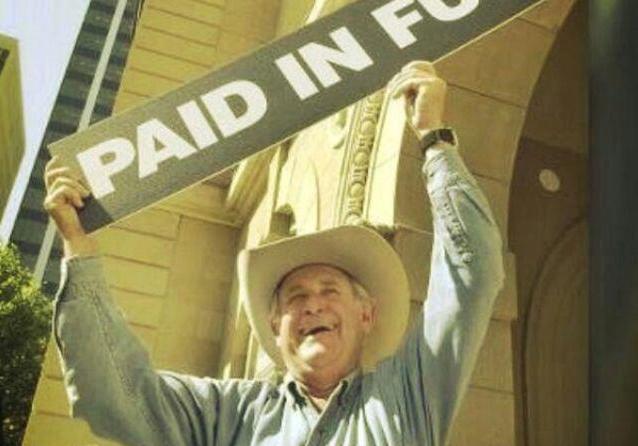

Anyone remember Ralph Klein’s declaration Alberta’s debt was “paid in full” back in 2004?

Even without the mountainous infrastructure deficit Klein left behind after his disastrous tenure as Alberta’s premier — the provincial equivalent of not patching your roof for decades and then bragging about how much money you’d saved while the rain drips into the kitchen — it turns out living debt-free is not such a great idea anyway for governments.

Actually, economists have known this pretty well forever. But the politics of economics in Canada and especially Alberta nowadays is not driven by the study of economics as much as it is by the quasi-religious superstitions of neoliberal dogma.

This is how it came to be a truism here among Alberta’s chattering classes that if the New Democratic Government of Premier Rachel Notley, elected last May 5, fails to balance its first budget, or any of its budgets thereafter, there will be serious political consequences.

This is quite possibly true, but we need to remember when we acknowledge this fact that it is equally true there are unlikely to be many serious economic consequences from public debt alone.

On the contrary, as Nobel Prize winning economist Paul Krugman reminded our American cousins in his New York Times column on Friday, “the economy needs a sufficient amount of public debt out there to function well.”

Krugman was making fun of Rand Paul, one of the loonier seekers after the Republican presidential nomination south of the Medicine Line — and in a field that includes Donald Trump and Scott Walker, that’s saying something — for his shocked observation that “the last time the United States was debt-free was 1835.”

Um, yes, Krugman observed, and the United States on the whole did pretty well during those 180 years, didn’t they? Indeed, the United Kingdom hasn’t been debt-free since 1692, which, notwithstanding the current panic about debt by Britain’s Tory government, includes some fairly successful years for that country too.

“Government debt is quite acceptable, within limits,” explains Canadian economist and sometime Globe and Mail columnist Jim Stanford, adding elsewhere in his 2008 book, Economics for Everyone, that “it is quite wrong to assume that government debt is inherently ‘bad’ and must be eliminated.”

“Counter-intuitively, a government can maintain a stable debt burden (measured as a share of GDP) while still incurring annual deficits,” Stanford stated, explaining that the trick is that the jurisdiction’s Gross Domestic Product needs to be growing.

“It is clear that conservative anti-debt and anti-deficit campaigns of the past quarter century were motivated more by politics than economics,” he concluded. “Neoliberals used fear of public debt to politically justify the elimination of public programs (like income security programs) which they wanted to get rid of anyway.”

Krugman takes the point farther in his column, however. “There’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt,” he wrote in the column published Friday. “The power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people… are making the case that we need more, not less, government debt.”

The reasons for all this aren’t that hard to understand, even for us non-economists. For one thing, you can use debt to buy and maintain useful things — like that house on which you should have replaced the roof. For another, interest rates are at historic lows — especially for governments — so the cost of debt is also at historic lows.

Debt also helps the economy function better, Krugman asserts, because “the debt of stable, reliable governments provides ‘safe assets’ that help investors manage risks, make transactions easier and avoid a destructive scramble for cash.”

In other words, Ralph Klein — who has now been pretty much sainted by the market fetishizing cargo cultists in right-wing think-tankery and demagoguery who have dominated public discourse about economics in this country for three decades — was doing no favours for Alberta or Albertans with his debt obsession.

So wherever the Finance Minister Joe Ceci puts the provincial bottom line in the budget he is expected to introduce this fall, we need to remember this and take a deep breath when the Opposition starts to screech about the catastrophes debt is certain to bring to Alberta.

You know, just like those that have been visited upon Britain in every year since 1692, and the United States in every year since 1835. We all know the screed: If this keeps up, we’ll turn into Greece — just as the U.S. and the U.K. mysteriously never did.

Keep that in mind when Wildrose Finance Critic Derek Fildebrandt hooks the Canadian Taxpayers Federation’s old Alberta debt clock to his truck and starts hauling it around the province like he used to do in his old job.

This post also appears on David Climenhaga’s blog, AlbertaPolitics.ca.

Like this article? rabble is reader-supported journalism. Chip in to keep stories like these coming.