In February 2022, the University of Ottawa (uOttawa) announced plans to divest all its direct equity fossil fuel holdings by 2023 and all indirect fossil fuel holdings by 2030. This was a huge win for our student-led divestment group, but our celebrations were short-lived. The largest funder of fossil fuels in the country remained on our campus.

The Royal Bank of Canada (RBC) shamelessly holds that title. The recent Banking on Climate Chaos report highlights RBC’s ongoing support for fossil fuels. The bank increased its fossil fuel financing by over $2 billion USD in just one year, totaling $42.1 billion in 2022. Since 2016, RBC has poured $253 billion into this harmful industry.

The fossil fuel industry has long been cited as a key driver behind anthropogenic climate change, and climate scientists continue to emphasize the need to transition away rapidly and justly from this harmful industry.

The Intergovernmental Panel on Climate Change’s sixth assessment report echoes these warnings, in which climate scientists from across the globe unanimously agreed that planetary warming is on track to far exceed two degrees Celcius. This will bring catastrophic consequences that harm those least responsible for the climate crisis first and worst.

Regardless, this report noted that “public and private finance flows for fossil fuels are still greater than those for climate adaptation and mitigation.”

RBC is undeniably funding climate chaos. On top of this, the bank funds colonial violence by financing the Coastal GasLink (CGL) pipeline being constructed through unceded Wet’suwet’en territory. This pipeline project is now in its fourth year of trampling on Indigenous land rights, the right and rights to free, prior and informed consent, criminalizing Indigenous land defenders.

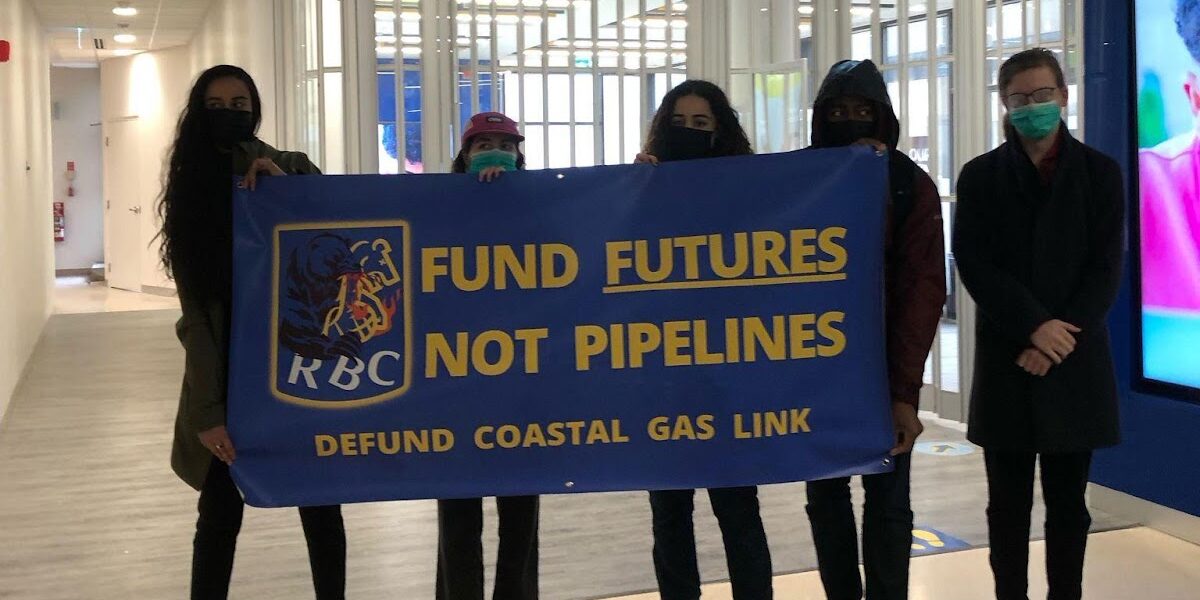

In Canada, 25 post-secondary institutions have partnerships with RBC, including uOttawa. Frustrated with this reality, we joined activist groups across the country in October 2021, just a few days before COP26, to demand RBC stop funding climate chaos and the CGL pipeline.

Around eight of us arrived nervously for our first on-campus action since the lifting of COVID-19 restrictions. We brought with us a banner, a couple of posters, and a prepared speech.

However, upon arrival, not only had the staff set up the security gate, but we were quickly approached by the branch manager who immediately threatened to call campus security and the police, despite us standing squarely in the university centre and outside the RBC branch.

uOttawa students have continued to contest the presence of RBC on campus, and more recently students leafleting outside the branch saw the unwarranted arrival of campus security and the Ottawa police.

RBC is now embedded in campus life at uOttawa with numerous sponsored events that take place on campus year-round. Recently this has included the university’s Welcome Week show, Career Week events, a Beaver Tail giveaway and arguably one of uOttawa’s most sustainable events, the Free Store Pop-up.

The bank also provides large donations to the university, such as a $500,000 donation in 2020, and hosts workshops on financial literacy and opening accounts with them.

Aside from seeing RBC’s logo on adverts everywhere, it’s hard to miss RBC’s presence since it has taken over a student lounge in the university centre beside the cafeteria.

The bank’s presence at uOttawa is one example of the corporatization of university campuses. Between 1985 and 2015, the share of operating revenue funded by the public sector decreased by 31 per cent. The increasing reliance on donations from individuals and corporations to higher education institutions calls into question what universities exist for: do they exist to foster research and educate students, or to promote corporations and be beholden to donors?

Partnerships between universities and banks have already raised concerns about the standard of climate change research conducted at these institutions. Beyond this, as institutions that are meant to be supporting future generations, universities need to consider the impacts of their partnerships. Adequate public funding and community investments are alternatives that are central to the de-corporatization of university campuses.

But first and foremost, we cannot accept the continued financing of climate chaos and colonial violence. Until universities cut ties with RBC, they are complicit actors in the acceleration of climate change and ongoing acts of colonization.