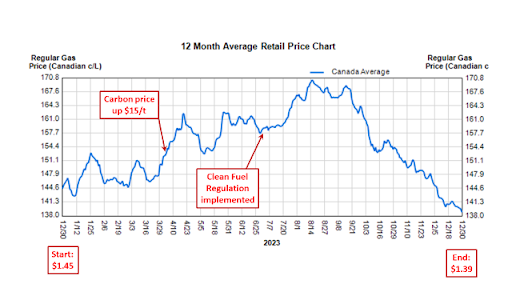

Looking back on 2023, it is instructive to review the path of gasoline prices (which are the most volatile major component in Canada’s consumer price index) over the year. According to the GasBuddy website, the average price on December 31 was $1.39/litre. That was $0.05 cheaper than at the beginning of 2023. But gas prices followed a long, winding road to get there.

Of course, the ups and downs of world oil futures markets are the major reason for this roller-coaster (even for gasoline extracted, refined & consumed here in Canada). What is striking is the irrelevance of Canadian fiscal and climate policies to the path of gas prices over the year.

The backstop federal carbon price (which applies in provinces not participating with their own carbon price) rose $15/tonne on April 1. The new federal Clean Fuel Regulation came into effect July 1. Conservatives claimed both would send gasoline costs soaring. But their impact (small for the carbon price, non-existent for the fuel regulation) was swamped by global price turmoil.

Conservative leader Pierre Poilievre and his team tried to exploit both policy moments to farm more rage against virtually anything to do with the federal government. On April 1, he warned about a wave of robberies at gas stations across the country, with the culprit stealing $0.14/litre from every customer.

Likening a policy measure adopted by an elected government and implemented in accordance with the rule of law, to the actions of a gas station stick-up bandit, seems irresponsible… but sadly it is par for the course these days for Canadian populism.

Then, on June 30, Poilievre urged Canadians to fill their tanks before the next “tax hike on gas” kicked in. (In reality, the Clean Fuel Regulation is not a tax, and no serious analyst expected it to have an impact on current gas prices.)

Ironically, gas prices in most parts of Canada fell slightly over the subsequent week. Anyone who took Mr. Poilievre’s financial advice literally, and actually believed they would save money by filling up on June 30, ended up losing a dollar or two. That’s not as much as the losses incurred by those who followed his previous advice to buy cryptocurrency. But it’s a reminder that politicians who muddle personal financial advice with ideological hot takes, are playing with fire.

Gas prices then fell through the autumn, thanks to lower world oil prices (OPEC+ efforts to cut supply didn’t succeed), seasonal factors, and gasoline supply trends. That’s been key to slowing inflation down to 3.1% by November – just as sky-high gas prices in summer 2022 were key to the 8% inflation experienced then.

Ironically, gas prices are now about $0.14/litre lower than on April 1. Will Poilievre now tweet his thanks to Trudeau for reimbursing $0.14/litre to all Canadians gassing up on the New Year’s holiday? That would be no more ridiculous than his claim Trudeau robbed them all on April 1.

More irony: even though gas prices are lower than a year ago (despite the higher carbon price), federal Climate Action Incentive Payment (CAIP) rebates (paid in seven provinces without equivalent carbon prices) will grow in 2024, as the federal government reimburses higher proceeds from the carbon price. Details will be announced by the Finance Minister in the spring.

Provinces with their own carbon pricing systems will largely follow suit. Lower prices and higher rebates sounds like a win-win. Of course, when Poilievre promises to “axe the tax”, he is silent on what that means for CAIP rebates (currently worth up to $1,544 for a family of four).

Several lessons arise from this review of the gas price roller-coaster during 2023.

Lesson 1: People tend to blame politicians for hardship caused by private markets and businesses. (I’ve seen left-wing politicians do it, too, not just Conservatives.) It is convenient to use any problem as a point of attack in political debate. But we should be honest about what’s causing the hardship.

High gasoline prices in 2022 mostly resulted from the gyrations of speculative, financialized oil futures markets which overreact to any shocks. Canadian energy policy transmits that turmoil directly to consumers, amplified by unprecedented profit-taking by petroleum corporations (who have booked over $120 billion in net income since the start of 2022 and the Russian invasion of Ukraine).

This way of managing energy markets is not natural or inevitable, nor does it reflect ‘real’ economic forces like production costs, supply and demand, etc. To see how it could be done differently, compare gyrating gas prices to electricity costs in Quebec, Manitoba, & B.C., where a combination of public ownership and strict price regulation has kept electricity prices low – and boringly steady.

Lesson 2: Conservatives have focused on carbon pricing as their key hot button to exploit in preparing for the next election. But carbon pricing is virtually irrelevant to the genuine cost-of-living challenges facing Canadians. Our review of gas prices in 2023 is just one more piece of evidence supporting this assertion, but there is abundant evidence from many other sources.

However, that reality won’t stop populist Conservatives from blaming carbon pricing for any economic or social ailment. Unfortunately, Canadians need to prepare for a New Year filled with unprecedented misinformation. The need for evidence-based research, policy dialogue, and journalism has never been more urgent